Here is an interesting data point you may have missed: A study found that securitized mortgages were five times as likely to be delinquent as mortgages that were not resold to securitizers.

Kinda makes you think that the banks that planned on keeping their mortgages had different lending standards than those that knew the paper would be off their hands soon. (Approximately one in eight homeowners have had their mortgages securitized). I do not recall the data source, but sub-prime mortgages are also much more likely to be securitized than prime mortgages are.

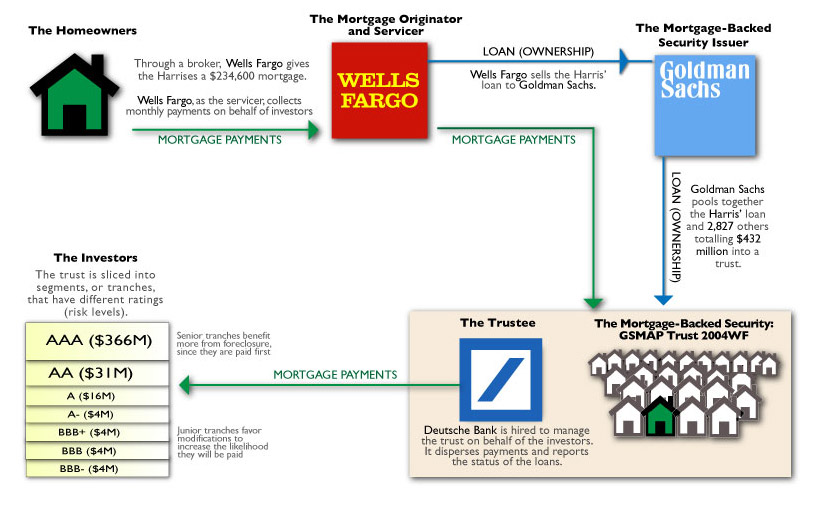

The graphic from Pro-Publica is probably the best explanation I have seen on the securitization process yet:

>

Hat tip Paris-SF

>

Sources:

Bundled Mortgages Pose Problems for Housing Program

Karen Weise

ProPublica – August 6, 2009

http://www.propublica.org/ion/bailout/item/making-home-affordable-loan-modifications-denied-806

Bundled loans stall modification plan

Marketplace, August 6, 2009

http://marketplace.publicradio.org/display/web/2009/08/06/pm-loan-mods/

What's been said:

Discussions found on the web: