Source: Office of Debt Management, Fiscal Year 2013 Q4 Report

The recent chaos in emerging markets has driven investors into U.S. Treasuries. The flight to safety has helped push down interest rates, with the yield on the 10-year bond now 2.6 percent. Although that is higher than the 1.5 percent of last summer, it is considerably lower than the 3 percent the 10 year yielded last month.

This decrease in rates creates another opportunity — perhaps the last one for this rate cycle — for Uncle Sam to borrow. A broad assortment of long-term projects requires attention and low rates make it the ideal time to renovate America’s decaying infrastructure.

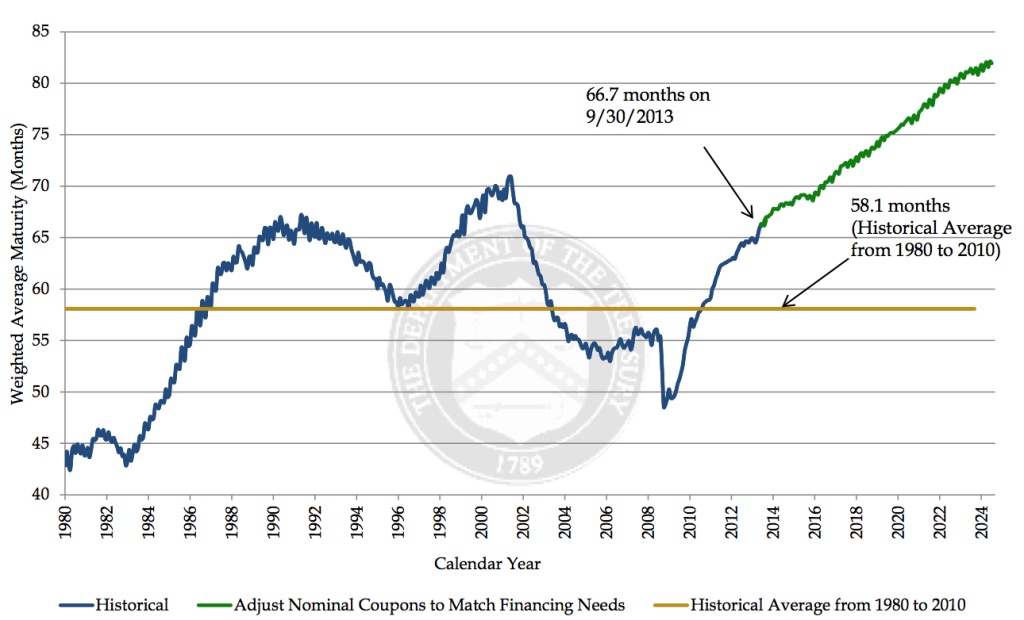

Indeed, this is quite significant, especially when you consider how we fund the U.S. budget deficit. According to a recent Treasury report, the average maturity of U.S. debt is 66.7 months (see Fiscal Year 2013 Q4 Report).

This is very short-term given the U.S.’s long-term unfunded obligations. This funding mismatch is a recipe for disaster in a rising rate environment. If you learned nothing else from the 2008-09 financial crisis, you should have at least picked up that small insight. The Treasury Department should be aggressively pushing longer-term funding with 30-year or even 50-year bonds while the opportunity exists.

Beyond refinancing the debt, the U.S. has an embarrassment of riches in worthwhile projects to consider. None of these are pie-in-the-sky fantasies. What follows is a list of the basic plumbing of any modern society, all of which need an upgrade:

Electrical grid. It is vulnerable to attack, unreliable and subject to blackouts. Copper wires strung between wooden poles may have been a huge innovation in 1850, but as we saw during superstorm Sandy, it is inadequate today. If it were up to me, I would bury almost the entire electrical grid. And I would defray the cost with a modest 3 cent per kilowatt-hour grid fee.

Roads, bridges, tunnels. I don’t know about you, but I am tired of driving on potholed, rutted and otherwise unsafe roads. Compared with Europe and Asia, the U.S. transportation grid is embarrassing. Countries such as Germany and China have made much greater commitments to newer, more-innovative designs and regular maintenance.

We can also start to make dumb roadways smart. We should be integrating more road sensors with traffic lights and controls to move traffic more efficiently and quickly. A dedicated infrastructure gas tax of 10 cents a gallon might help defray the cost of modern transportation system. (That’s about $2 per full tank of gas).

Mobile telephone and data networks. We have made some progress over the past few years, but the U.S.’s mobile communications network remains a decade or more behind those of other nations in terms of coverage and reliability. In exchange for using the public airwaves, we should mandate better minimum service levels. A public-private partnership could be formed to take advantage of the cheaper financing. We could take the same approach with building faster and more ubiquitous broadband as well.

I have addressed this issue several times in the past (see for example,this and this). Now, however, I’m concerned that the window is even smaller for the government to lock in low rates.

My arguments remain the same: Major infrastructure repairs would improve the quality of life in America, create jobs, make us more competitive and improve our security. The window to take advantage of low rates won’t stay open forever.

What's been said:

Discussions found on the web: