The IMF’s latest working paper — A Fistful of Dollars: Lobbying and the Financial Crisis — is yet another indictment of the nexus between Wall Street and Washington.

We know from previous reports that the lobbying of most aggressive, freest spending banks led to the greatest return in bailout monies. The IMF shows that it also led to riskier lending with less supervision and regulation:

“Our analysis establishes that financial intermediaries’ lobbying activities on specific issues are significantly related to both their mortgage lending behavior and their ex-post performance. Controlling for unobserved lender and area characteristics as well as changes over time in the macroeconomic and local conditions, lenders that lobby more intensively (i) originate mortgages with higher loan-to-income ratios, (ii) securitize a faster growing proportion of loans originated; and (iii) have faster growing mortgage loan portfolios.”

Our analysis of ex-post performance comprises two pieces of evidence: (i) faster relative growth of mortgage loans by lobbying lenders is associated with higher ex-post default rates at the MSA level in 2008; and (ii) lobbying lenders experienced negative abnormal stock returns during the main events of the financial crisis in 2007 and 2008.”

The authors identify key goals of lobbying by banks. Lenders lobby to:

• prevent any tightening of lending laws that reduce the benefits of short-termist strategies over long-term profits;

• allow systematic underestimation of default probabilities by overoptimistic bankers;

• not just to originate loans that carry more risk, but to convince legislators that such lending is prudent;

• to thwart bills aimed at lax lending standards and riskier loans;

• to tighten regulations that restrict entry by others preventing competition;

• to have a higher probability of receiving preferential treatment in a crisis.

Hence, their conclusion that lobbying by banks can put the entire financial system at risk. How to fix it? A suggestion that today looks impossible, but should have been jammed through in March during the crisis denouement:

“Therefore, it provides some support to the view that the prevention of future crises might require weakening political influence of the financial industry or closer monitoring of lobbying activities to understand the incentives behind better.”

Unfortunately, given the regulatory capture of Congress by banks, it is unlikely to occur . . .

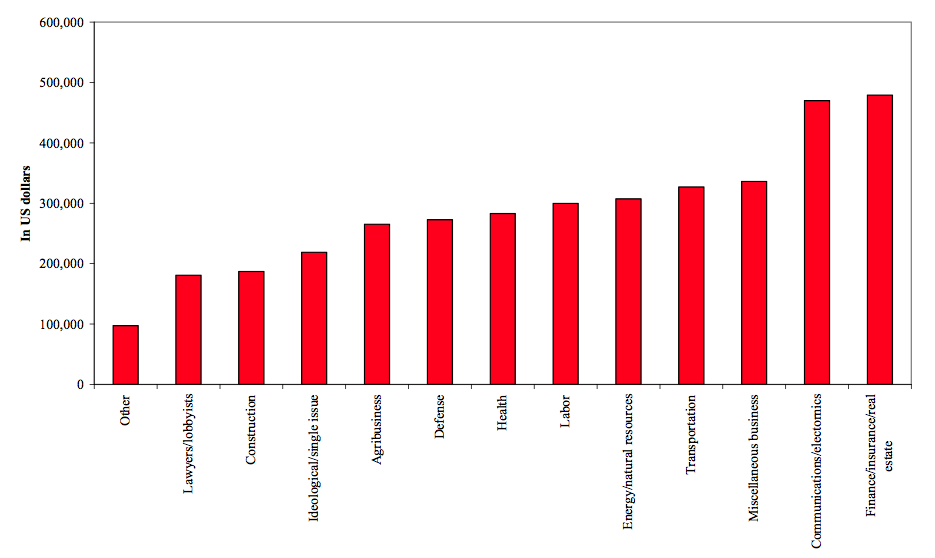

Lobbying exp/firm, by sector, 2006

>

Previously:

Total Campaign Contributions/Lobbying by TARP Recipients (October 11th, 2009)

http://www.ritholtz.com/blog/2009/10/total-campaign-contributions/

Source:

A Fistful of Dollars: Lobbying and the Financial Crisis

Deniz Igan, Prachi Mishra, and Thierry Tressel

IMF, December 2009

http://www.imf.org/external/np/res/seminars/2009/arc/pdf/igan.pdf

What's been said:

Discussions found on the web: