“There’s a huge disconnect between what the average American worker receives in terms of compensation and some of what we’re hearing about on Wall Street. We do believe that when the taxpayer monies are invested that compensation should be fair.”

>

Well, yes and no.

There is clearly a disconnect between Wall Street and Main Street. The compensation for making bets that payoff is outsized on Wall Street, thanks to the fact that a) Its OPM (other people’s money), and 2) it is a difficult job that few people do well; and 3) it is inordinately stressful.

However, remember there are several different aspects to Wall Street compensation:

1) Stock Options for C-level execs;

2) Commission for Sales people;

3) Bonuses for Traders;

My biggest issue is with the first item — Stock options. Why? Two major reasons: First, they get issued when stocks are up, and more are given when stocks are down. Eventually, some slug of these options will hit pay dirt. Thus, stock option compensation works out to be a big payoff for Volatility, not Performance.

This includes the CEOs/CFOs/Senior Execs of companies that have been bankrupted/bailed out, and recieved insane windfalls for helping to destroy these firms. It makes no sense, shows that the Boards of Director and large shareholders are either corrupt, or clueless.

Second, as we saw in the 1990s, many CEOs and other execs received huge compensation for the simple act of being at the company during a raging bull market. There is no adjusting for how well the company did relative to the market, or to their peers in the same sector. That’s not pay for performance, its pay for good timing of when you start your job.

~~~

Here’s where you have to be careful not to paint with too broad a brush: The vast majority of people who work on Wall Street are ordinary hard working, albeit well compensated people. And taht vast majortity of these folks did not cause the problems.

Take for example commission sales: I have zero issue with that, regardless of what these employees are selling — Cars, Frozen Steaks, Institutional Sales, Mutual Funds, whatevers. The guys that can raise the money and close these deals should get whatever their employment contract states.

As to the P&L Traders whose bonuses are dependent upon profitability, as long as there is some appropriate w/h for future risk — meaning, they can’t bankrupt the company — than those contracts should be honored.

Take AIG for example: There were 400 employees who worked in the Financial Products division (AIG FP) that caused all the problems — out of 116,000 employees. We simply cannot blame everyone who worked there for what those 400 did.

The Bear Stearns hedge fund that blew up were a handful of people — so too were the Mortgaged backed traders there, as well as at Lehman Brothers. And the nimrods that caused Citi’s woes (and Merrill’s and Bank of America’s and CIT) were a tiny percentage of employees.

I have a suspicion that some of the anger over compensation is misdirected . . .

>

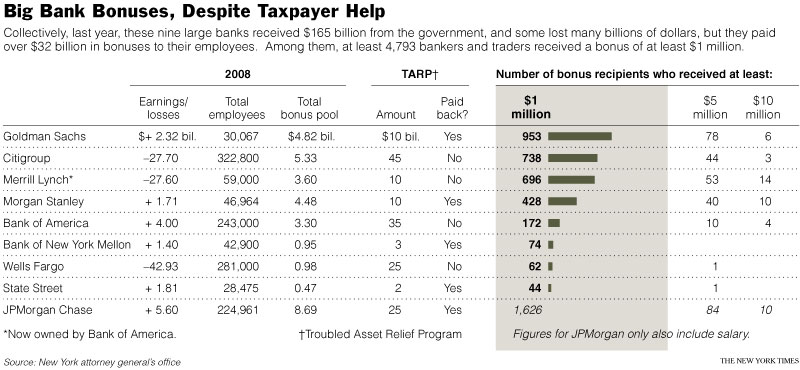

Courtesy NYT

>

Sources:

Bankers Reaped Lavish Bonuses During Bailouts

LOUISE STORY and ERIC DASH

NYT July 30, 2009

http://www.nytimes.com/2009/07/31/business/31pay.html

Biggest banks in US reward stars with huge bonuses

ADAM GELLER

AP, July 31, 2009

http://www.google.com/hostednews/ap/article/ALeqM5hDoEn8Uu3hgHZTzv2bM03eLCUFCgD99PMIAG1

Wall Street Executive Pay Shows ‘Huge Disconnect,’ Jarrett Says

Nicholas Johnston

Bloomberg, August 1, 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=aN.QDeYjf4qI

House Gives Regulators Incentive Pay Role; Senate Prospects Dim

Jesse Westbrook and Ian Katz

Bloomberg, August 1, 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=aPcjPb7SuWVw

What's been said:

Discussions found on the web: