About a year ago, I mentioned our intermediate term technical target for Gold was $1,350. The spot price broke that yesterday intra-day, and next month’s futures already closed over that price. With that target met, let’s take a look at Gold and what the average investor should be doing with it.

From 2001-03, Alan Greenspan slashed rates to 1%. At that time, I wrote of impending inflation and a rise in commodities, especially Oil and Gold. This was right out of the macro playbook (i.e., not any great insight on my part). What was surprising was the dearth of sell side Commodity/Gold enthusiasm.

The first time I recommended Gold to the investing public was on CNBC’s Power Lunch, when I suggested having a position in the GLD ETF. This was about 5 years ago, and it was in the $40s. I still have that position, but I would be cutting it back by a third on the next major technical break in GLD.

We look at Gold and Precious metals as an asset class unto themselves. Holding a 5% position, especially from lower levels, provides diversification and a hedge against inflation.

When evaluating equities, one of the key metrics we use is Valuation. We can determine an approximate value based on earnings, dividend yield, discounted cash flow, etc.

That is not possible with Gold. People have tried to develop a model for the price of the precious metal (See Eddy’s attempt here), but it always is relative to something else — inflation, interest rates, Oil, Silver, etc. Indeed, an inability to objectively value Gold — other than what someone else is willing to pay for it — is why I am not enthusiastic about any more than a 5% position. With no objectively ability to value it, we are left with technicals, historical comparisons, and the Greater Fool theorem.

Let’s consider 3 different ways to contextualize the price of Gold: 1) Relative to the US Monetary Base; 2) Gold versus the SPX; and 3) On an Inflation adjusted basis. All three of these suggest Gold has more upside over the next few years. (Traders wanting to add should look for a pullback, rather than chasing momentum here).

~~~

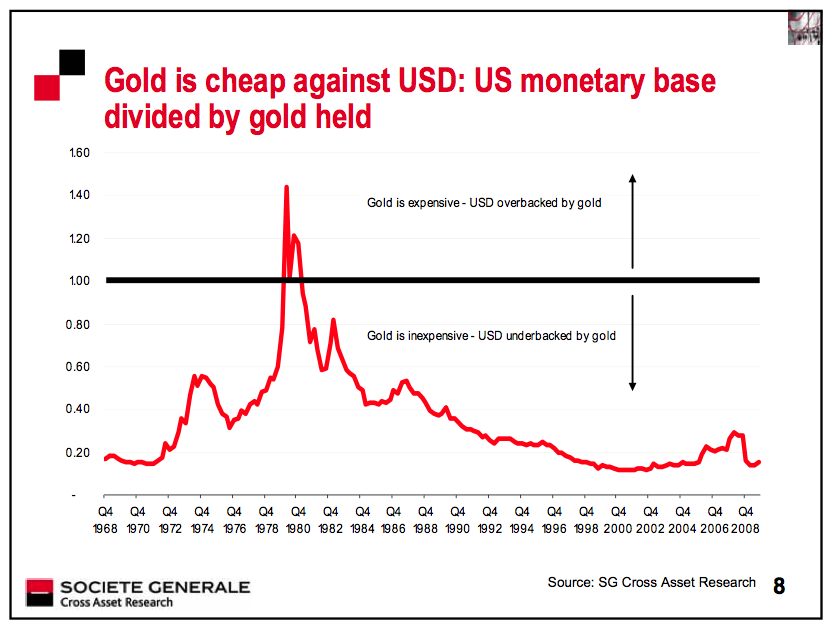

1. Gold versus US Money Supply: Looking at the price of Gold relative to the US Monetary base, Albert Edwards of SocGen drew the conclusion (December 2009) that Gold is cheap; even if you take a median around 0.60 (or even .40), it remains under-priced relative to US Money Supply — and that is before QE2:>

>

2. Gold priced via SPX: John Roque prefers to look at Gold relative to an asset class that has a valuation component. His chart of Gold Relative to S&P500 (1928-2010) suggests there is also upside to the metal:

click for larger chart

Thanks to John Roque, WJB Capital Group

>

3. Inflation Adjusted Gold: We do not inflation adjust stocks, as their price is typically a function of cash flow and earnings. Hence, a nominal $1 of earnings for $15 stock produces a P/E ratio of $15, regardless of past price splits. That’s why we do not need to adjust for inflation when looking at stock prices.

But with Gold, there are no earnings, no cash flow, and no price splits. The price of an ounce of Gold in 2010 is very different than the price in 1975. While many are all abuzz over Gold’s new highs, be aware that these are nominal, not real (inflation adjusted) highs.

If we were to adjust for inflation, Gold is nowhere near its all time peak — in real terms, its only about half its prior highs:

>

>

All three of the above metrics suggest Golds is not yet fully valued has not yet reached its highest potential price point. Slapping a $2,000 target is not unreasonable, and breaching its inflation adjusted target of $2,358 is also possible over the next few years.

So why do you sense some hesitancy on my part?

First, Gold fever has risen to the point of excess. The crowd always piles in at the top. The only thing missing from the recent enthusiasm is a Time magazine Gold cover. Even without it, Gold feels like a crowded trade setting up for at least a minor correction.

And, I see way too many investors who have drunk the Kool-Aid; they have turned their portfolios into a combination of Gold Futures, Miners, and ETFs. This is way too risky for individuals who may not have the trading discipline to honor their stop losses — i.e., cut & run when the momentum stutters. Lastly, this is a high beta momentum play. As we have seen as recently as yesterday (EQIX anyone?), when a volatile high beta name has a hiccup, it can get severely whacked.

As noted yesterday, participating in one asset class (Equities) does not preclude you from owning other asset classes.

>

Previously:

I Love Gold (August 16th, 2010)

Fools Gold: Inside the Glenn Beck Goldline Scheme (July 28th, 2010)

What's been said:

Discussions found on the web: