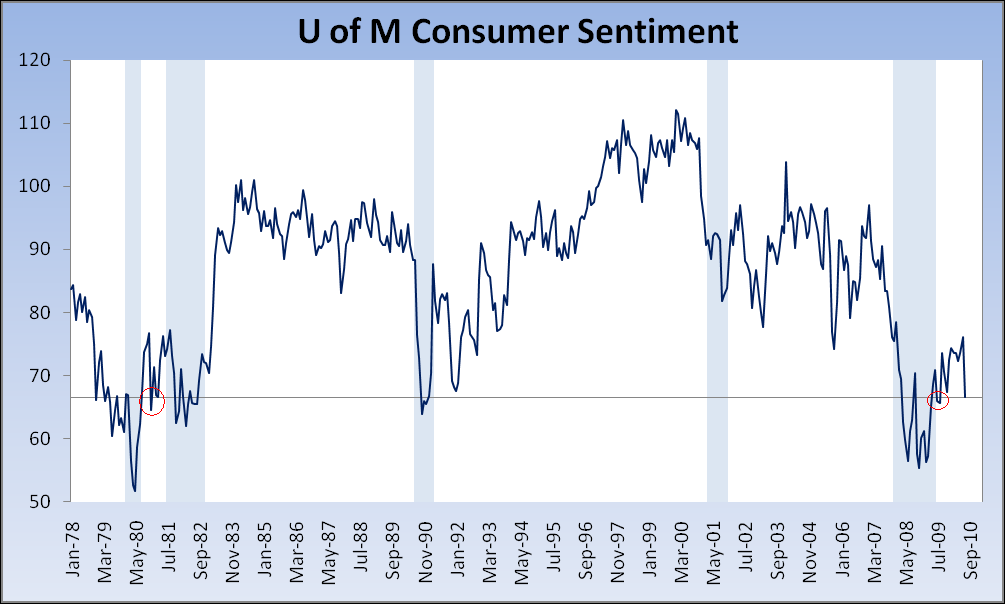

The last time the University of Michigan Sentiment reading was at its current level outside of recessionary periods (it printed Friday at 66.5) was smack in the middle of the non-recessionary blip in the early 80s (see red circle in lower left hand corner of chart; December 1980 and March 1981):

Source: St. Louis Fed (except most recent reading)

That said, we were at this level about one year ago (see red circle in lower right hand corner of chart), but we don’t know for sure as yet whether we were out of the recession (according to the NBER and, as I’ve argued, what we call this is more an exercise in semantics than anything else). Friday’s print also represents the largest month-to-month drop in this metric since October 2008 (not a fun time, as I recall) — drops of this magnitude are exceedingly rare, having occurred only seven times in the history of the series (390 readings). I’ll note that there’s a loose contrarian correlation between sentiment and the market — sell when confidence is high, buy when it’s low. However, the correlation is not quite strong enough for me to stand fully behind it.

Anyway, might past be prologue?

Adding (Monday 11:22) David Rosenberg’s take:

The dive to 66.5 in the University of Michigan consumer sentiment for July takes the index back to August 2009 levels. Just awful. Even by November 2002 (12-months after the recession ended in 2001) consumer sentiment was at 84.

Even with the bounce-back in the equity market, the volatility is crushing confidence — along with increasing signs of slowing economic growth. A 9.5 point plunge in this indicator does not happen too often — you have to go back to the aftermath of the Lehman collapse in October 2008 and before that in September 2005 after Katrina. The decline we saw, believe it or not, was nearly as big as the plunge we saw right after 9/11. Then, you have to go back to August 1990, when U.S. troops began to amass in the mid-East for the eventual war with Iraq (operation Desert Storm).

To put this latest dive into perspective it was twice as severe as the decline after the October ‘87 crash — then again, the economy was booming at a 7.0% annual rate in the fourth quarter of that year. And, then prior to that, guess what? We endured such a decline in December 1980 when double dip concerns were morphing into reality. …

Let’s talk about what is normal and what is not. What is normal is that at this stage of the cycle, a year into a supposed recovery, the UofM sentiment index is sitting at 89.3. In recessions, the index averages out to be 73.8, and in expansions, it is usually already sitting at 90.9, on average. Today we sit at 66.5. Could it be that we are still in a recession?

What's been said:

Discussions found on the web: