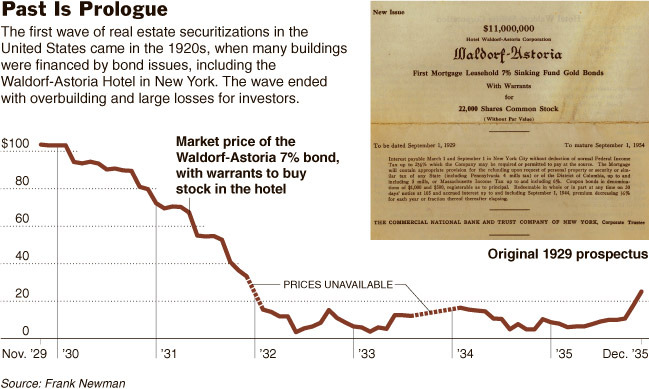

Great piece in Friday’s Times by Floyd Norris on an earlier boom and bust in securitized mortgages: The 1920s and 30s!

“Real estate securitization was one of the great innovations in finance in the last quarter-century. In an unprecedented way, it allowed vast sums of money to go into the real estate market from people who traditionally did not take part in it. But the people making the loans did not need to worry if they would be repaid, and in the end the entire edifice collapsed.

Now, with the securitization market nearly dead, getting that market going again is vital to providing Americans with mortgage loans. Securitization may need to be reformed a little, but it remains critically important to a well-functioning economy.

That is the conventional wisdom now, at least among many bankers and economists.

Most of it is right, except that “unprecedented” part. Although few people now remember it, another wave of private securitizations once altered the real estate landscape, particularly in New York but also in Chicago and some other American cities.

That wave ended pretty much like this one did. . .

The original wave of securitizations took place in the 1920s, when the United States went on the greatest building boom ever. Many investors saw how rapidly real estate prices were rising and wanted in on the action. The builders and brokers were only too happy to oblige.” (emphasis added)

Fascinating stuff!

>

Source:

In the Packaging of Loans, a Bust With Precedent

FLOYD NORRIS

NYT, January 28, 2010

http://www.nytimes.com/2010/01/29/business/29norris.html

What's been said:

Discussions found on the web: