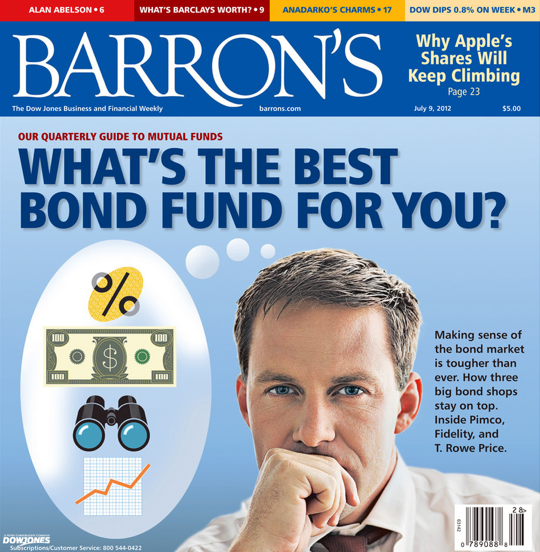

So I am still catching up with some of the more interesting reads from while I was away, and this THIS damned cover made me fall off my chair:

Source: Barron’s

A few words about this: The classic magazine cover contrary indicator is a non-business press issue. This is because by the time a specific financial issue reaches the cover of a mainstream media, the entire world has already made the trade. Its late, and all that’s left are the suckers coming in to top tick the trade.

Regardless, there is something terrible disconcerting about a cover story on bond funds AFTER a 30 year bull run in fixed income instruments.

My point of view on bonds as investments or income sources is simple. Here are 5 points to know:

1. Ladder: Owning individual bonds in a ladder (no longer than 7 years) is much preferred to bond funds. If and when rates go up, you get to replace the specific holdings with higher yielding issues (note that if this happens, inflation is likely higher)

2. Independent Credit Risk Analysis: Work with Bond managers who do their own due diligence and have a deep research division. DO NOT WORK WITH ANY MANAGER THAT RELIES ON Moodys or S&P for credit ratings. These firms are worthless money-losers who sold out inmvestorsd to iBanks the last crisis. They should have been put down like rabid dogs. If you invest based on their “analysis” you will deservedly lose money.

3. Bond ETFs/Indexes: If you cannot afford a ladder, consider bond ETFs that are more like indices. I like shorter term Treasuries, high quality Corporates, and (non-bank) emerging markets bonds.

4. Income/Yield: You can create a yield/income portfolio, but only if you understand there is more risk involved and are willing to accept the loss of principle. (See this).

5. Bond Funds Have Different Risks than Bonds If you buy a quality bond, and hold it to maturity, you will get your money back. Sure, a treasury can move up and down but held to maturity it will pay back its investment. Not so with all bond funds. If markets go topsy turvy and a bond fund faces redemptions, they sell what they can, sometimes at a loss. Hence, its another risk factor versus bonds or bond ETFs.

That is my short bond lecture. Now go enjoy your Summer Friday!

What's been said:

Discussions found on the web: