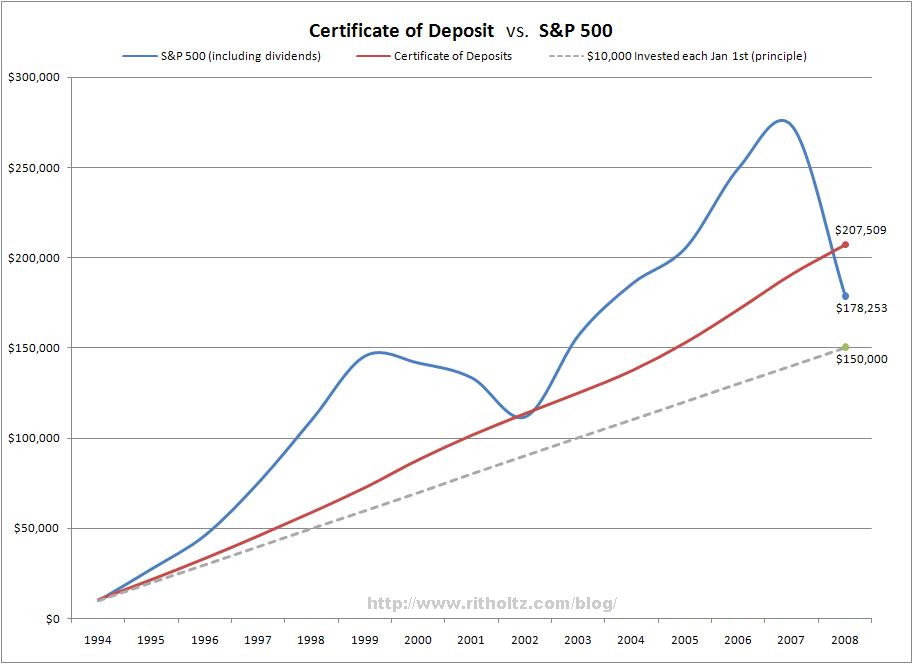

Imagine two people who added $10,000 to their investment accounts on January 1st, every year for the past 15 years.

One of them is risk averse. They put the money into Certificates of Deposits, getting a few percentage points each year, but the principal is insured.

The other is less risk averse; they put money into an S&P500 Index each year.

Who comes out ahead? The answer might surprise you:

>

Stocks vs Certificates of Deposit (1994 – 2008)

>

CDs in 2009 yield 1% – 2%, as the market fell and then rally; if the S&P doesn’t perform well for the rest of this year, CDs will have more gains again.

As of March, Bonds had outperformed Stocks from 1968 to 2009 — 40 years

>

Thanks, RM!

>

Previously:

Stocks vs. Bonds (March 28th, 2009)

http://www.ritholtz.com/blog/2009/03/stocks-vs-bonds/

Sources:

Used the CDs 6 mo (Annual) data from here:

http://www.federalreserve.gov/releases/h15/data.htm

Used the annual returns (with dividends) from here:

(did each year gain/loss seperate, then added the $10K for the next year)

http://www.moneychimp.com/features/market_cagr.htm

What's been said:

Discussions found on the web: