Last year, we took a Closer Look at the Second Leg Down in Housing.

Today, the S&P Case Shiller NSA 20 checked in at 139.27; the previous post-bubble low is 139.26.

Here’s the release:

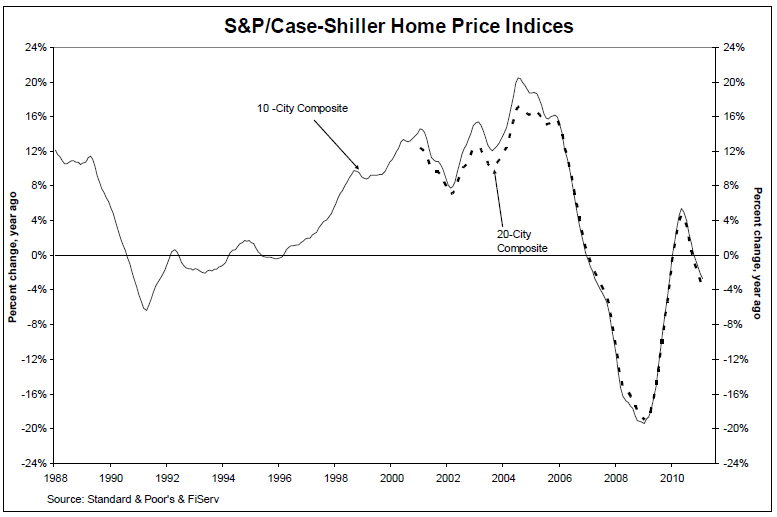

“Data through February 2011, released today by S&P Indices for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show prices for the 10- and 20-city composites are lower than a year ago but still slightly above their April 2009 bottom. The 10-City Composite fell 2.6% and the 20-City Composite was down 3.3% from February 2010 levels. Washington D.C. was the only market to post a year-over-year gain with an annual growth rate of +2.7%. Ten of the 11 cities that made new lows in January 2011 saw new lows again in February 2011. With an index level of 139.27, the 20-City Composite is virtually back to its April 2009 trough value (139.26); the 10-City Composite is 1.5% above its low.”

Case Shiller charts:

>

What's been said:

Discussions found on the web: