In this morning’s WSJ, William Isaac, the 1980s FDIC chair, argues against nationalization of the insolvent mega banks. Isaacs oversaw the nationalization of Continental Illinois National Bank and Trust Company, and uses that as the basis of his opinion.

In this morning’s WSJ, William Isaac, the 1980s FDIC chair, argues against nationalization of the insolvent mega banks. Isaacs oversaw the nationalization of Continental Illinois National Bank and Trust Company, and uses that as the basis of his opinion.

Unfortunately, it makes for an awful comparison. In his OpEd, Isaacs overlooks so many dissimilarities between the present situation and that of 1984 so as to render his argument meaningless. Continental has but one parallel to the current situation — it was a large and insolvent bank. On all other counts, the situation was extremely dissimilar to the bailouts circa 2008-09.

We discuss below those differences, but first, let’s see what Isaac has to say:

“People who should know better have been speculating publicly that the government might need to nationalize our largest banks. This irresponsible chatter is causing tremendous turmoil in financial markets. The Obama administration needs to make clear immediately that nationalization — government seizing control of ownership and operations of a company — is not a viable option.

Unlike the talking heads, I have actually nationalized a large bank. When I headed the Federal Deposit Insurance Corporation (FDIC) during the banking crisis of the 1980s, the FDIC recapitalized and took control of Continental Illinois Bank, which was then the country’s seventh largest bank.

The FDIC purchased Continental’s problem loans at a big discount and hired the bank to manage and collect the loans under an incentive arrangement. We received 80% ownership of the company, which increased to 100% based on the losses suffered by the FDIC on the bad loans.”

The comparisons between 1984 and the present are worlds apart, as are the dynamics between Continental versus Citi or B of A.

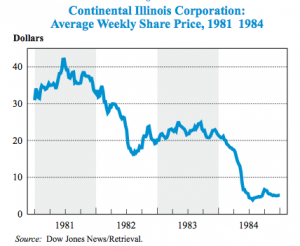

Let’s begin with Continental, which went into FDIC receivership in 1984, came out of receivership in 1991, and was ironically purchased by Bank of America in 1994 (their track record of lousy acquisitions goes back decades). Continental went bust due to a fatal combination of an aggressive growth strategy and a very poor purchase of loans from PennSquare. When Penn went bust, it dragged Continental along with it. Isaacs somehow fails to mention that Continental had a rather corrupt senior management, with kickbacks for approving risky loans; some of Continental’s execs ended up doing jail time for fraud.

While management of our current mega money center banks are incompetent and have failed to adequately account for foreseeable risk, no one is alleging that they are criminally corrupt.

Continental was also unique in that it was the very first major bank rescue plan under the concept of “Too Big to Fail” (TBTF). It was novel, a case of first impression, and there were no prior experiences to rely upon. In virgin territory, there was simply nothing in the FDIC playbook to explain how to handle the event.

In its eventual look back at the era, the FDIC wrote that Continental wasn’t Too Big to Fail; rather, it was more accurate to say it was “too big to liquidate.” At present, I know of no serious commentators who are suggesting a Lehman-like liquidation for the mega money centers.

“Regulatory options were also limited by “Continental’s peculiar characteristics: Although very large, it had proportionately few core deposits, no retail branches, and little franchise value.” (History of the Eighties, Lessons for the Future, page 253).

The two situations couldn’t be more dissimilar. Unlike Continental, Citi and BoA have massive assets, enormous deposits, a huge number of retail branches and extremely valuable franchises. The comparisons between Continental and C/BAC are simply absurd.

Further, any suggestion that these entities become wards of the state indefinitely is not on the table. We are contemplating a very short period of time — months, not years. Not a single person is suggesting a 7 year holding period — that was how long Isaacs and the FDIC kept Continental a government owned entity.

Also insane: While the Continental shareholders were wiped out, all creditors and preferred shareholders came out whole — a ridiculous notion directly subsidized by the FDIC to the tune of $1.6 billion dollars. In the current situation, the idea that creditors, bond holders and preferred shareholders won’t be given a severe haircut is patently ridiculous.

Lastly, politicians in DC are already dictating executive pay, marketing expenses, employee trips, dividend policy advertising sponsorships, etc. These firms have, for all intents and purposes, already been nationalized.

Let’s compare 1984 to the current situation: We have already poured $90 billion into the two big banks, plus agreed to insure another $450 billion in assets. Now compare that to the relative pennies we spent on Continental. Any suggestion these two are remotely parallel is utterly ridiculous.

Continental was the first major bank rescue of the modern era. Since then, we have learned how to accomplish these workouts through the entire savings and loan crisis, along with the Resolution Trust Corporation (the government-owned firm which disposed of failed S&L assets); the subsequent government takeover of the Bear Stearns (immediately flipped to JPM), the 80% nationalization of AIG, the full blown takeover of Fannie Mae and Freddie Mac; the seamless transition of Wachovia, and Washington Mutual by the FDIC; What is effectively a 75% takeover of CitiGroup and Bank of America.

And that’s before we even get to the current issue of systemic risk, or the drag on the overall economy of having two massive Japan-like zombie banks hanging around. Given that we have already spent 300% of their market caps in terms of capital injections, and are on the hook for another 1500% of their valuations in terms of insured paper, these two banks are becoming vast money pits, ginormous black holes into which vast sums of taxpayers wealth disappear, never to be seen again in this universe.

Former FDIC chairman William Seidman notes that we have not only encourage moral hazard, we have incentivized the banks to keep coming back to Uncle Sam for more cost-free taxpaper money:

“It’s the question of, ‘What’s the best way to get this system cleaned up and going again?’” William Seidman, a former FDIC chairman said in an interview. “In my view, you have to nationalize some of the banks to do that. The alternative is they’re losing money, they come back to say, ‘We’re too big to fail, we need money.’ They’ll do that every month.”

It would be fair to state that Mr. Isaacs was dealing with a problem of first impression. We have since learned a great deal through trial and error — especially Seidman’s role as first chairman of the Resolution Trust Corporation.Seidman oversaw far greater liquidations and nationalizations than did Isaacs. And at present, the FDIC is liquidating 2 banks per week without any fuss or muss.

Let’s not ignore these hard lessons and experiences for foolish reasons of ideological purity.

>

Sources:

Bank Nationalization Isn’t the Answer

WILLIAM M. ISAAC

WSJ, FEBRUARY 23, 2009, 11:19 P.M.

http://online.wsj.com/article/SB123543631794154467.html

Continental Illinois and “Too Big to Fail”

FDIC

http://www.fdic.gov/bank/historical/history/

http://www.fdic.gov/bank/historical/history/235_258.pdf#search=’Continental%20Illinois’

Obama Bank Nationalization Is Focus of Speculation

Linda Shen

Bloomberg, Feb. 23 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=anGxzRYhVF_Y&

What's been said:

Discussions found on the web: