“The simultaneous selling of securities to customers and shorting them because they believed they were going to default is the most cynical use of credit information that I have ever seen. When you buy protection against an event that you have a hand in causing, you are buying fire insurance on someone else’s house and then committing arson.”

-Sylvain R. Raynes, structured finance expert at R & R Consulting

>

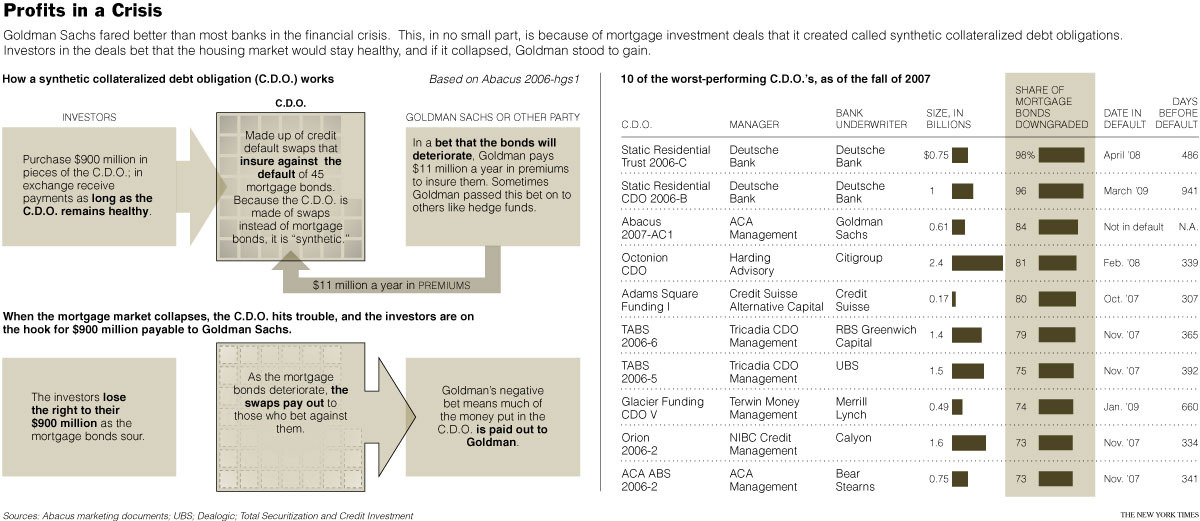

Should investment banks make bets against their own clients? How about when they create new synthetic products, sell that to their clients, and then make bets that their own products will collapse?

Those questions get a once over from Gretchen Morgenson and Louise Story in a long, front page piece in the NYT.

Of course, front and center in this mess is Goldman Sachs. Their PR people must be putting in big overtime hours these days.

Goldman points out that the C.D.O.’s were made to satisfy client demand for such products (at least for those folks who had an optimistic view of the housing market). Further, Goldman says their clients knew they might be taking the other side of bets against the mortgages that underlay the securities. GS’ last defense: Buyers of synthetic mortgage C.D.O.’s were well financed, sophisticated investors .

Here’s an excerpt:

“Mr. Egol, a Princeton graduate, had risen to prominence inside the bank by creating mortgage-related securities, named Abacus, that were at first intended to protect Goldman from investment losses if the housing market collapsed. As the market soured, Goldman created even more of these securities, enabling it to pocket huge profits.

Goldman’s own clients who bought them, however, were less fortunate.

Pension funds and insurance companies lost billions of dollars on securities that they believed were solid investments, according to former Goldman employees with direct knowledge of the deals who asked not to be identified because they have confidentiality agreements with the firm.

Note that other firms, such as Deutsche Bank and Morgan Stanley, also sold synthetic collateralized debt obligations and then bet against them. But no one else bet as much againstt heir own clients, and profited fromt hose bets, as Goldman Sachs did.

Congressional investigators, the Securities and Exchange Commission, and FINRA are all making inquiries into whether these “disastrously performing securities” violated any securities laws for “fair dealing.”

>

Courtesy of NYT

>

Source:

Banks Bundled Bad Debt, Bet Against It and Won

GRETCHEN MORGENSON and LOUISE STORY

NYT, December 23, 2009

http://www.nytimes.com/2009/12/24/business/24trading.html

What's been said:

Discussions found on the web: