Nice chart via my fishing buddy, John Silvia, who notes:

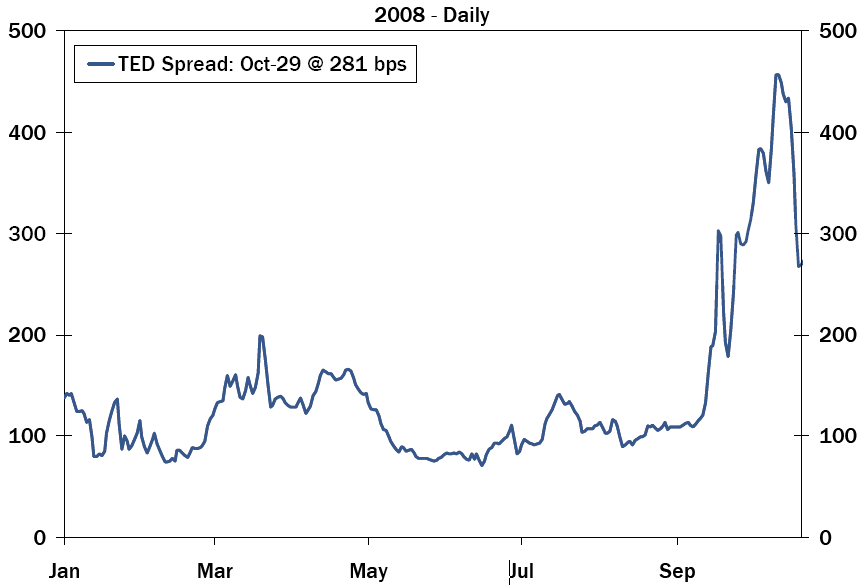

In its statement, the Federal Open Market Committee suggested that recent policy actions should help over time to improve credit conditions. Financial markets have evidenced some very modest improvement in credit spreads, but the search for that new equilibrium between risk and reward remains in progress. For example, both the price and the availability of credit to the high grade and high yield bond markets have assumed a very different tone from earlier in this decade. Meanwhile, the TED spread widened to over 400 basis points and has now retreated below 300 basis points (Figure 3). Commercial paper issuance has increased especially for commercial paper maturities over 81 days. The market and the economy remain constrained by the paradox of lemons—make more lemonade. This process will take time and supports continued Fed easing at the short end of the curve and credit aversion in the private market.

TED Spread

Source: Federal Reserve Board and Wachovia

What's been said:

Discussions found on the web: