I have to admit a morbid fascination with watching all of the sturm und drang of financial reform wind its way through Washington DC.

This is worse than slowing down to look at a car wreck — its watching a surgeon botch an operation that you know how to do correctly.

I understand that positioning for the next election, partisan politics and lobbying money are a deadly combination to any possible reform. But its so obvious to me watching these folks push and shove good ideas away that they: 1) are utterly clueless how all of this (credit crisis, recession, housing bust) happened; b) have absolutely no idea how to fix any of it; iii) are primarily concerned with getting re-elected.

What surprised me was that for “two months, four pairs of Senate Banking Committee members — each with one Democrat and one Republican — have been meeting behind closed doors to reach a bipartisan compromise on regulatory reform.” For a brief moment, that almost made me think that perhaps they might do something that benefits the nation, instead of their own re-election campaigns.

Fat chance. The vote in the House went down along partisan lines,and the Senate remains mired in the usual senatorial silliness (greatest deliberative body in the world my arse).

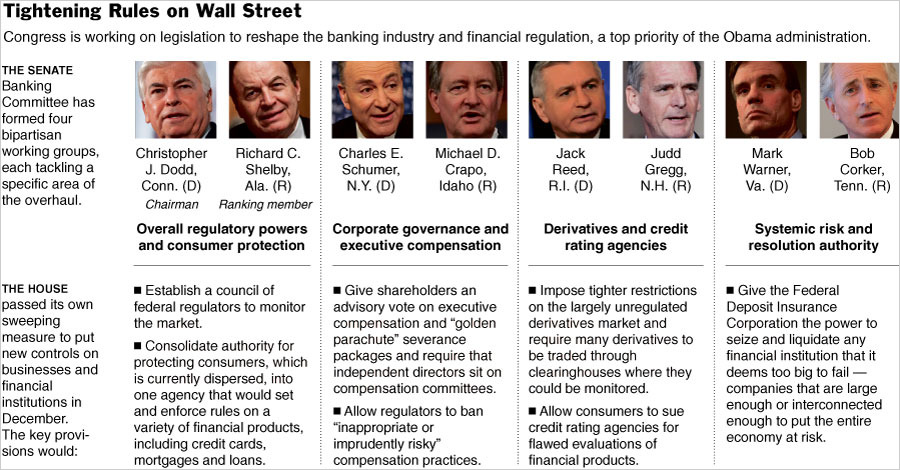

Regardless, the latest collective acts of futility from the fetid DC swamp are detailed in this graphic from a NYT article this morning titled Curveball Alters Talks on Wall St. Reform:

>

click for larger graphic

courtesy of NYT

>

Source:

Curveball Alters Talks on Wall St. Reform

SEWELL CHAN and DAVID D. KIRKPATRICK

NYT, February 1, 2010

http://www.nytimes.com/2010/02/02/business/02regulate.html

What's been said:

Discussions found on the web: