Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at Washington’s Blog – is a busy professional and a former adjunct professor.

~~~

For years, I’ve been writing about the long-term decline of the Dollar, and the rise of the Chinese Yuan … and it’s potential to become the world’s next reserve currency.

As I pointed out in 2007, many countries have started moving out of the Dollar as the basis for international trade settlements, including:

- Venezuela and 12 other Latin American countries as well as Cuba

- Many other countries

In 2008, I wrote:

Assistant Secretary of the Treasury, and the “Father of Reagonomics”, recently said: “The dollar’s reserve currency role is drawing to an end”. See also this article, this article, this report, this essay, this roundup, and this one.

I also noted:

There are numerous hints that the dollar will not remain the world’s reserve currency for long:

- Iran is bartering oil for Thai rice, as a way to stay out of the dollar in its trades

- Russia’s Putin is suggesting that Russia and China ditch the dollar and use their own currencies in trade deals

- Thailand’s Deputy Prime Minister, Olarn Chaipravat, told Bloomberg News:

“The message of this initiative is for China to consider whether or not China would open up its banking system and allow the strongest currency in the world, which is the Chinese yuan, to be the rightful and anointed convertible currency of the world.”

- The Wall Street Journal writes that China is being asked to play America’s role of being at the center of the world financial system

In May 2009, I pointed out:

Nouriel Roubini says that the Yuan will eventually take over from the dollar as reserve currency:

What could replace [the dollar]? The British pound, the Japanese yen and the Swiss franc remain minor reserve currencies, as those countries are not major powers. Gold is still a barbaric relic whose value rises only when inflation is high. The euro is hobbled by concerns about the long-term viability of the European Monetary Union. That leaves the renminbi.

China is a creditor country with large current account surpluses, a small budget deficit, much lower public debt as a share of G.D.P. than the United States, and solid growth. And it is already taking steps toward challenging the supremacy of the dollar. Beijing has called for a new international reserve currency in the form of the International Monetary Fund’s special drawing rights (a basket of dollars, euros, pounds and yen). China will soon want to see its own currency included in the basket, as well as the renminbi used as a means of payment in bilateral trade.

At the moment, though, the renminbi is far from ready to achieve reserve currency status. China would first have to ease restrictions on money entering and leaving the country, make its currency fully convertible for such transactions, continue its domestic financial reforms and make its bond markets more liquid. It would take a long time for the renminbi to become a reserve currency, but it could happen. China has already flexed its muscle by setting up currency swaps with several countries (including Argentina, Belarus and Indonesia) and by letting institutions in Hong Kong issue bonds denominated in renminbi, a first step toward creating a deep domestic and international market for its currency.

Roubini provides advice which the American economic policy-makers ignore at their peril:

This decline of the dollar might take more than a decade, but it could happen even sooner if we do not get our financial house in order. The United States must rein in spending and borrowing, and pursue growth that is not based on asset and credit bubbles…

Now that the dollar’s position is no longer so secure, we need to shift our priorities. This will entail investing in our crumbling infrastructure, alternative and renewable resources and productive human capital — rather than in unnecessary housing and toxic financial innovation. This will be the only way to slow down the decline of the dollar…

A couple of days later, I reported:

According to the Financial Times:

Brazil and China will work towards using their own currencies in trade transactions rather than the US dollar, according to Brazil’s central bank and aides to Luiz Inácio Lula da Silva, Brazil’s president…

In June 2009, I wrote:

George Soros said a couple of days ago that China’s global influence is set to grow faster than most people expect.

He might be right.

As the Telegraph writes today:

The head of China’s second-largest bank has said the United States government should start issuing bonds in yuan, rather than dollars, in the latest indication of the increasing importance of the Chinese currency.

The same month, I noted:

Yesterday, the BRIC countries said they might be each others’ bonds (and not just U.S. Treasury bonds). As Bloomberg writes:

Brazil, Russia, India and China are considering buying each other’s bonds and swapping currencies to lessen dependence on the U.S. dollar….

The BRIC countries have combined reserves of $2.8 trillion and are among the biggest holders of U.S. Treasuries.

In August 2009, I reported that Pimco was warning it’s clients to diversify out of dollars, as the dollar is losing it’s global reserve currency.

In October 2009, I noted:

The Wall Street Journal reported yesterday:

China and Russia are working on ways to eventually settle their trade with the Chinese yuan and Russian ruble, senior government officials from the two countries said Tuesday.

In January, it was reported that China had reached a similar arrangement with Brazil:

The Brazilian Central Bank announced it had reached an initial understanding with China for the gradual elimination of the US dollar in bilateral trade operations which in 2009 are estimated to reach 40 billion US dollars.

***

As I and many others have argued for years, everyone wants to get out of the dollar, but not all at once. Foreign central banks want to move out of dollars gradually so they are not left holding worthless paper.

But the process actually started a while back.

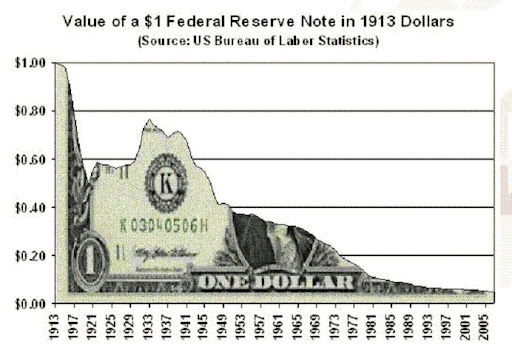

Last August, I noted that – for 100 years – the dollar has been losing it’s value, one of the main disqualifications for a reserve currency:

Here’s a chart of the trade weighted US Dollar from 1973-2009.

And here’s a bonus chart showing the decline in the dollar’s purchasing power from 1913 to 2005:

Last September, I noted:

China will issue a non-Dollar denominated Renminbi bond sale on September 28th (6 Billion Renminbi worth).

Last November, I wrote:

These are headlines from the past 2 days:

It’s not yet clear whether the Renminbi, gold, SDR, Bancor or something else will eventually take the throne of the new world’s reserve currency. See this and this.

And many settlements are still, obviously, being made in dollars.

But there is at least an argument that the dollar has already lost its status as world reserve currency, even if there is no ready replacement to jump into the breach.

In November, the Yuan actually started trading against the Ruble.

Last week, the Bank of India (a state-owned bank, India’s 4th biggest) started trading Yuan for Rupees. See this, this and this.

China Takes Giant Step Towards Making Yuan the World’s Reserve Currency

But all of the foregoing is just background for what happened today.

Specifically, as Tyler Durden reports:

Today’s biggest piece of news received a mere two paragraph blurb on Reuters, and was thoroughly ignored by the broader media. An announcement appeared shortly after midnight on the website of the People’s Bank of China.

***

Reuters provides a simple translation and summary of the announcement: “China hopes to allow all exporters and importers to settle their cross-border trades in the yuan by this year, the central bank said on Wednesday, as part of plans to grow the currency’s international role. In a statement on its website www.pbc.gov.cn, the central bank said it would respond to overseas demand for the yuan to be used as a reserve currency. It added it would also allow the yuan to flow back into China more easily.” To all those who claim that China is perfectly happy with the status quo, in which it is willing to peg the Renmibni to the Dollar in perpetuity, this may come as a rather unpleasant surprise, as it indicates that suddenly China is far more vocal about its intention to convert its currency to reserve status, and in the process make the dollar even more insignificant.

International Business Times provides further insight:

This is all part of China’s plan for the internationalization of its currency, which may, in the decades to come, threaten the global ‘market share’ of other currencies like the US dollar.

Previously, China also announced that bilateral trades with Russia and Malaysia will begin to be conducted with the yuan and the ruble and ringgit, respectively.

Other moves on the part of China to internationalize its currency include allowing foreign companies to issue yuan-denominated bonds and relaxing rules for foreign financial institutions to access the yuan.

Aside from the efforts of the Chinese government, fundamentals also point to the increasing international popularity of the Chinese currency.

China is already the leading trade partner with Australia and Japan. It’s also the leading or a large trade partner with many of its smaller neighbors. The purpose of having foreign currencies is to conduct foreign trade and investment, so the yuan is expected to become a more attractive currency for China’s trade partners, espeically as the government continues to relax restrictions.

The reason for this dramatic move may be found in what Stephen Roach [former chief economist for Morgan Stanley, and now director of Morgan Stanley Asia] wrote a few days ago in Project Syndicate:

In early March, China’s National People’s Congress will approve its 12th Five-Year Plan. This Plan is likely to go down in history as one of China’s boldest strategic initiatives.

In essence, it will change the character of China’s economic model – moving from the export- and investment-led structure of the past 30 years toward a pattern of growth that is driven increasingly by Chinese consumers. This shift will have profound implications for China, the rest of Asia, and the broader global economy.

Like the Fifth Five-Year Plan, which set the stage for the “reforms and opening up” of the late 1970’s, and the Ninth Five-Year Plan, which triggered the marketization of state-owned enterprises in the mid-1990’s, the upcoming Plan will force China to rethink the core value propositions of its economy. Premier Wen Jiabao laid the groundwork four years ago, when he first articulated the paradox of the “Four ‘Uns’” – an economy whose strength on the surface masked a structure that was increasingly “unstable, unbalanced, uncoordinated, and ultimately unsustainable.”

The Great Recession of 2008-2009 suggests that China can no longer afford to treat the Four Uns as theoretical conjecture. The post-crisis era is likely to be characterized by lasting aftershocks in the developed world – undermining the external demand upon which China has long relied. That leaves China’s government with little choice other than to turn to internal demand and tackle the Four Uns head on.

The 12th Five-Year Plan will do precisely that, focusing on major pro-consumption initiatives. China will begin to wean itself from the manufacturing model that has underpinned export- and investment-led growth. While the manufacturing approach served China well for 30 years, its dependence on capital-intensive, labor-saving productivity enhancement makes it incapable of absorbing the country’s massive labor surplus.

Instead, under the new Plan, China will adopt a more labor-intensive services model. It will, one hopes, provide a detailed blueprint for the development of large-scale transactions-intensive industries such as wholesale and retail trade, domestic transport and supply-chain logistics, health care, and leisure and hospitality.

Obviously, a reserve currency would be not only extremely useful, but quite critical in achieving the goal of China’s conversion to an inwardly focused, middle-class reliant society. And even that would not guarantee a smooth transition. However, should China really be on a path to a step function in its evolution, the shocks to the system will be massive. Roach puts this diplomatically as follows:

But there is a catch: in shifting to a more consumption-led dynamic, China will reduce its surplus saving and have less left over to fund the ongoing saving deficits of countries like the US. The possibility of such an asymmetrical global rebalancing – with China taking the lead and the developed world dragging its feet – could be the key unintended consequence of China’s 12th Five-Year Plan.

A less diplomatic version implies that the relationship between China and the US would suffer a seismic shift in which the game theoretical model of Mutual Assured Destruction, and symbiotic monetary and fiscal policies, would no longer exist, allowing China to pursue its fate completely independent of any economic shocks that the increasingly distressed United States may be going through.

And confirming that the PBoC announcement is far more serious than the amount of airtime allotted to it by the mainstream [U.S.] media, is the just released article in Spiegel “China Attacked the Dollar” (google translated):

The Chinese central bank surprised with a spectacular announcement: The would-be superpower wants to handle their entire future foreign trade in yuan, not in dollars. Beijing shakes America’s claim to represent the key currency – with serious consequences for the U.S..

The announcement was inconspicuous , but it has the potential, to permanently change the balance of power on the world currency market: China strengthens the international role of the yuan. All exporters and importers will, this year, be allowed to settle their business with their foreign partners in Yuan, the central bank said on Wednesday in Beijing.

This will respond to the growing importance of the yuan as a global reserve currency. “The market demand for cross-border use of the yuan rises,” said the central bank. The PBoC had previously tested this plan by allowing 67 000 enterprises in 20 provinces to run their business abroad in yuan. The trade volume amounted to the equivalent of €56 billion.

Now the amount of yuan to be extended, it should be handled much more business in Chinese currency – and less in the U.S. Chinese companies trade at present often in dollars, they are thus dependent on the decisions of the U.S. Federal Reserve to pay on it in a rising oil price and will have pay higher transaction fees than necessary. That should change now.

Currently, the People’s Republic can hardly take yuan out of the country and even that is monitored within the boundary of all legitimate capital flows. Chinese exporters have to change a large part of their euro, yen or dollars at a fixed rate revenue in yuan. Foreign companies wishing to do business in China must do so in Yuan, they can exchange their money in the People’s Republic. Tourists are allowed a maximum of 20,000 yuan and exporting. Yuan an international market can not occur – and not on supply and demand-based exchange rate.

Needless to say, should the yuan be seen increasingly as a reserve currency, all of this, and virtually everything else is about to change.

The only question is whether or not the Yuan will cement its status at the top of the currency pyramid by allowing the backing of the currency with individual or a basket of commodities. If that were to happen, it would be the last nail in the coffin of the already terminally ill dollar.

What's been said:

Discussions found on the web: