Here’s yet another reason why the Fed should not be driving interest rates to zero: It helps out far less people inthe economy that they imagine.

Here’s yet another reason why the Fed should not be driving interest rates to zero: It helps out far less people inthe economy that they imagine.

From the NYT:

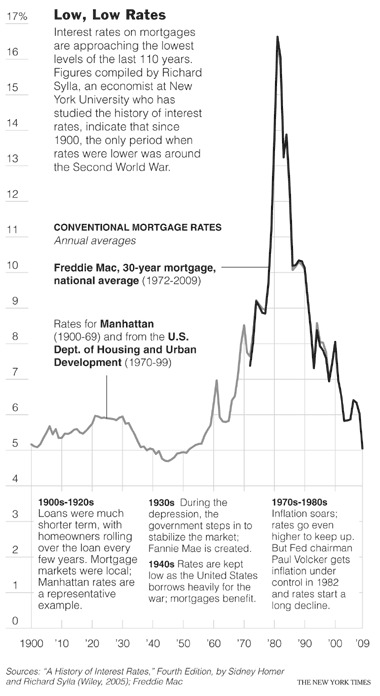

“Mortgage rates in the United States have dropped to their lowest levels since the 1940s, thanks to a trillion-dollar intervention by the federal government. Yet the banks that once handed out home loans freely are imposing such stringent requirements that many homeowners who might want to refinance are effectively locked out.

The scarcity of credit not only hurts homeowners but also has broad economic repercussions at a time when consumer spending and employment are showing modest signs of improvement, hinting at a recovery after two years of recession.”

Sure, refinancing could save home-owners lotsof money they could then plow back into the economy — or even avoid foreclosure. But not if bank lending standards are too tight.

That is the problem with an abdication of lending standards — as we saw from 2002 – to 2007. After the collapse, the over-reaction sends the pendulum swinging too far the other way. Lending standards become too tight.

If only we monkeys could learn anything from history . . .

>

Source:

Interest Rates Are Low, but Banks Balk at Refinancing

DAVID STREITFELD

WSJ December 12, 2009

http://www.nytimes.com/2009/12/13/business/economy/13rates.html

What's been said:

Discussions found on the web: