There is a fascinating discussion in Scientific American: “Why the Most Important Idea in Behavioral Decision-Making Is a Fallacy.” It is based on a paper in the Journal of Consumer Psychology written by David Gal, University of Illinois at Chicago and Derek D. Rucker Northwestern University (and a subsequent defense of that paper).[i]

Gal writes in SciAm:

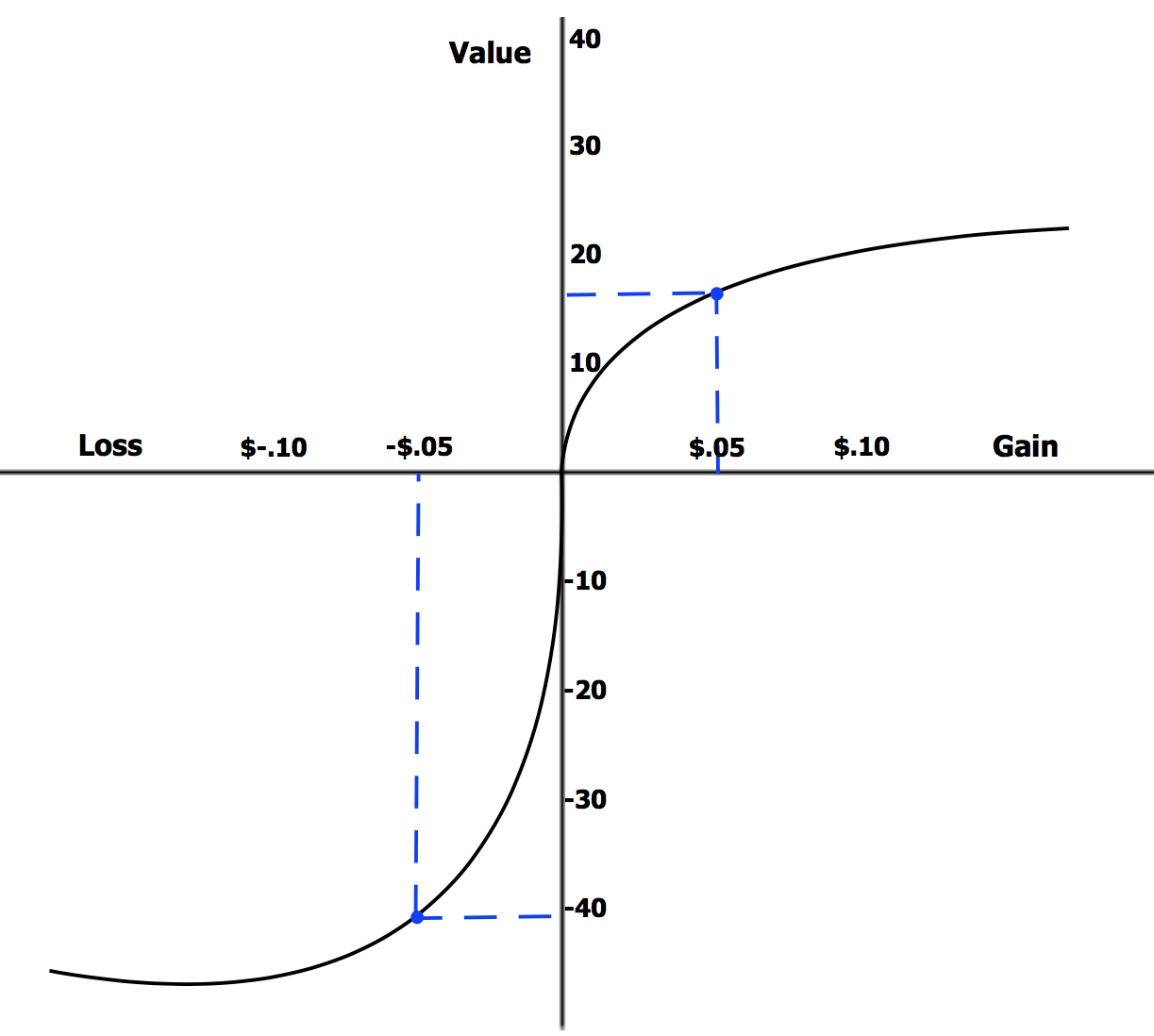

“Why has such profound importance been attributed to loss aversion? Largely, it is because it is thought to reflect a fundamental truth about human beings—that we are more motivated by our fears than by our aspirations. This conclusion, it is thought, has implications for almost every aspect of how we live our lives.”

Gal makes the somewhat outrageous explanation that “loss aversion is essentially a fallacy.” He suggests that cognitive bias via loss avoidance does not exist, and messages framed in terms of losses are no more persuasive than those framed in terms of gains.

I did not find that takedown of “Loss Aversion” especially persuasive. And since this is an extraordinary claim, it requires extraordinary evidence. That standard has not been met.

Perhaps that reflects my own cognitive dissonance at work; I tumbled into behavioral finance decades ago as a trader, and I found it enormously helpful in explaining the seemingly random outcomes of the P&Ls of those around me. The psychology behind behavioral economics was so profoundly compelling that the asset management firm that bears my name was designed in large part on its principles.[ii]

More on this to come . . .

UPDATE: Full column is posted here.

_______

[i] The Loss of Loss Aversion: Will It Loom Larger Than Its Gain?, Journal of Consumer Psychology, 9 Oct 2017 Last revised: 26 Apr 2018, by David Gal, University of Illinois at Chicago and Derek D. Rucker Northwestern University (Mirror). See also their response to critics, Loss Aversion, Intellectual Inertia, and a Call for a More Contrarian Science: A Reply to Simonson & Kivetz and Higgins & Liberman, Journal of Consumer Psychology 2 Mar 2018, by David Gal, University of Illinois at Chicago and Derek D. Rucker Northwestern University. (Mirror)

[ii] At some future date, I will detail the ways we have utilized behavioral economics and known cognitive errors to protect investors from their own worst enemies – themselves.