Before we take a look at the Retail Sales data, let’s step back and see if we can explain why we even track this data. We want to know:

-What the consumer is doing with their money;

-How comfortable people are with their current economic situation;

-What potential jobs are being created;

-What sort of tax revenue will be coming into the government’s coffers;

-What the corporate profit picture will look like.

I bring these elements up because there is a tendency to read the headline, get all excited, and draw the wrong conclusion.

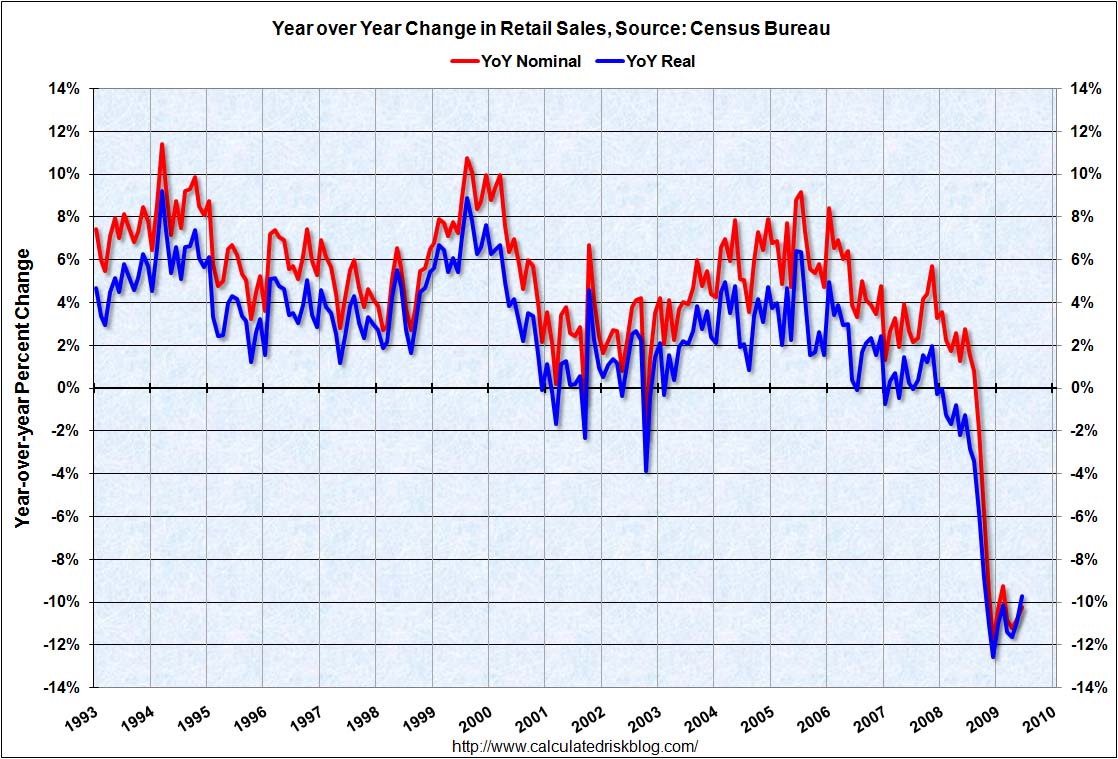

Monthly Retail sales rose a better-than-expected 0.6% — the best since January 2009. Year-over-year, retail sales were down 9%.

As always, there was a little hair on the data: Sales data was inflated by rising gasoline prices (+5.0%), plus an auto sales bounce from record low levels. Note that Retail sales are seasonally but not inflation adjusted.

-Ex-Autos, (+2.3%), sales grew 0.3%.

-Ex-Gasoline, sales gained 0.3%.

Back out both autos and gas, and sales in June fell 0.2% — the fourth straight monthly decline.

via Calculated Risk

>

Sources:

Retail sales score best gain in five months, U.S. data show

Greg Robb

MarketWatch, July 14 2009

http://www.marketwatch.com/story//retail-sales-have-best-rise-in-5-months-in-june

U.S. Producer Prices Rose in June as Gasoline Surged

Bob Willis

Bloomberg, July 14 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=aU.CYEbeHh28

What's been said:

Discussions found on the web: