2015 Is Shaping Up to Be a “Turkey” of a Year for the U.S. Economy and Stock Market

Paul L. Kasriel

November 17, 2014

On November 24, 2013, I penned a piece entitled “Unless the Fed Goes Cold Turkey on Us, Expect a Bountiful Economic Harvest for Thanksgiving 2014”. In it I argued that 2014 would be a good year for the U.S. economy and U.S. risk assets, such as equities, because I expected a year of robust growth in “thin-air” credit, i.e., the combined credit created by the Federal Reserve and the U.S. depository institution system, primarily commercial banks. Although thin-air credit has not grown as rapidly as I had projected, largely because the Fed tapered its securities purchases more aggressively than I had assumed, still, thin-air credit grew at a relatively robust pace for most of the past 12 months. And, despite a weather-induced weak first quarter of economic activity, the economy has performed quite well since Thanksgiving 2013. In the 12 months ended October 2014, U.S. car and light truck sales clocked in at 16.2 million units, the highest 12-month unit-sales volume since June 2007. In both September and October 2014, the unemployment rate for those covered by state unemployment insurance programs stood at a seasonally-adjusted level of 1.8% — the lowest unemployment rate since May 2006. In October 2014, the ISM-Manufacturing production index stood at 64.8, its highest level since May 2004. For the week ended November 14, 2014, the Wilshire 5000 stock market index, a proxy for all U.S.-traded equities, reached a record high and was up 13.3% from its year-ago weekly average. In the aggregate, then, I think it safe to say that we have enjoyed a bountiful economic harvest here in the U.S. in the past year.

If relatively robust growth in thin-air credit was a major factor accounting for 2014’s bountiful U.S. economic harvest, as I believe it was, then 2015’s “harvest” is likely to be considerably less bountiful. Growth in thin-air credit has already begun to decelerate and is on course to further decelerate in 2015. As mentioned above, the Fed curtailed its purchases of securities more aggressively than I had reckoned a year ago and ended its purchase program in October 2014. Although bank credit has grown considerably faster than I had anticipated, it is not fast enough to compensate for the slowdown in the growth of Fed thin-air credit.

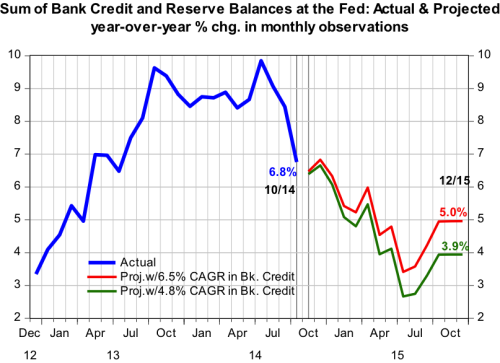

Plotted in the chart below are actual and projected monthly observations of year-over-year percent changes in the sum of commercial bank credit and reserves held by these banks and other depository institutions at the Federal Reserve. The actual data are through October 2014, with the projections running from November 2014 through December 2015. There are two separate projections, both of which assume that reserves held at the Fed (the Fed’s contribution to thin-air credit) remain constant at the actual October level. When the Fed is not engaged in a quantitative easing (QE) policy, reserves of depository institutions held at the Fed typically grow less than 1% annually. In the 12 months ended October 2014, bank credit grew by 6.5%. So, in the first projection of thin-air credit growth, I assume that bank credit increases each month at a compound annual growth rate (CAGR) of 6.5% and reserves held at the Fed remain constant. In the 3 months ended October 2014, bank credit increased at a CAGR of 4.8%. So, in the second projection of thin-air credit growth, I assume that bank credit increases each month at a CAGR of 4.8% and, again, reserves held at the Fed remain constant.

After reaching a recent peak in growth of 9.8% in July 2014, year-over-year growth in thin-air credit decelerated to 6.8% in October 2014. A deceleration in growth of three percentage points in three months is severe in and of itself. But, wait. There is more, or less, as the case may be. With reserves at the Fed constant, if bank credit increases at a CAGR of 6.5% going forward, its October 2014 year-over-year increase, then the year-over-year growth in thin-air credit, i.e., the sum of bank credit and reserve balances at the Fed, will further decelerate to 5.0% by December 2015. With reserves at the Fed constant, if bank credit increases at a CAGR of 4.8%, its CAGR in the three months ended October 2014, then the year-over-year growth in thin-air credit will decelerate to 3.9% by December 2015. To put all of these growth rates into context, the median year-over-year change in monthly observations of the sum of bank credit and reserve balances at the Fed from December 1977 through December 2006 was 7.4%.

As U.S. thin-air credit growth is on track to slow in 2015, thin-air credit growth in the eurozone and in Japan is likely to accelerate as the European Central Bank and the Bank of Japan step up their QE programs. These foreign QE programs could indirectly stimulate U.S. exports. But the dominant factor affecting the U.S. economy in 2015 will be below-normal growth in U.S. thin-air credit. So, as you gather your family around you on Thursday, November 27, to give thanks for our bountiful 2014 economic harvest, bear in mind that next year’s harvest is likely to be a “turkey” in comparison.

Paul L. Kasriel

Econtrarian, LLC

Senior Economic and Investment Adviser

Legacy Private Trust Co. of Neenah, WI

econtrarian@gmail.com

What's been said:

Discussions found on the web: