James Quinn is a senior director of strategic planning at The Wharton School of University of Pennsylvania. James has held the positions of treasurer, controller, and head of strategic planning at with retailers, homebuilders and the university in his 22-year career. He earned a BS in accounting from Drexel University and an MBA from Villanova University.

This article reflects the personal views of James Quinn, and do not necessarily represent the views of his employer.

~~~

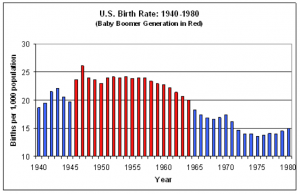

The Baby Boom Generation will never be mistaken for the Greatest Generation that survived the Great Depression and defeated evil in a World War that killed 72 million people. I hate to tell you Boomers, but putting a yellow ribbon on the back of your $50,000 SUV is not sacrifice. Our claim to fame is living way beyond our means for the last three decades, to the point where we have virtually bankrupted our capitalist system. Baby Boomers have been occupying the White House for the last sixteen years. The majority of Congress is Baby Boomers. The CEOs and top executives of Wall Street firms are Baby Boomers. The media is dominated by Baby Boom executives and on-air stars. We have no one to blame but ourselves for the current predicament. Blaming Franklin Roosevelt or Lyndon Johnson for our dire situation is a cop out. Baby Boomers had the time, power, and ability to change our course. We have chosen to leave the heavy lifting to future generations in order to live the good life today.

Of course, not all Baby Boomers are shallow, greedy, and corrupt. Mostly Boomers with power and wealth fall into this category. There were 76 million Baby Boomers born between 1946 and 1963. They now make up 28% of the U.S. population. Their impact on America is undeniable. The defining events of their generation have been the Kennedy assassination, Vietnam, Kent State, Woodstock, the 1st man on the moon, and now the collapse of our Ponzi scheme financial system. They rebelled against their parents, protested the Vietnam War, and settled down in 2,300 square foot cookie cutter McMansions with perfectly manicured lawns, in mall infested suburbia. They have raised overscheduled spoiled children, moved up the corporate ladder by pushing paper rather than making things, lived above their means in order to keep up with their neighbors, bought whatever they wanted using debt, and never worried about the future. Over optimism, unrealistic assumptions, selfishness and conspicuous consumption have been their defining characteristics.

Boomers are currently in their prime earning and spending years. A Baby Boomer turns 50 years old every 7 seconds. The older Boomers had a fantastic run from 1989 through 2004. Median net worth for those between the ages of 55 and 59 rose 97% over 15 years to $249,700 in 2004. Median income rose 52%. The younger generation between the ages of 35 and 39 saw their median net worth fall 28% to $48,940. Their median income dropped 10% over the same 15 year period. It is clear that all Baby Boomers are not created equal. Based on calculations made by the Federal Reserve, at least 50% of Boomers will not have a happy retirement. The bottom 30% will reach the age of 65 with net worth of less than $100,000. They will try to subsist in poverty, dependent upon social security and part time Wal-Mart jobs until they die peniless. The top 30% will retire to lives of luxury and leisure. The middle 40% will muddle through with social security payments the only thing keeping them from an old age in poverty.

We have become a have and have not society. Our economy favors education, entrepreneurship, and creativity. Those benefitting from a good education will make dramatically more money than the uneducated laborers. The top 20% of households make 12.5 times the lowest 20% of households. This ratio was 7 to 1 in 1982. The top 1% of households make 20% of all the income in the U.S., the highest rate since 1928. Does this statistic portend a decade long depression? The difference between now and 1928 is the huge household debt burden of Americans. This usage of debt by the poor has masked the gap between haves and have nots for the last 20 years.

As I drive to work every day in my fully paid for 2002 CRV with 110,000 miles, I have plenty of time to observe my surroundings. Sitting in traffic on the Schuylkill Expressway, I have noticed that the number of luxury Mercedes, BMW, Cadillac and Lexus vehicles seems out of proportion to the number of wealthy people in the Philadelphia population. When I see an older gentleman, wearing a suit, driving one of these automobiles, I assume that he is a wealthy executive who has put in his time and rewarded himself with a luxury vehicle. But, most of these vehicles are being driven by Joe the Plumber types. As I take a short cut through some of the more depressed areas of West Philadelphia, I see people talking on their Apple iPhones, Direct TV satellite dishes attached to dilapidated row homes, and Cadillac Escalades & Mercedes parked on the mean streets. This is not exactly the world that Henry Fonda’s character, Tom Joad, described in The Grapes of Wrath:

“I’ll be all around in the dark – I’ll be everywhere. Wherever you can look – wherever there’s a fight, so hungry people can eat, I’ll be there. Wherever there’s a cop beatin’ up a guy, I’ll be there. I’ll be in the way guys yell when they’re mad. I’ll be in the way kids laugh when they’re hungry and they know supper’s ready, and when the people are eatin’ the stuff they raise and livin’ in the houses they build – I’ll be there, too.”

When I see “poor” people appearing to live a more luxurious life than myself, I don’t feel jealous. The thought that goes through my head is: Which banks or finance companies were foolish enough to loan these people the money to live this lifestyle? These foolish financial institutions will never get their loans repaid. What does bother me is that the Bush-Paulson-Pelosi Bailout of Stupid Banks will use my taxes to buy these bad loans from the foolish banks. So, who is the fool in this scenario? The “poor” person got to drive a Cadillac Escalade for a period of time, the foolish banks got bailed out, the bank CEOs took home $30 million, and I lived within my means and footed the bill for the reckless actions of others. It appears that the fools are the Americans who lived their lives according to the rules. The anger is building. I don’t think the politicians running this country realize what true anger looks like. They are used to Americans being herded along like passive sheep.

I’ve heard many Republican ideologues blame the current crisis on the people who took the subprime loans for home purchases. I’ve also heard many Democratic ideologues blame the crisis on the regulators. The ideologues are wrong, as usual. If a poor person has no home, no vehicle, and no prospects; then a bank tells them that they can buy a $300,000 home, drive a $55,000 Mercedes SUV, and live like people on TV; why wouldn’t they say yes? What is their downside? If you have nothing and “The Man” offers you the American dream, you’d actually be foolish to say no. Now that they have lost the home in foreclosure and the repo man has taken the Mercedes, they are exactly where they were a few years ago with no home, no vehicle and no prospects.

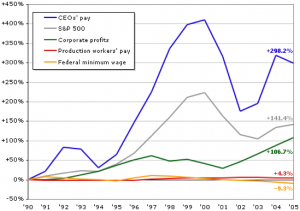

The regulators were certainly asleep at the wheel. They did not enforce existing rules, foolishly waived leverage rules for the biggest investment banks, and believed that the banks would regulate themselves. They were wrong, but they never made a single loan. The commercial banks, investment banks, auto finance companies, and credit card companies made the ridiculous loans to people who could never pay them back in the search for short term profits. Greedy Wall Street executives created an artificial market for the loans in order to generate billions in fees so they could enrich themselves through stock options and obscene bonuses. They spent their false riches on $2 million NYC penthouses, $100,000 Porsche 911s, and $5 million beachfront estates in the Hamptons. Based on the estimated $2 trillion of losses that our banks have generated, the CEOs certainly deserved annual pay 500 times as high as the average worker. There is no way an “average” worker could possibly be talented enough to lose $2 trillion. You would need to be truly extraordinary to lose that much.

CEOs’ average pay, production workers’ average pay, the S&P 500 Index, corporate profits, and the Federal minimum wage, 1990-2005 (adjusted for inflation)

Source: Executive Excess 2006, 13th annual CEO Compensation Survey

The brutal necessary lesson that should have been learned is that if you loan money to people who can’t pay you back, your bank will go bankrupt. The “poor” people who made a bad decision in buying homes and cars they couldn’t afford have lost those homes and cars. The banks made a bad business decision in making those loans. The taxpayer was not involved in these business transactions. This is where Hank Paulson, Ben Bernanke and George Bush, formerly free market capitalists, decided to commit our grandchildren’s money to bailing out the horribly run financial institutions. Our government has chosen to allow these banks off the hook for their bad business decisions at the expense of taxpayers. Rewarding bad decisions and bad behavior will lead to more bad decisions and more bad behavior. The government has made a dreadful decision that will haunt our country for generations. Now the Federal Reserve has lowered interest rates to 1% again. This is where this horrible nightmare started. The massive printing of currency throughout the world will ultimately lead to a hyperinflationary bust. The law of unintended consequences can be devastating.

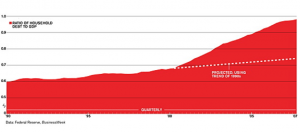

Source: Credit write downs

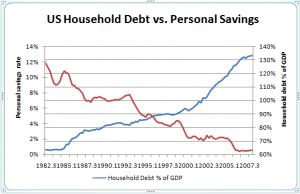

Early in the 1st Reagan administration Americans saved 12% of their income and household debt as a percentage of GDP was 63%. In 1980, the oldest Baby Boomers turned 34. They entered their prime earnings and spending years. This is when something went haywire with our great country. Deficit spending became fashionable for government, corporations and individuals. Dick “deficits don’t matter” Cheney was probably in his glory as the country ran up deficits of money, morals, and brains. The Boomers and our government chose to try and borrow and spend their way to prosperity. As we now know, Mr. Cheney’s advice about deficits not mattering was about as good as his belief that you can fire a shotgun in any direction without implications. The Boomer generation has freely made choices over the last quarter century that has brought us to the brink of a second Great Depression.

During the current Bush administration, Americans’ savings rate actually went below zero, while household debt as a percentage of GDP soared above 130%, a doubling in 25 years. These figures prove that the apparent prosperity of the last 25 years was an illusion. Beginning in 1982, Baby Boomers chose to take the easy road. Saving, investing and living within your means were cast aside as “Old School”. Boomers were handed a better future through the blood, sweat and tears of the “Greatest Generation”. Through their hubris, they’ve squandered that better future, the future of their children and imperiled our entire capitalist system. Between 1989 and 2007, credit-card debt soared from $238 billion to $937 billion, a 300% increase. Household liabilities that are in delinquency or default totaled $775 billion at the end of June, according to CreditForecast.com data. This is equal to 7.5% of all U.S. household debt, up from 3% just two years ago. In the last five years, our live for today Boomers, sucked over $3 trillion of equity out of their homes to fund their selfish lifestyles. At the end of June, there were 2.72 million mortgage loans in default at an annualized rate. For all of 2008, defaults will hit 3 million, up from approximately 1.5 million in 2007, and 1 million in 2006.

What “essentials” do the Boomers invest all this borrowed money in every year? The U.S. Census bureau provides the answers:

• $200 billion on furniture, appliances ($1,900 per household annually)

• $400 billion on vehicle purchases ($3,800 per household annually)

• $425 billion at restaurants ($4,000 per household annually)

• $9 billion at Starbucks ($85 per household annually)

• $250 billion on clothing ($2,400 per household annually)

• $100 billion on electronics ($950 per household annually)

• $60 billion on lottery tickets ($600 per household annually)

• $100 billion at gambling casinos ($950 per household annually)

• $60 billion on alcohol ($600 per household annually)

• $40 billion on smoking ($400 per household annually)

• $32 billion on spectator sports ($300 per household annually)

• $150 billion on entertainment ($1,400 per household annually)

• $100 billion on education ($950 per household annually)

• $300 billion to charity ($2,900 per household annually)

The priorities of our Boomer led society are clearly born out in the above figures. We spend more eating out than we give to charity. We spend as much on big screen TVs and stereos as we do on education. This may explain why 37 million (12.5%) of all Americans live in poverty and our high school students trail the students of 25 other countries (including Latvia) in science and math knowledge. Our school system processes many more clueless morons who don’t know the candidates for President, versus intelligent, thoughtful, hard working, driven young people. The $160 billion spent on gambling is indicative of the get rich quick without hard work attitude of the Boomer generation. Even worse, households with income under $13,000 spend, on average, $645 a year on lottery tickets, about 9 percent of all their income. Our government feeds this addiction by siphoning off billions in taxes from these gambling revenues to redistribute as they see fit.

What the data proves is that Boomers love to shop and eat, whether they have the money or not. The top 100 retailers in the U.S. have 250,000 stores that generated $1.7 trillion of sales last year. How could America function without 31,000 McDonalds, 35,000 KFCs, Taco Bells, & Pizza Huts, 15,000 Starbucks, 7,000 Wal-Marts, 2,000 Home Depots, 4,000 K-Marts/Sears, and 8,000 Blockbusters? There are 91,000 shopping centers in the United States. The Advertising industry spends $275 billion per year to convince you to spend money you don’t have for things you don’t need. This generation lacks self control, morals, a work ethic, and savings ethic. Based on the recent actions of our government and corporate leaders, we seem to lack any ethics at all. It is immoral for the boomer generation to run up $53 trillion in unfunded future liabilities in Social Security, Medicare and Medicaid to leave as our gift to future generations, while we live it up today. Optimists like to point out that Europe and Japan have much worse unfunded liability problems than the U.S. That is like taking pride in being the best looking horse at the glue factory. In the end, we’ll all still be glue.

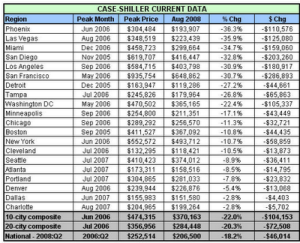

The 25 year Boomer borrowing and spending binge is coming to an end. The hangover will be really bad. The Federal Reserve and Treasury are trying to keep the frat party going, but everyone is passed out on the floor. The Case Shiller housing data shows that the 20 largest cities have experienced an average 20% decline in price from their peaks. The futures index predicts a further 10% to 15% loss in value. There are 75 million owned homes in the U.S. One in six, or 12 million homeowners, owe more than the house is worth. With further expected losses, 20 million homeowners will eventually be underwater on their mortgage. In California, where home price declines will be 40% to 50%, half the homeowners in the State will owe more than the house is worth. If you are one of these homeowners and can afford the mortgage payment, time will eventually bail you out. If you can’t afford the mortgage payment, you should lose the house to someone who can make the payment. This is the failure side of the creative destruction that is true capitalism. If the government steps in to subsidize and eliminate failure, the system will ultimately collapse.

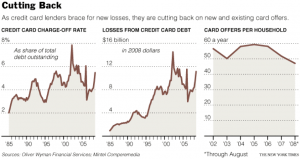

Part two of the great Boomer credit contraction will be the collapse of credit card companies who have mailed out 27 billion credit card offers in the last five years. They are now reaping what they have sown. As Boomers could no longer borrow from their homes, they switched to credit cards to make mortgage payments and car payments. That well is running dry. The losses to card companies will make the losses in 2000 to 2002 seem like good times. Losses in the 1st half of 2008 soared to $21 billion. Losses are expected to total $55 billion in the next year and a half. This brings me to the latest outrage perpetrated upon the U.S. citizens by Hank Paulson and his Treasury cronies. The credit card industry, which collects 23% interest and $12 billion in late fees from consumers, is lining up to get their piece of the $700 billion bank handout. Capital One has just received a $3.6 billion injection from the American taxpayer, one week after projecting that their write-offs will be $7.2 billion in the next twelve months. This will allow them to send another million offers to more people who shouldn’t have a credit card. Why not? The taxpayer will pay, if the losses are too high. Why aren’t the pundits on CNBC outraged at this misuse of taxpayer money? Would the bankruptcy of Capital One hurt our country in any way?

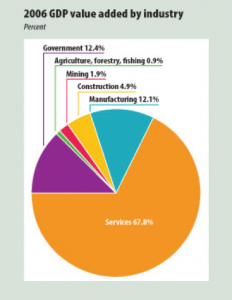

The Great American Empire has begun its long slow decline. It may take a few generations to reach its nadir, but the poor decisions already made and crucial decisions postponed in the last 25 years by our Boomer dominated leadership has put our country on a path to a declining standard of living. The U.S. is like a punch drunk ex-champion boxer who still thinks he has what it takes, but is living off his old press clippings. He lived the good life, got fat and didn’t do the hard work required of a champion. A slew of young brash fighters are itching to take him down. It is just a matter of time. In our heyday during the 1950s, manufacturing accounted for 25% of GDP. In 1980 it was still 22% of GDP. Today it is 12% of GDP. By 2010 it will be under 10% of GDP. Our Government bureaucracy, which contributes nothing to the advancement of our society, now is a larger portion of GDP than manufacturing. Services such as banking, retail sales, transportation, and health care now account for two-thirds of the value of U.S. GDP. We have become a nation of bureaucratic paper pushers. Past U.S. generations invented the airplane; invented the automobile; discovered penicillin; and built the Interstate highway system. The Baby Boom generation has invented credit default swaps; mortgage backed securities; the fast food drive thru window; discovered the cure for erectile dysfunction; and built bridges to nowhere. No wonder we’re in so much trouble.

Now that I have laid out our bleak future, I can tell you that, like Dickens’ Christmas Carol, this is only a vision of what might be. There is time to change our course before our ship wrecks on a jagged reef. David M. Walker, former Comptroller of the United States, at a recent Fiscal Wake Up Tour at the University of Pennsylvania, described what has been happening in this country for the last 25 years in one word – laggardship. The last six months have been a perfect example of laggardship. Our leaders have floundered from crisis to crisis, overreacting and blustering rather than leading. True leaders are proactive, not reactive. After not addressing our energy policy for decades, as soon as oil reached $140 a barrel, Congress lurched into action so their constituents would think they were leading. As our financial system has imploded, government “leaders” have flailed about with one rescue package after another and Congress looks for scapegoats. Meddling, tinkering, and non-enforcement of rules by Congress and other government bureaucracies caused the crisis that they are reacting to. Government creates the problems and then assumes even more power over our lives with their ridiculous “solutions”.

No one in Washington has shown an ounce of leadership in decades. True leadership requires strength of character, clear vision to see the future as it is, the bravery to make unpopular decisions, and the honesty to tell the public the unvarnished truth based on the facts.

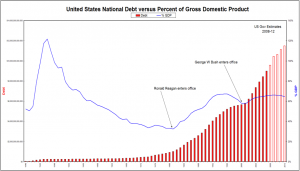

The facts are: we have a $10.5 trillion national debt; $53 trillion of unfunded liabilities; a military empire that has U.S. troops in 117 countries and has spent $700 billion on a pre-emptive war that has killed over 4,000 Americans; a $60 billion trade deficit; an annual budget deficit that will exceed $1 trillion in the next year; a crumbling infrastructure with 156,000 structurally deficient bridges; almost total dependence on foreign oil; and an educational system that is failing miserably. We can not fund guns, butter, banks and now car companies without collapsing our system.

I truly hope that President Obama can rise to the occasion and become a true statesman and leader. David Walker lays out our dilemma:

“The regular order in Washington is broken. We must move beyond crisis management approaches and start to address some of the key fiscal and other challenges facing this country if we want our future to be better than our past. Our fiscal time bomb is ticking, and the time for action is now!”

Ultimately, it is up to the Baby Boom generation to change our country’s course. The oldest Boomer is 62 years old and the youngest 45 years old. It is time for Boomers to take a hard look in the mirror and rethink their priorities. It is time to cast aside the $88,000 Range Rovers, $1,200 Jimmy Choo boots, $5,000 Rolex watches and daily double lattes at Starbucks. It is time to live within your means, distinguish between needs and wants, reduce debt, save 10% of your income, make sure your kids get a good education, not try and keep up with the Jones’, show compassion for your fellow man, and possibly pay more taxes and get less benefits, for the good of the country. We must support true leaders like David Walker and get rid of the old time corrupted politicians who want to keep the status quo. Texas Congressman Ron Paul gives the blunt truth that a true leader is willing to give:

“Our government has lived beyond its means for decades. We now face a crucial juncture, at which we determine whether to continue down the path of debt, inflation, and government intervention or choose to return to the economics of the free market, which have been ignored for almost a century. Increased debt leads to higher taxes on future generations, while increased inflation diminishes the purchasing power of American families and destroys the dollar. No society has ever been achieved prosperity through indebtedness or inflation, and the United States is no exception. We cannot afford to continue our current policies of monetary expansion and unending bailouts. Unless we return to sound monetary policy, sharply reduce government expenditures, and realize that the government cannot act as a lender of last resort, we will drive our economy to ruin.”

The Baby Boom generation has one last chance to change the course of U.S. history, keep us from wrecking in a storm of debt on the approaching jagged reef and shed the title of “Shallowest Generation”.

What's been said:

Discussions found on the web: