We at the Big Picture have never been fans of economist Michael Boskin. The infamous Boskin commission was an intellectually dishonest exercise in clever ways to understate inflation, thus lowering Social Security obligations. (I found that approach cowardly, and instead offered up some SS truths).

We at the Big Picture have never been fans of economist Michael Boskin. The infamous Boskin commission was an intellectually dishonest exercise in clever ways to understate inflation, thus lowering Social Security obligations. (I found that approach cowardly, and instead offered up some SS truths).

His commission helped the BLS to habitually understate inflation, the net result of which was to encourage Greenspan’s rate recklessness, setting the table for the 2007-09 crisis. How about Boskin’s “discovery” of a 12 trillion dollar cash horde that the government had somehow “overlooked?” That was used to justify unfunded tax cuts. Afterwards, he issued an Oops, declaring “My Bad.”

Perhaps most unforgivable to investors, those who followed Boskin’s investment advice in March 2009 missed one of the best market rallies in decades. Indeed, Boskin’s partisan screeds costs any investor foolish enough to listen to him big money.

So when earlier this month, he published yet another partisan rant (Summer of Economic Discontent), I loathed having to fisk the intellectual dishonesty likely to be its main theme. Fortunately, Northern Trust’s Paul Kasriel has spared me the labor. His commentary eloquently disembowels Boskin, and reveals him to be a hypocrite to boot.

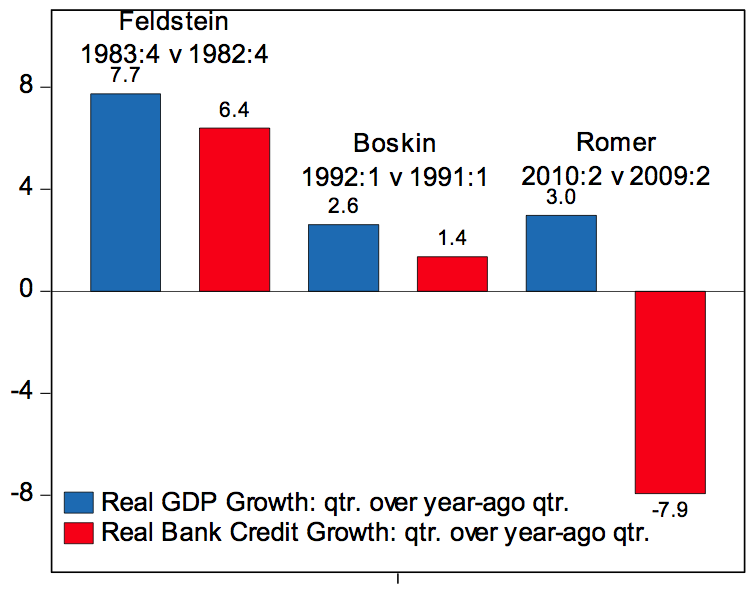

Boskin’s OpEd compared the anemic current economic recovery with more vibrant ones such as Q1 1983, when Martin Feldstein was chairman of President Reagan’s Council of Economic Advisers. He blames the lackluster recovery not on the prior crisis, but on Obama’s overly aggressive responses. Other’s, such as FT’s Martin Wolf, have called the Obama response “too feeble.”

Kasriel points out one notable omission from Boskin’s history: Q2 1991, when “Mr. Boskin himself was the chairman of the President’s Council of Economic Advisers at the time of the 1991 economic recovery.” Kasriel finds it “curious that he makes no reference to that recovery when critiquing the current recovery.”

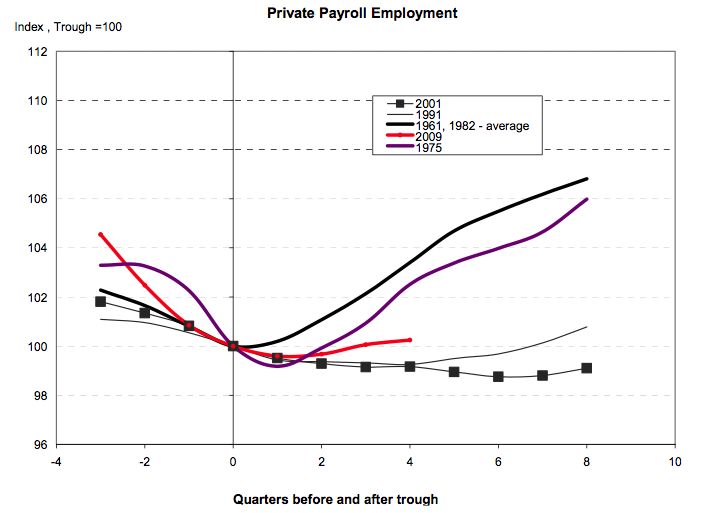

To rectify that notable omission, Paul shows 2 charts (top right, below) — comparing various recoveries, including the 1991 Bush I that Boskin somehow overlooked. These include the year-over-year percent changes in real GDP and real bank credit one year after the final quarter. The current recovery compares favorably with the one Mr Boskin oversaw in 1991 — when the terms “double-dip” and “jobless recovery” entered the economic lexicon.

>

charts courtesy of Northern Trust

Perhaps Boskin’s omission is due to other factors:

Perhaps Mr. Boskin is not suffering so much from amnesia, as I have suggested, but rather is experiencing an episode of déjà vu. He intimates that if current economic trends continue, President Obama will have a difficult time being elected to second term in 2012. Yes, just as President George Herbert Walker Bush was unable to win a second term in 1992, which terminated Mr. Boskin’s tenure as chairman of the President’s Council of Economic Advisers.

I still think its intellectual dishonesty, which has been a hallmark of Boskin’s career. I will defer to Mr. Kasriel, and simply call it a case of déjà vu all over again.

>

Previously:

The Danger of Dogma (July 27th, 2003)

Michael Boskin on “The Obama Crash” (December 7th, 2009)

Why Michael Boskin Deserves Our Contempt (January 19th, 2010)

Sheehan on Michael Boskin (January 19th, 2010)

Sources:

Michael Boskin’s Summer of Economic History Amnesia

Paul L. Kasriel

Northern Trust Global Economic Research, September 07, 2010

http://bit.ly/bXWN2k

Summer of Economic Discontent

MICHAEL BOSKIN

WSJ, September2, 2010

http://online.wsj.com/article/SB10001424052748703882304575465462926649950.html

What's been said:

Discussions found on the web: