~~~

Investment letter – August 26, 2009

HOW TECHNICAL ANALYSIS CAN IMPROVE FUNDAMENTAL ANALYSIS

Over the last 3 years, most economists have fallen into one of two groups. The smaller group were those economists who saw the housing and credit crisis coming. Granted, most were a bit early and turned negative in 2006. Given subsequent events and the severity of the crisis, being early was certainly not a character flaw. The second and far larger group of economists failed to see almost any aspect of the credit crisis and severe recession coming. Many were still forecasting that there would be no recession as late as last July and August.

What I find fascinating is how these two groups believe the economy will perform in coming quarters. The first group, who correctly anticipated the crisis and recession, believe the economy will bounce and then dip again and form a W pattern. A few think the economy will remain in recession until 2010. For the most part, this group did not see the rally in the stock market coming, and now believe valuations are too high, especially in light of the coming second dip and its impact on corporate earnings.

After failing to see the deepest recession since the Depression coming, and a 50%+ decline in the stock market, the second group of economists are the most stringent supporters of the V-shaped recovery. This view is credible, since economic activity is giving signs of at least bottoming, and nascent signs of improvement. The rally in global stock markets and commodities like oil is based on the expectation of better economic growth. Strategists then cite the improvement in markets as proof of the recovery. This bit of circular logic is taken as an article of faith by those who believe markets ‘know’ something about the future, and are merely discounting better times. I’m not sure what better times the stock market was discounting in October 2007. But this inconvenient truth never fails to dissuade the ‘market discounts the future’ fools from advancing this bit of Wall Street ‘wisdom’.

Something each group of economists and strategists have in common is the omission of technical analysis as part of their analysis. It is a critical omission, and accounts for why each group missed either the significant turning points in October 2007, or March 2009.

Most of the economists who saw the housing crisis coming turned negative on the economy and stock market in 2006. Although housing was clearly rolling over, technical indicators of the stock market’s health uniformly showed that the up trend in the stock market was intact. Throughout 2006, the advance/decline line continued to make higher highs after every decline. As I noted numerous times throughout 2006, there was a very supportive supply/demand dynamic at work. Companies were buying enormous quantities of their own stock and private equity firms were using cheap credit to take over a record number of firms. In total, almost 5% of the supply of existing shares was absorbed thru buybacks and takeovers. This underlying demand was not met with much selling since the economy was in good shape. Had those crisis prescient economists incorporated technical analysis into their fundamental analysis, they would have remained more constructive on the stock market, without compromising their excellent fundamental work.

There were numerous warning flags in the second half of 2007 and first half of 2008 of the impending crisis that the majority of economists failed to see. Some of this is driven by the fear of sticking one’s neck out too far. If you’re young and are right, you’ve given your career a big boost. If you’re established as most of the economists on Wall Street are and you venture too far from the consensus and are wrong, it’s bye-bye time for your career. The most significant warning flag was not understanding that the Federal Reserve was going to be far more limited in dealing with this crisis. As I wrote in my December 2007 letter, the amount of credit supplied to the economy from the banking system had shrunk from 75% twenty-five years ago to just 35%. In its place, the securitization markets had developed, but these markets were outside of the Fed’s reach. The Federal Reserve’s capability to manage the credit creation process had diminished, and with it the ability to contain the credit crisis. The astonishing aspect is that even after Bear Stearns collapsed in March 2008, most economists still did not comprehend how far behind the curve the Fed was. In the summer of 2008, the majority of economists still expected the U.S. to avoid a recession! Routinely, Larry ‘right on everything except the economy and financial markets’ Kudlow, heralded a number of prominent economists as being great Americans for having bullish forecasts.

Had these economists incorporated a measure of technical analysis into their fundamental views, they would have seen how technically weak the market was as it was making new all time highs in October 2007. The advance/decline line was noticeably lower than in July 2007. They would have also seen how the market broke down in January 2008, which suggested their sanguine view of the economy was on shaky ground.

As the stock market was plunging to new lows in early March, every measure of market momentum was not nearly as oversold as they were in November. This suggested that selling pressure was lessening. In addition, the economic stats had gotten so bad; they had to get less bad given all the fiscal and monetary stimulus. Putting these two pieces together made it possible for me to anticipate the largest rally since the October 2007 top. In the February letter I wrote, “The market will enjoy the largest rally since the bear market began in October 2007. It will be ignited by economic statistics showing the rate of decline in the economy is getting less bad.”

Total volume (21 day ave.) has contracted from 1.8 billion shares a day to 1.2 billion shares, since the stock market rally began in March. This is unusual since volume has historically increased in a new bull market. But the stock market is a bit like the line of scrimmage in football. Whichever teams controls the line of scrimmage, usually wins (turnovers aside). In the stock market, the line of scrimmage is formed by the balance between buying pressure and selling pressure. It must be noted that buying pressure almost always holds the stronger hand, since the investment game is skewed by the buy and hold philosophy. Investors are counseled to diversify and buy and hold, through good times and bad times. Large institutions consider cash a performance burden, so they must be motivated by adversity to increase cash. As psychology shifted last spring from fearing bad news to expecting less bad news, selling pressure dried up. It takes only a small amount of buying to push stock prices up when selling pressure is low. Buying has been further reinforced by short covering. During July’s rally, short interest in Nasdaq stocks fell by 5.1%, and 10.3% on the NYSE.

As forecast since March, GDP will be positive in the fourth quarter, and maybe in the third quarter, if inventory restocking kicks into gear. That now appears likely, as the success of the cash for clunkers program will boost auto production in the third quarter. As discussed last month, the National Bureau of Economic Research could determine that the trough of this recession was reached in July or August. Although they won’t make their call until next year, they determined the last two recessions ended in the month preceding an increase in Industrial Production, which did tick up in July. The more important point is not when NBER says the recession ended using a rear view mirror, but that coming economic data points are going to continue to show improvement. As it has, the stream of less bad stats will keep selling pressure low. Even if the double dip economists are eventually proven right, in the short term, the rally in the stock market can continue, as selling pressure remains muted, and buyers control the line of scrimmage.

Since we won’t know for a number of months whether a self sustainable recovery is at hand, or a double dip, combining technical analysis with fundamental analysis could prove valuable, as it did in October 2007 and March 2009. At some point, the stock market and economy will come to an inflection point, and the economy will have to deliver on the expectations for a recovery. As long as the advance/decline line and other measures of market momentum remain strong, corrections will likely be confined to a range of 4% to 7%. However, if breadth falters, the key will be how much selling pressure increases in response to disappointment. As long as selling pressure recedes quickly, and the advance/decline line rebounds to new highs, as it did in 2006 and the first half of 2007, the V-shaped recovery story will have legs. This is what has occurred after each short term high in the market since early May. If a selling squall is followed by a weak rally, the odds of a self sustaining recovery will diminish. My bias has been, and continues to be, that a self sustaining recovery is not likely to develop. If this proves correct, and a sustained increase in selling pressure develops, the market could prove especially vulnerable, since the level of buying pressure has been below average during this rally. But until there are significant indications that the rally from the March low is over, based on technical analysis, I will not turn negative on the market. That could be in 3 weeks, or 3 months.

I am surprised that so few economists and strategists incorporate technical analysis with their fundamental work, since it can provide additional validation and understanding of when the stock market will take heed of coming economic turning points.

ECONOMY

The depth of the current recession has led more than a few economists to compare it to the 1981-1982 recession, which was followed by a strong recovery. Like a stretched rubber band, they expect the combination of monetary and fiscal stimulus, along with a surge of inventory rebuilding to launch a solid recovery. The economy is likely to experience at least one quarter of decent positive GDP growth that could exceed 3%, depending on the timing of inventory restocking, However, the glide path of the economy is more likely to resemble the flight of Howard Hughes’s Spruce Goose, which was made entirely of wood. On November 2, 1947, Hughes himself piloted the “Flying Lumberyard” on its one and only excursion, which reached an altitude of 70 feet and traveled all of 1 mile.

As discussed in a number of letters over the last 18 months, the U.S. economy is facing a number of secular and cyclical headwinds that are deflationary, and are going to take time to work through. Expecting a similar recovery in the current environment to the post 1982 recession recovery is misguided. In the first quarter of 1982, the Federal funds rate was 15.6%, the Prime rate was 17.0%, and the 20-year Treasury bond yielded 14.5%. By year end 1982, those rates were down to 8.7%, 11.0%, and 10.8%. The dramatic decline in the cost of money unleashed a torrent of pent up demand. Currently, the Federal Reserve has cut the Fed funds rate to less than .25%, but its stimulative effect is near zero. The Fed has been forced to adopt an alphabet soup of programs because traditional monetary policy was overwhelmed. Like others, I am heartened that Ben Bernanke spent so much time studying the Great Depression. But let’s face it, no one knows how this is going to play out, including the Fed. I could study Ted Williams and Tony Gwynn for years, but that wouldn’t ensure that I could hit a major league curve ball. The consensus assumes Bernanke’s knowledge of the great depression virtually guarantees we no longer have to worry about a repeat. The primary concern of most economists is whether the Fed will know when to pull the plug in a timely manner, so inflation doesn’t become a major problem. But what if Ben & Co. are facing a Nolan Ryan or Sandy Koufax curve ball?

In 1982, consumers had an ample reservoir of savings to finance consumption, and not much debt. Since then, household debt has mushroomed from 44% of GDP to 97%, and savings, although climbing, is still less than half 1982 levels. With interest rates already near 0%, consumers can’t get any relief from their heavy debt burden from lower rates. In fact, credit card companies are raising rates and restricting credit availability. Talk about kicking someone when they’re down!

Existing home sales rose 7.2% in July, spurred by the $8,000 tax credit for first time homebuyers. Low prices and the tax credit are definitely stabilizing the low end of the housing market, and I will be very surprised if the tax credit is not extended beyond December 1. Despite the increase in sales, the inventory to sales ratio was unchanged at 9.4 months, well above a 5 month supply in a healthy market. Foreclosures still represented 31% of total sales. According to RealtyTrac, more than 360,000 households drew a foreclosure filing in July, a record. That was up 7% from June, and 32% from last year. Foreclosure sales are going to continue to weigh on prices in coming months, especially in the high and middle price range. According to Ivy Zillow, the lowest tier of the housing market has seen prices fall 45%, the mid tier is down 33%, but high end prices are only down 27%. A further decline in mid and high end home prices will hurt those consumers who’s discretionary spending have historically spurred growth.

Last week, the Mortgage Bankers Association reported that 13.2% of all mortgages were at least one month past due or in the foreclosure process as of June 30. Prime fixed rate mortgage foreclosures have increased to 32.4% of total foreclosures from 20.4% a year ago, an increase of 59%. According to First American Core Logic, more than 30% of all mortgage properties are worth less than the mortgage. Deutsche Bank estimates that 14 million homeowners (27%) are currently underwater. By 2011, they think that will rise to almost 50%. As more homeowners miss a mortgage payment and are also underwater, the incentive to become current again on their mortgage is low. A July study by Fitch Ratings of 16% of total mortgages outstanding bears this out. Fitch found that just 6.6% of prime loans had become current again after missing a payment, versus an average of 45% between 2000 and 2006, which includes the 2001 recession.

In 1982, consumers were not reeling from the double shock of falling home values and stock prices. This double whammy is also affecting more consumers, since the rate of home ownership is higher now, as is the percent of consumers who are invested in the stock market. The largest impact is on the baby boomer generation, the largest demographic. The number of job losses in July fell to 247,000, but the percent of those unemployed or under employed remains a staggering 16.3%. In the first and second quarters, government income transfers, in the form of jobless benefits, tax cuts, and the one-time $250 social security distribution amounted to more than 16% of personal income. Congress has extended jobless benefits from 26 weeks to 79 weeks, but almost 1.5 million of the 6.7 million unemployed will exhaust their benefits by year end. I have little doubt that Congress will extend these benefits.

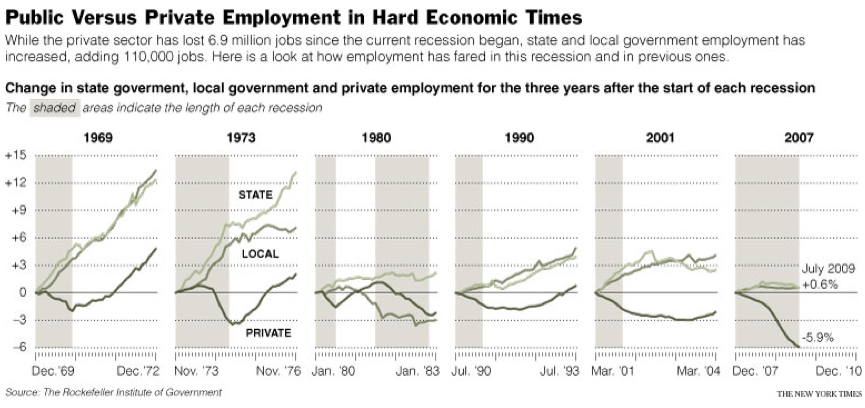

If we’re going to have a self sustaining recovery coming out of this deep recession, job growth is going to have to pick up quickly. In 1982, job growth coincided with the end of the recession, as it did when the 1970 recession ended. In 1974, job growth resumed within 4 months of the recession’s end. However, after the 1991 recession, it took 9 months for job growth to kick in, and a whopping 22 months after the 2001 recession ended in November. An analysis of private, state, and local government jobs explains what happened. Private payrolls fell 3% in the 2001 recession, slightly more than the 1982 recession, and slightly less than in 1974. However, total job losses were less in 1991 and 2001 compared to 1982, and some economists have suggested that the subsequent weak job growth after the recessions in 1991 and 2001 was because there were fewer total job losses in those recessions. But total job losses were less only because state and local government job growth was much stronger in 1991 and 2001. As discussed last month, state finances will remain under severe pressure until 2011, so growth in state and local government jobs will not help offset private job losses in this cycle. This suggests that private, state, and local job growth will be weaker coming out of this recession than any other post World War II recession. My guess is the increasing lag time before job growth resumes is another symptom of monetary policy impotency, due to higher levels of debt. Since 1982, total debt as a percent of GDP has increased from 165% to 370%.

As noted last month, there is more excess capacity in the U.S. economy than at any other time since World War II. The huge overhang of spare capacity squeezes profit margins, as companies compete for every dollar of sales, and postpones when business investment will need to increase to meet demand. Productivity is already high, so there is no compelling technology to boost it further. At the end of the first quarter, business had $4 trillion in equipment and software, about 29% of GDP. During the tech boom, it was 30%. Business investment is not going to contribute much to growth over the next 2 or 3 quarters.

Commercial real estate was in far better shape coming out of the 1982 recession than now. In fact, commercial real estate is likely to remain weak until 2011 or 2012. According to Reis, Inc., the average lease rate at open air shopping centers in the top 77 U.S. markets has declined 5 quarters in a row, the longest stretch in the 29 years of data. The vacancy rate for office space has surged to 15.9%, and rents have fallen 6.7% over the last year. The vacancy rate for apartments rose to 7.5% at the end of June, a 22 year high.

According to the MIT Center for Real Estate, commercial real estate prices have plunged 39% over the last two years, far exceeding the 27% price decline during the S&L crisis. Real Capital Analytics estimates that $2 trillion in commercial properties bought or refinanced after 2004, when lending standards were loose, are underwater. The equity involved in $1.3 trillion of transactions between 2006 and 2008 have been completely wiped out. With five-year terms quite common in commercial real estate, Crosswind Capital estimates $1.4 trillion of commercial real estate loans are coming due in the next five years, with $800 billion due in the next three years. With so many properties worth less than the loan value, banks are going to be hard pressed to roll over the $1.7 billion in loans they hold.

Although the panic phase of this financial crisis has been weathered, the effects of the crisis remain. There will be several hundred more bank failures in the next two years, lending standards will remain high while credit availability is retrained, as banks absorb more losses from residential and commercial real estate. There is no parallel with 1982.

Although the total number of bank failures is relatively low, the absolute size of the failures is not. As a result, the FDIC’s insurance fund is running low. Since March 2008, their assets have fallen from $53 billion to $13.0 billion. The FDIC insures $7 trillion in deposits, so the ratio of insurance to deposits is .18%. Although the FDIC has increased the insurance cost to banks, I suspect the FDIC will be drawing money from the Treasury Department before the end of 2010.

The U.S is going to have what appears to be a V-shaped recovery as GDP turns positive in the third and fourth quarter. However, the secular and cyclical headwinds will cause the recovery to stall before a self sustaining recovery can take hold.

CHINA

Chinese banks issued a record $1.1 trillion in new loans in just the first six months of 2009. The Chinese government also launched a $587 billion stimulus plan. Combined, this represents about 45% of China’s GDP. On the back of this unprecedented stimulation, the Chinese economy grew 7.1% in the first half of 2009. The extraordinary increase in lending has raised concerns, as well it should. The China Banking Regulatory Commission is considering new rules that will slow future lending. The CBRC is considering disqualifying subordinated debt from bank capital. In the first half of 2009, Chinese banks issued $31 billion of subordinated debt, triple the amount fro all of 2008. China Construction Bank, China’s second largest bank, is planning to cut loan issuance in the second half of 2009 by 77%. There is a good chance other Chinese banks will follow their example. The decline in lending will slow China’s economy over the next year, and curb China’s appetite for raw materials. In addition, a stampede in lending invariably leads to an increase in bad loans down the road. It will lead to an increase in even more excess capacity in a world awash in excess capacity. If I’m right, commodity prices are due for a dip.

DOLLAR

As detailed last month, and in special updates on August 6 and August 14, I think the Dollar has likely made an intermediate low. The Dollar never dropped down to 76.80 per last month’s instructions to buy. If you didn’t buy based on the special updates, buy the ETF UUP and the futures now, using a stop of 77.60 on the September futures on both positions. Raise the stop to 78.15, if the futures exceed 79.65. If this trade works, we will have to roll to the December contract.

GOLD

If the dollar goes up, I think gold is going down. Last month, instructions were given to short gold at $975.00 and GLD at $95.20. Unfortunately, gold only rallied to $974.30, but the GLD short was triggered on August 4. Short gold above $936.00, and go long DZZ below $21.00, using $19.90 as a stop. Use $963 as a stop for GLD and gold.

BONDS

Per instructions in the June letter, we are long the 20-year Treasury ETF TLT at $91.00. Raise the stop to $93.30, and to $93.81, if TLT exceeds $96.81. Sell if it reaches $97.80.

STOCKS

Last month, I thought the S&P would break above 956 and carry up to 1007, which was the November 4, 2008 high. After pausing between August 4 and August 20, the S&P has pushed to 1037. On a short term basis, my Intermediate Trend indicator is below its August 10 high, even though the S&P has moved higher. This also happened between the early May peak and June high, and led to the correction into early July. This ‘divergence’ suggests the market is close to a pullback, likely down to the 980 to 1000 level, before another push above 1037. The high on October 14, 2008 was 1044, so this is the next target. The percent of bears in the weekly Investors Intelligence survey has dropped below 20%, for the first time since October 2007. This is another reason to expect a pause in the rally. However, an increase in bullishness and drop in bearishness alone will not cause the market to top. Institutional investors will not be persuaded to sell, unless the economic recovery story is seriously challenged. That’s not likely in the immediate future.

E. James Welsh

What's been said:

Discussions found on the web: