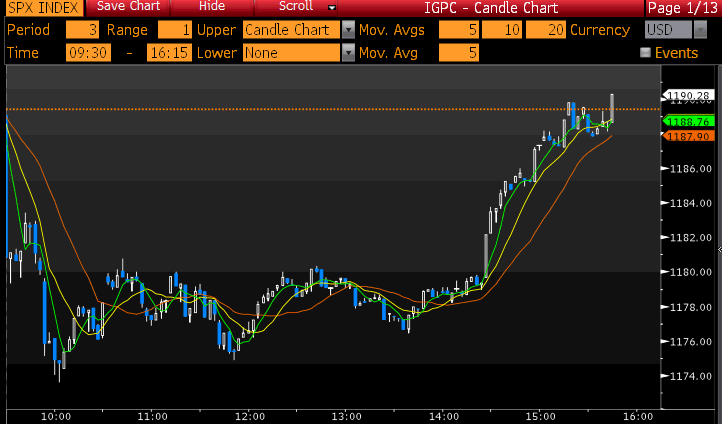

Say what you will about QE2, holiday sales, economic fundamentals: This market is resilient.

Look, anyone with even half a brain knows that the massive bailouts only papered over the structural problems. We all know that no country can borrow/stimulate/ease its way to prosperity. That said, you would have to be a fool to ignore the impact of a tidal wave of Treasury and Fed monies since early 2009.

The backwards looking negativity is astounding. Today is a perfect example of the adage “Markets climb a wall of worry.”

No one believed the (long-side) capitulation 20 months ago; look at the comment streams on some recent positive posts, and the bearishness is just relentless (See this and this and this). We have yet to have a bearish capitulation to the upside to mirror the March surrender by the bulls.

I suspect markets will not top until one of two things occur: Higher prices force Mom & Pop to rush into the markets; or, The Bears throw int he towel.

Meanwhile, this is a very tough market to be short in . . .

>

>

What's been said:

Discussions found on the web: