I stumbled across a fascinating new blog: David Lereah Watch.

Here’s the description:

“David Lereah is the Chief Economist and Senior VP of the National Association of Realtors (NAR). Mr. Lereah regulary makes statements regarding the housing bubble. The media regulary turns to him for real estate quotes. He is very influential. Mr. Lereah tells half truths and manipulates facts and figures. He cannot be trusted as he is a paid shill.”

Geez, its as if people pay attention to what you say and make you accountable.

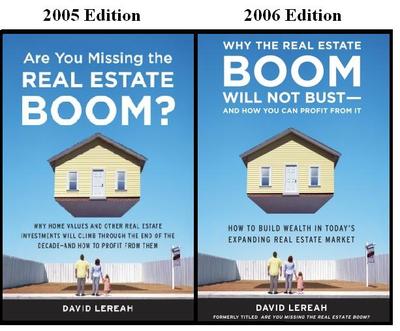

One of the more interesting things I came across on David Lereah Watch was the new version of his book. You may recall we discussed this last months in Are You Missing the Real Estate Boom?

Turns out we were using the older version of the cover; the new cover is somewhat telling:

Hat tip: David Lereah Watch

UPDATE: October 31, 2006 11:29 am

Kevin over at Minyanville imagines what the subsequent title revisions will look like in the future:

2007: “Why the Real Estate Boom Will Not Bust and How

Foreclosures are Technically Part of the Continuing Real Estate Boom, In a

Way.”2008: “Why the Real Estate Boom in Distressed

Properties Will Not Bust (except in certain local markets) and How You Can Use

Leverage to Profit From It.”2009: “Why the Phrase “Real

Estate Boom” is Often Misunderstood to Mean Higher Prices and How You Can Pray

for Them.”2010: “Why the Real Estate Boom Will Soon

Bounce Back and How to Eventually Profit From It.”2011:

“Why Did I Have to Write “The Real Estate Boom Will Not Bust Through the End of

the Decade” and How Did I Not Realize How Long A Decade Really

Is?”2012: “Oh, Dear God, Please, Please Let the Real

Estate Boom Bounce Back… and How You Can Profit From

It.”2013: “Please, Please, Just Let the Real Estate Boom

Come Back This One Time for This One House and How You Can Break Even From

It.”2014: “Why I Am Willing to Accept a Small Loss of 35%

On the Real Estate Boom and No Longer Care About How to Profit From

It.”2015: “Why Can I Maybe Borrow a Couple Dollars Off You

Until the Real Estate Bust is Over?”

Too funny — thanks Kev . . .

Lereah is nothing but a well paid cheerleading shill for the RE Industrial complex.His analysis makes Mary Meeker and Henry Blodgett seem like Warren Buffet.

It would be more appropriate if that family of four were standing directly under the floating house.

Notice that Lereah’s original masterwork contended that RE would stay bubbly until the end of the decade (2009-2010). Then, he surmises, the demographic waves of the baby boom will sink RE as an investment for some years.

This is the same argument a number of other RE messiahs have been using. Gain now, pain later.

Also fits in nicely with Harry “My Head’s Got a” Dent who says the Dow will hit 25,000-35,000 by 2009, then we’ll enter a global depression in the next decade.

Have no idea if they’re right or wrong. But perhaps the weakness we’re seeing in RE right now is just folks getting an early jump on the supposed coming Depression. Basically a version of “sell when you can, not when you have to.”

There is and has been a real estate boom going on.

Real Estate can be divided into several sectors: Apartments, Industrial, Retail, Hotel, Housing. Within housing is existing (85%) and New Home Builds (15%).

Commercial valuations are derived from cap-rates and/or vacancy rates. And, vacancies are dropping nationwide and cap-rates have been going down.

That’s a “boom” and it has not been running for a long time.

Housing is weak in most markets, but, with the U.S. population expected to increase by 25% to 400,000,000 in the next 35 years, it may very well be the century of real estate in the U.S.

http://www.usatoday.com/news/nation/2006-10-26-100-million_x.htm

Begs the question, what’s the title for his next revised book?

Why the Bust will not last?

How to profit from the Next Real Estate Boom (??)

I’ve heard that about “RE prices in american cities are still cheap relative to foreign cities” before. I think it was 1989 in a real estate office here in Washington DC. About 6 months later, the market crashed and didn’t come back for 7 years.

barry: see today’s MSN market roundup, says Saut and others referring to one (1) “mysterious buyer” responsible for concentrated buying on 9 days when shorts forced to cover heavy. wonder who that could be?

The avg 3br home where i live in Calif is $1.2M. There aren’t many places in the world more expensive, maybe Hong Kong, London and a few others.

But no one is arbitraging the cost of a home in Omaha vis-a-vis a home in Toulouse. It’s a meaningless argument. It’s all relative to the wealth characteristics of the local population, the credit environment and the supply/demand profile of the individual market.

I’ve been a RE investor all my life and, for the first time in 30 years, I have no interest in buying investment property here in California. None whatsoever. And it’s been berry, berry good to me.

Why? I’ll tell you why. Everything is now based on the come. It’s based on pie in the sky. The cap rates are nonsensical. You can’t find a commercial prop that generates so much as a 4% return. Many of the deals I see are cash-flow negative, at least for the first few years.

We’re about to sell a 70-unit building for a 2.5 cap rate. And it needs about $1M worth of work to boot. The last building we bought was at 7 and it was clean as a whistle. You do the math.

Who in their right mind buys “income” property that doesn’t generate income? Well, people are doing it. Why? Because they believe the properties will go up in value to make up for the cash-flow loss. This is a very slippery slope to step onto.

Maybe this is some brave new world where you don’t need cash flow to make a deal work. But it’s not a world I care to invest in.

Seems to me it’s all based on EZ credit and oceans of liquidity sloshing around looking for a home. I’ve seen a few cycles come and go and know what happens when credit dries up. It ain’t pretty. And this is the biggest cycle of them all. Nothing before, at least in my lifetime, compares with it.

So we’re selling out as much as we can and getting liquid ourselves. And we’ll wait for the next downturn. No point in waiting around for a “top” since I know how difficult it is to sell property when no one’s buying.

Seems like folks expect this cycle to last forever. And i’ll admit, it seems like it just might. But that’s not a bet i’m willing to make.

“Seems to me it’s all based on EZ credit and oceans of liquidity sloshing around looking for a home.”

Which has nothing to do with commercial cap-rates. You want a better cap rate? Go to Arizona or Texas….

“Who in their right mind buys “income” property that doesn’t generate income?”

People have invested in land over the years as an “investment” and have made a fortune. Land generates no current income.

The homebuilders have been buying farm land in Arizona for years and “banking it”. Guess what they do with it while waiting? Lease back to the farmers until they are ready to place the land into service. They have made a lot of money holding land.

“You want better cap rate? Go to Arizona or Texas”

ARIZONA? Phoenix, Flagstaff, Tucson, have you been watching those cap rates since 05?! They are horrible. California horrible! Check for yourself with updated numbers.

One more thing.

If people have “invested” in raw land over the years and made a fortune by simply holding onto it, WHY WOULD ANYONE SELL IT TO THEM? It would be giving away a winning lottery ticket.. Unless of course there was a BIG chance that the price would stagnate as it has done for 98% of the raw land in this country for 300 years! This is why people demand a high “Cap Rate” my friend.

It’s way too much wasting of good time focusing on what Mr. Lereah has to say.

C’mon, give the guy a break. I personally believe there is a housing boom that will at the very least deflate more rapidly than many might expect… but, Lereah hasn’t said anything that I’ve seen that is beyond the bounds of reasonable debate.

Housing hasn’t crashed yet… the variable rate people appear to be converting to fixed… rates may drop and save the day for them. Who knows?… housing may just take an upturn. Even if it crashes, I’ve seen reasonable evidence that it will be contained within about 10% of subprime loans. The lenders will have a great incentive to absorb those loans, carry them, work them off, write them off and offset their losses with gains from their overall portfolio.

No body can be certain they won’t be able to accomplish it.

It’s still a bit too early to build conclusions about Lereah’s motivations into our opinions about what he says and how he says it.

You have to remember… right now, Mr. Bernanke hasn’t got a growth engine to fall back on. He may have to bend his knee to housing again. Otherwise, the book he wrote about the Great Depression being merely a monetary event; he may have to write an addendum to that work in a year or two.

And… for God’s sake!

You’ve awakened Rip Van Nusbaum, and now there’ll be hell to pay!

Yes, it will be a population of 400 million. But 200 million of them will be old and poor, living not in big houses but in small apartments. Aand because many of them will not have cars they will densely cluster in urbanized gettos, within walking distance from grocery stores and graveyards.

Where I am?

>>>RE prices in american cities are still cheap relative to foreign cities. the US economy is still booming. i expect prices to accelerate in hot markets sometime next year. remember RE is highly non-exchangeable, you have to evaluate case-by-case<<< I agree, RE can be evaluated case-by-case. So, then, how can you make the general assumption that american cities are still cheap relative to foreign cities? Have you standardized for employment, standard of living, cost of living, income, political environment, etc?

>>>the US economy is still booming. <<< I guess whatever you read here goes in one eye, so to speak, and out the other. To each his own...

speaking of old and poor, a terrible thought just occured to me. I just checked Bernanke’s age and he’s only 51. That means he is going to be in the wheelhouse guiding S.S. Boomer into retirement. Now that may be considered a good thing because, unless he plans on quitting in the middle of hitting the iceberg, he has a vested interest in getting it right but it also occurred to me that probably a good portion of the rest of my investing ‘career’ will be tied to how he steers the ship.

It’s like I just woke up and realized I’m going to be FINANCIALLY MARRIED TO THIS GUY FOR THE REST OF MY LIFE!!!!

AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAHHHH!!!

DavidB:

It isn’t just Bernanke. Congress and the President can and will exercise their ability to dig deeper holes and/or distract the populace.

BTW, an earlier comment referenced Saut and the PPT. Here is the link:

http://www.raymondjames.com/inv_strat.htm

Thanks for the mention!

:-)

David

David Lereah Watch

Those are like the inlaws right Mr. Beach?

Nussbaum, you are a plague on blogs worldwide. I know of half a dozen that have banned you from posting for your endless trolling. I encourage Barry to do the same before every comment stream devolves into the Larry Nussbaum Cretin Hour.

I said, and I quote, “Who buys ‘income’ property that doesn’t generate income?”

Raw land is not “income property” now is it?

you only need a few “whizz lines” above the house, and maybe a little drawing of a hole underneath the people and they can use it as the cover for next year’s edition too.

http://research.stlouisfed.org/publications/review/06/09/Garriga.pdf

Here’s a readable paper on home ownership statistics.

There has to be liquidity.

Mostly comes from people with $.

When the unified deficit explodes to “pay off” all the notes the treasury “sold” to social security, Bernanke will have to run up the printing presses or join his generation in impoverished retirement.

By then the PRC will either be melted down in riots or actually investing in something other than US T notes.

Where is the liquidity when SS is bankrupt and a large elder poor population has no $?

It is a good time to liquidate real estate.

The high on the slope the better.

When does the rush to the door begin?

It is almost time for me to get my RE license.

There are some things here that can be crushed by misformed assumptions.

1) The elderly will be predominately poor.

2) The inability of land to increase in size reduces the liklihood of real estate decreasing in value.

3) The only tangible in real estate is price.

4) Price and ability to pay are not correlated.

First, between social secuirty and pensions there will be a substancial portion of the retiree crowd in the middle and above quintiles or annual earnings. Public pensions are very lucrative at the moment and there are still private pensions out there that are substancial. This may change in 30 years.

Second, land is only one part of the real estate puzzle. What is put on the land is another issue. Depending on the construction method, what is on the land can take 30 to over 100 years to fully depreciate. This goes to the third point, but is applicable here: the average square footage per family has gone through the roof. We have gone from a typical 900 sq ft of living space to over 1800 sq. ft. This can be reversed. There are very few limiting factors – this is not to say there are no factors – that prevent a 3,500 sq ft McMansion from being converted to a duplex. To bring this full circle, land value as it relates to housing correlates to the ability to achieve ‘x’ number of square feet of living space. (There are intrinsic factors that make land more valuable, but the differential between 1,800 sq. ft condo on the 3rd floor and a 1,800 sq ft home is not infinite.) This a long way of saying that there are indeed substitute goods for land.

As far as price and ability to pay, it should be obvious that there is correlation. This is not to say that inequalities cannot presist for a long time. Currently there is a very high positive risk rate – what folks are actually paying – for real estate on the expectation that greater income will be availabe in the future. For most things there is a negative risk rate. Whether such is rational will be determined in good time.

tangible s/b variable in #3

Land generates no current income.

The homebuilders have been buying farm land in Arizona for years and “banking it”. Guess what they do with it while waiting? Lease back to the farmers until they are ready to place the land into service.

It’s amazing how someone can be stupid enough to claim that land generates no income right before mentioning that it can be leased to farmers. Do you even pay attention to what you are saying?

Pending sales

National Association of Realtors® Pending Home Sales IndexSeasonally Adjusted Annual Rate, 2003-2006

The Pending Home Sales Index,* based on contracts signed in September, slipped 1.1 percent to a level of 109.1, following a 4.5 percent gain in August,

It would seem contrary at first blush. However, not all land is farmland.