There’s a Raise in Your Future

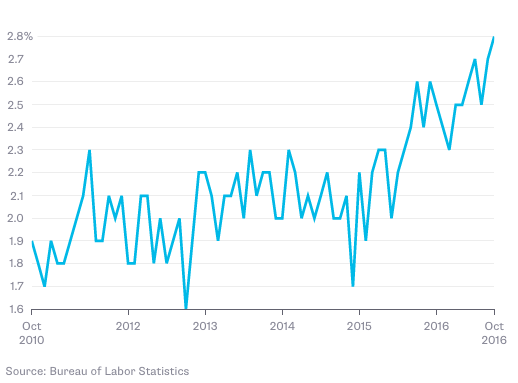

U.S. average hourly earnings change in private sector

We interrupt this interminable election season for a brief I-told-you-so about wages and jobs.

On Friday, the Bureau of Labor Statistics released the October employment report. It is the latest in a 73-month run of data showing employment has been slowly but surely increasing in the post-financial-crisis era. Gross domestic product has been rising even longer, although there have been a couple of negative periods.

Wages rose 2.8 percent year over year, the BLS reported, with average hourly earnings rising 0.4 percent from a month earlier to $25.92. That is the highest since 2009. Long overdue increases have been the brightest spot among the employment data the past few months. This has been especially true for the bottom half of wage earners (and no, the BLS numbers are not cooked). See the chart below:

This positive development potentially affects a number of important issues:

• Wage gains are correlated with improved retail spending, durable goods purchases and home sales;

• Higher wages are likely to reduce deflation concerns and raise stubbornly low inflation;

• Compensation gains have been strongest among the lower half of the income distribution, reducing income-inequality and the potential for civil unrest;

• Higher wages make it more likely the Federal Reserve will raise rates more, getting off its emergency footing and ending financial repression;

• Wage gains suggest that a virtuous cycle may be beginning, and the economic expansion is far from over.

All of the above are in the “probable” column, but are by no means “definite.”

One item I left off this list is the impact of higher wages on corporate profits. That is hard to gauge. At this stage, it is too early to tell if higher spending will offset increased labor costs. I suspect it will, but there are too many variables and too little conclusive data to draw any conclusions yet.

I think much of the wage increases will come in the lowest-paying industries — specifically those that have the most difficulty finding qualified workers and suffer from low morale and high employee turnover. That includes lower-end retail, fast food, hospitality and health care.

It is imperative to point out how so many observers and economists have gotten this entire economic cycle wrong, especially when it comes to employment and wages. This probably is because so many of them failed to recognize that recoveries from financial crises are very different from the usual kind of recession; because of this, they used the wrong historical data set as part of their models. No wonder so much of the dismal-science set has done so poorly in describing and predicting this recovery.

Anyone who understood this had better context for grasping what this recovery was going to be like as households and corporations worked long and hard to pay down debt. Meanwhile, state and local governments (with some notable exceptions) saw their fortunes improve as increased employment and wages led to higher revenue, easing deficits and funding woes.

As we noted 18 months ago, investors have long overlooked what might go right in the economy. It looks as if they will struggle to come to terms with the recovery for a while longer, regardless of who wins tomorrow.

Originally: Bigger Paychecks Are Coming

What's been said:

Discussions found on the web: