Good Afternoon: I will briefly dispense with the market action during the last gasps of 2008 before turning to a review of 2008. I will conclude with what can only be called wild guesses for 2009.

The last trading day of 2008 enabled our capital markets to close with the type of upside flourish that was sorely lacking during most of the year. Stocks enjoyed a solid, if low volume, move to the upside to cap off the worst year for the major averages since the 1930’s (see below). Gains ranged from 1.25% for the Dow Industrials to 3.5% for the Russell 2000 Bonds moved in the opposite direction, though rising yields couldn’t prevent Treasurys from posting their best year since 1995 (see below). The dollar closed out Wednesday and the year with modest gains, while commodity prices tried to recapture some of the glory that marked the first half of this year (see below). Another energy spat between Russia and the Ukraine lifted prices across the board, but Wednesday’s 5% rally in the CRB index still left it down 36% for the year (and down 52% from the July 3 highs).

Since 2008 will go down as one of the most memorable years in the history of capitalism, it needs very little recounting. The housing and mortgage woes so evident in 2007 finally migrated to the rest of the capital markets as 2008 commenced, resulting in a shotgun wedding for Bear Stearns, federal co-habitation for Fannie Mae, Freddie Mac, and AIG, and a toe tag for Lehman Brothers. Had the damage ended right there, 2008 could have been called “4 Weddings and a Funeral”, but the real economy started to really suffer in the wake of Lehman’s demise. As did the stock market, since indexes here and abroad closed with losses of between 35% and 60%. To top it off, a certain unsaintly Bernard made off with the savings of friends, investors, and charities when his firm was revealed to be the largest Ponzi scheme in history. How fitting for a year that caused so many homeowners to look at Wall Street’s mortgage finance machine in much the same way. As we head into 2009, we have steadily rising unemployment, a rapidly falling GDP, the virtual disappearance of lending, and a myriad of federal plans to deal with the whole mess. It was the most frightening year since the Great Depression, and here is how my year-ago predictions panned out (my comments are in parenthesis):

2008 Outlook:

U.S. Economy: Recession finally arrives (true, but in retrospect, an understatement)

Stocks: Bear market finally arrives once investors realize Fed is not omnipotent (ibid)

Bonds: Treasurys & TIPS offer little value at these levels; it’s time to look for high quality elsewhere. Candidates are select Municipal Revenue bonds, GNMAs, and certain investment grade corporates. True credit analysis makes a comeback! (the one howler in the bunch, as Treasurys soared and all but GNMA’s suffered)

Dollar: Should stay weak, but I’m only mildly bearish now. (correct early in the year, wrong later as the greenback enjoyed a flight to “relative” quality)

Precious metals: Like all commodities, precious metals should be a wild ride in 2008. And, as with most commodities, I’m long term friendly toward the precious metals, but rallies should be used to raise cash and wait for either recession worries or a downturn in the Chinese stock market to allow for better entry points. I’d certainly prefer to be long precious metals (or corn) over base metals like copper or lead (spot on as gold advanced for the 8th straight year. I was especially lucky with my mid year warning that most commodities had gone parabolic and should be avoided)

U.S. Housing Market: Will stay weak, despite more bottom sightings (Op.Cit. – see top)

The Fed: Grudging eases in ’08, but the Fed’s desire to preserve its “credibility” will paradoxically cause that credibility to be harmed. (correct only in direction — the Fed’s eases have been anything but grudging)

Volatility: With us all year; better than even chance we spike above the 2007 high (another lucky call that actually underestimated the outcome)

Credit Spreads: Some spreads (certain ABX tranches, jumbo mortgages & senior bank loans) could tighten, but most will stay wide or get wider. Again, credit analysis will finally be of real value. (only somewhat correct, since ALL spreads widened and credit analysis added little value during the great liquidation)

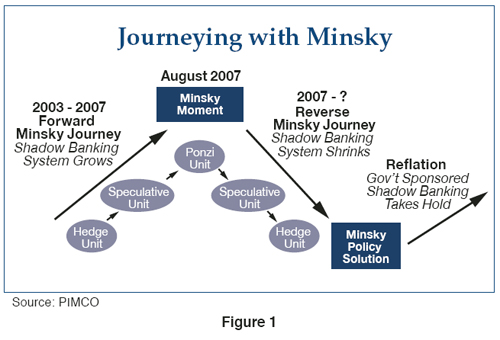

To me, the above predictions were not hard to make. Given the massive credit bubble that had been expanding for years, it took little foresight to imagine the detrimental impact a broken housing bubble would have on our markets and our economy. So, if 2008 was a well-telegraphed punch, then how should a thoughtful person handicap 2009? A truly wise individual would take a pass. The problems facing our economy are daunting, and the level of policy response out of Washington is massive and unprecedented. Literally almost anything is possible. To state the bullish case, I ask readers to peruse the latest thoughts from PIMCO’s Paul McCulley (see below). While maintaining a hint of caution, Mr. McCulley nonetheless thinks the multitude of actions taken by the Fed, the Treasury, and Congress will ultimately succeed. He sums up his argument with a simple graph,

While many believe in Mr. McCulley’s vision that the huge policy moves undertaken by governments and central banks around the world will be of help, many also rightly wonder whether such governmental activism might not have unseen costs down the road. Huge and growing government debt issuance is a given, but what if the eventual recovery from this mess is pushed out or even retarded by the rise of statism over capitalism? This question is the subject of the thoughtful Bloomberg article you see below. These forces will continue to clash in 2009, and the outcome will probably hinge upon whether governments and central banks can restore enough confidence to revive borrowing and lending.

With securitization a shadow of its former self and with the capital markets virtually closed to deals without either government backing or interest rates that would make a loan shark blush, it now falls to the banks to fill the void. Unfortunately, banks are hoarding cash and are not yet lending in large enough amounts to make a difference. It’s hard to appreciate just how large a hole has been blown in the credit creation process by the various broken asset bubbles (housing, equities, credit, and commodities). For this process to reverse, it will take more than just well crafted and well executed policy responses. It will require time — and some faith.

I believe in cycles in general and the cyclicality of belief and disbelief in particular. In 2007, investors faced crack ups in mortgage lending and leveraged loans with a belief that bordered on complete denial. Disbelief that our problems really were contained steadily crept into the minds of investors until it reached a crescendo on November 20. Belief has been trying to launch a comeback ever since. For now, investors want to believe these policy actions will grip and lead to us to the type of economic recovery that makes today’s stock prices look cheap. Market participants are therefore currently willing to overlook the worsening economic climate of today in the hope of a better tomorrow. They believe in the future, which is why stocks have rallied off the November lows and could continue higher in January.

This faith will, however, be tested in 2009. At some point in the first half of the year, the drumbeat of poor economic statistics will unnerve the herd, causing them to doubt whether Mr. McCulley’s “reverse Minsky journey” can be accomplished in a timely manner. If so, and especially if the 2008 lows get taken out, some wonderful buying opportunities will present themselves to equity investors. Perhaps the best way to play this uncertainty is to stay with quality in every asset class, and it also makes sense to be paid to wait while the economy tries to mend. As such, here are some speculative thoughts for 2009:

2009 Outlook:

U.S. Economy: Recession deepens in the first half and then tries to stabilize. A recovery worthy of the name doesn’t arrive until 2010.

Stocks: Trade in a wide range. Upper end for S&P is 1000 to 1100, while there is a better than 50/50 chance we see the November 2008 low of 741 taken out in 2009. Prefer low-debt, high dividend paying stocks.

Bonds: Avoid Treasurys and look for high quality elsewhere. Candidates are senior bank loans, select Municipal Revenue bonds, GNMAs, certain investment grade corporates, and TIPS with real yields above 3%. True credit analysis — finally — makes a comeback!

Dollar: Should weaken, but it could go anywhere. It might even rally if rest of globe stays weak or sees increased geopolitical conflict.

Commodities & Precious metals: Long term positive, but a mixed bag in ’09. Prefer agricultural commodities to energy and prefer precious metals over base metals. Most commodity production is capital intensive (a negative), but most governments seem bent on shredding their currencies (a positive). Small to mid-size precious metals mining stocks may be the best way to play this sector, but volatility is the only guarantee for commodities in 2009.

U.S. Housing Market: Will stay weak most of the year. Case/Shiller index to fall another 10% to 20%, but Fed efforts to lower mortgage rates will eventually help.

The Fed: All in — short rates already essentially at zero, so next trick for Bernanke and Co. is to peg long term rates by buying mortgages and perhaps long dated Treasurys.

Volatility: With us all year. Highs are in for VIX, though, and it should range between 25/30 & 55/60 in ’09.

Credit Spreads: Will be volatile but credit spreads offer the best value (the Graham & Dodd kind) among all asset classes. As deleveraging ebbs and as new money is earmarked for distressed assets, those with a talent for credit analysis (e.g. credit-oriented hedge funds and mutual funds) should have a banner year in 2009.

Inflation: CPI is not a worry in 2009, but could be a large one in 2010 or beyond. Currency devaluation attempts by various governments will make inflation a relative battle (i.e. standard of living differentials among nations) in ’09.

The risks to these forecasts are numerous and considerable. Whenever economic woes encircle the globe, conflict and even war have often been the unfortunate result. While U.S. citizens tend to think about Iraq and Afghanistan , we should remember that Russia invaded Georgia in 2008, Israel and Hamas are at each other’s throats again, and the nuclear-capable nations of India and Pakistan are preparing to exchange blows. Financial risks also abound. U.S. banks may have written down mortgage exposures, but stand by for all the consumer debt that will now go bad. Europe’s financial institutions may be in even worse shape than their U.S. brethren, but the structure of the E.U. leaves it poorly positioned to effectively respond. If the credit crisis worsens in 2009, Europe will likely be a focal point. Lastly, the U.S. dollar could pose a surprise in either direction. With all the trillions our government is throwing at our financial mess, the greenback could crack wide open if global investors become less willing to finance our debt. If, however, Europe hits the rocks or geopolitical hot spots erupt into war, then the buck could benefit from a flight to perceived safety. Precious metals should represent a hedge in either case, though mining stocks will benefit from the former scenario and suffer in the latter.

2009 shapes up to be a fascinating year, but I want to thank all the readers who have taken the time to offer encouragement and/or constructive criticism during the past twelve months. I appreciate the feedback, and I wish all of you a happy and prosperous new year!

— Jack McHugh

U.S. Stocks Rise, Trimming Worst Yearly Drop Since Depression

U.S. Treasuries Fall, Trimming Biggest Annual Rally Since 1995

Yen, Dollar Head for 2008 Gain Versus Euro in Flight to Safety

Gold Rises, Caps Eighth Straight Annual Gain, on Haven Demand

Global Central Bank Focus: “All In”, by PIMCO’s Paul McCulley, December 2008

Saving Capitalism No Sure Thing as Statism Undermines Economy