Very.

At least, that’s according to Rolfe Winkler’s analysis of the Depositor Insurance reserve ratio:

>

Rolfe:

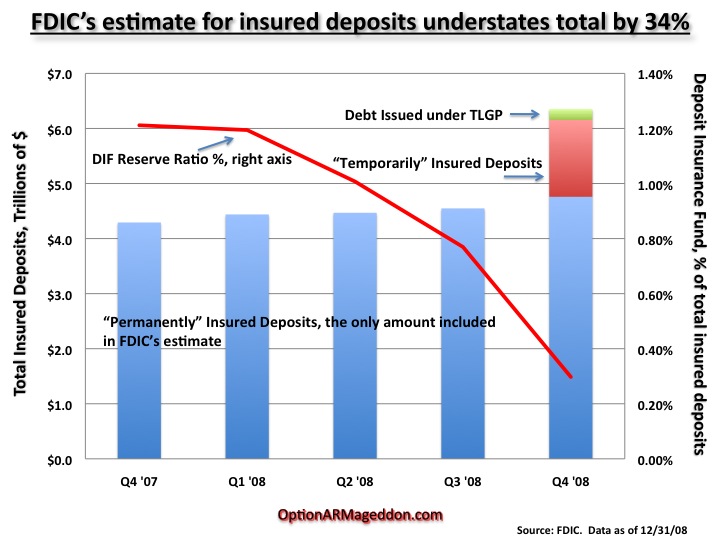

[Look at] FDIC’s 12/31/08 balance sheet. Note at the bottom of that link the estimate for total insured deposits: from Q3 to Q4 it increased only a smidge, to $4.8 trillion from $4.6 trillion. Odd, no? Why such a small increase even though FDIC dialed up deposit insurance limits so significantly during Q4? FDIC Senior Banking Analyst Ross Waldrop told me during an interview last week that it’s because so-called “temporary” increases in deposit insurance are excluded. If included, these would boost total insured deposits from $4.8 trillion to $6.2 trillion.

FDIC’s total commitments would increase an additional $224 billion to $6.4 trillion if you include debt issued prior to the new year under FDIC’s “Temporary” Liquidity Guarantee Program.*

In early October, FDIC boosted deposit insurance limits for individual non-retirement accounts to $250k, which, according to Waldrop, added $713 bilion to total insured deposits. He also noted that new insurance on non-interest bearing transaction accounts added $684 billion to the total.

Shorter version: A trillion and a half in additional guarantees should have a whole lot more in reserves.

>

Source:

FDIC’s Insurance Commitments 34% Higher Than Reported

Rolfe Winkler

Option Armageddon, April 6, 2009 – 4:00 am

http://optionarmageddon.ml-implode.com/2009/04/06/fdics-insurance-commitments-34-higher-than-reported/

What's been said:

Discussions found on the web: