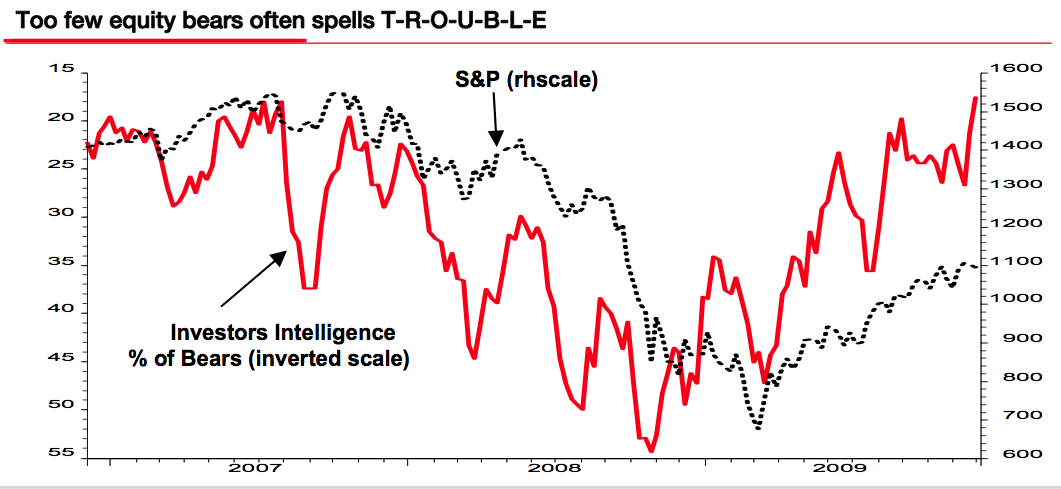

Albert Edwards of Société Générale makes the simple contrarian arguement that the low number of equity bears is a bad sign for equities:

“The current extremely low number of equity bears (the lowest since the market top of 2007 – see chart below), the likelihood is that the next leg of the long-term structural valuation bear market is closer than people might realise.”

Here is Edward’s chart:

>

Source: Datastream, SG Cross Asset Research

What's been said:

Discussions found on the web: