>

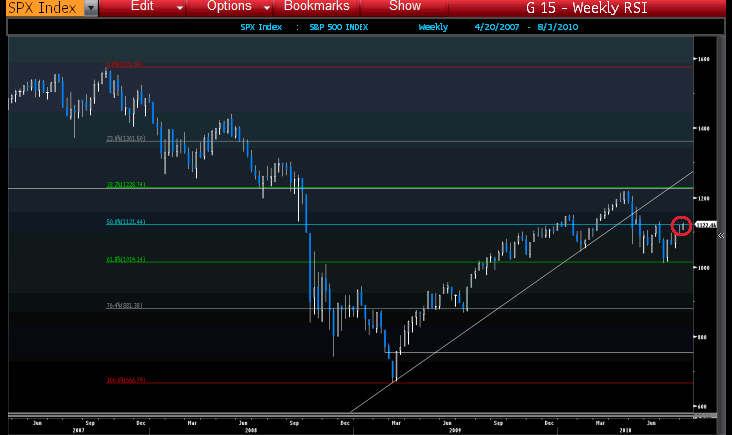

I was speaking to our head trader earlier this week, and he pointed out that for the 5th time since the market bottomed, we have hit the 50% retracement line.

From the October 2007 SPX highs of 1576, to the March 2009 lows at 666 — a drop of 710 910 points. SPX 1121 makes up exactly half of those losses.

The key question is how much strength do markets have? That 50% retrace worked off nearly all of the oversold conditions from the crash.

That does not mean we cannot grind upwards from here; it just means that its going to take a lot of something — good earnings, liquidity, sentiment, breadth, momentum, psychology, quantitative easing, something — to move higher from here . . .

What's been said:

Discussions found on the web: