Tons of talk and pixels being spilled over the imminent inflation threat. It bears an eerie resemblance to what we heard from the likes of Jerry Bowyer and Art Laffer two years ago. I’d fade it now, exactly as I suggested back then (here and here, the latter piece co-authored with Bonddad):

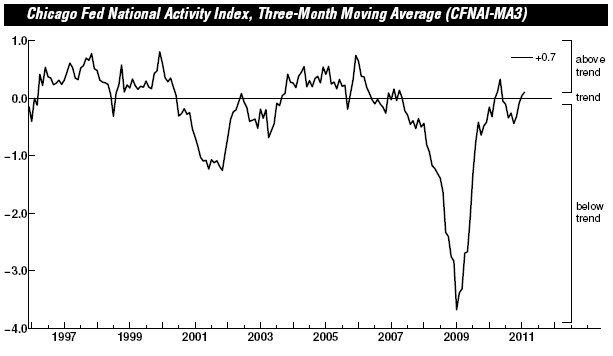

Exhibit A — The Chicago Fed National Activity Index (PDF)

When the CFNAI-MA3 value moves above +0.70 more than two years into an economic expansion, there is an increasing likelihood that a period of sustained increasing inflation has begun.

>

Current read of CFNAI-MA3: +0.11, and that with three of the four subcomponents doing the heavy lifting while one — Consumption & Housing — remains mired near multi-year lows and shows no signs of recovering any time soon. We might actually get a good call out of Bowyer or Laffer before we get to +0.70 on CFNAI-3MA — it’s gonna be a while.

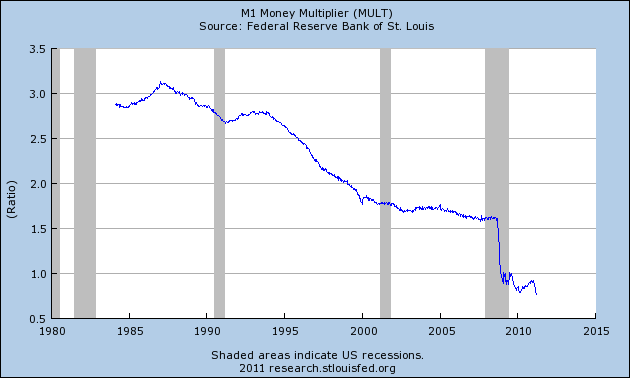

Exhibit B — The Money Multiplier — all that heavy breathing about the flood of liquidity that was going to pour into the system. Hyper-inflation! Except not so much, apparently. As David Rosenberg (who was spot-on in his assessment of the last bogus inflation scare) put it in his Monday note:

Fully 100% of both QEs by the Fed merely was new money printing that ended up sitting idly on commercial bank balance sheets. Money velocity and the money multiplier are stagnant at best.

Those who still think the credit spigots are going to open any moment now, consider this: We know that consumer credit, ex-student loans, is still contracting. And we know from National Federation of Independent Business that “the vast majority of small businesses (93 percent) reported that all their credit needs were met or that they were not interested in borrowing.”

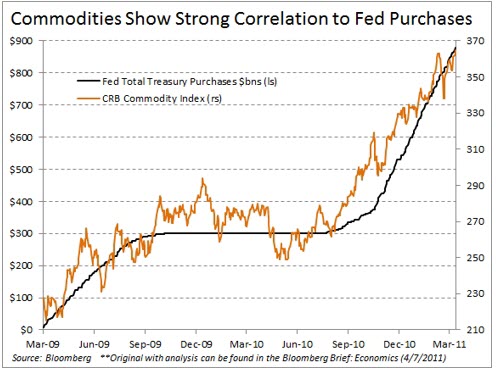

Exhibit C — This remarkable chart that I’ve cribbed from Minyanville, though the original source is Bloomberg. What happens if there’s no QE3?

(The chart above was really a stunner.)

Exhibits D and E

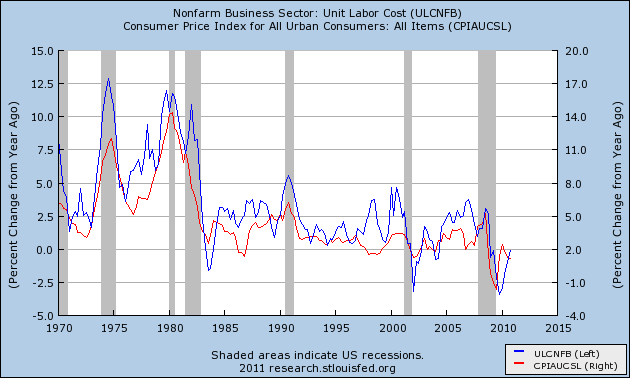

Two more reasons with a couple of homemade charts: Inflation has a very high correlation to the labor market. Indeed, the roots of inflation are generally found in higher labor costs. We are just not seeing upward pressure on labor costs — there is simply still too much slack in the system and the Unemployment Rate is too high. Unit Labor Costs and CPI sport a high +0.88 correlation:

>

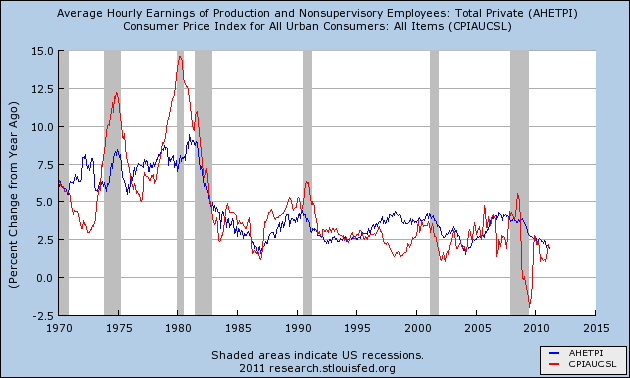

Average Hourly Earnings and CPI have a +0.79 correlation:

The Fed is on the record with their assessment that any bout of inflation will be “transitory.” I concur, as does this new Chicago Fed paper, and our old friend David Rosenberg (last week):

The key to the outlook for inflation is not commodities — it is the labour market. We have a situation where wages in nominal terms are running at +1.7% on a year-over-year rate and productivity is running at +2.0%. So we have unit labor costs fractionally deflating as they have been consistently since 2009 Q1. Go back to the 1970s, and guess how many quarters unit labor costs deflated? Try none. By the end of the 1970s, unit labor costs had surged at nearly a 7% annual rate for the decade as a whole; not sub-zero as is the case today.

And the last word to Rosie (from Monday’s note):

And it remains a legitimate question as to how we end up with inflation as credit contracts. Not just in the consumer and housing sectors, but in the government sector too. The state and local government sectors have dramatically cut back on bond issuance this year and are cancelling capital projects in the process. We see on the front page of the weekend WSJ this headline ― Inflation Drives a Shift in Markets and right above it is Deadline Drama Over Budget. Not only is household credit contracting, but the same is happening at the government level. This is deflationary, not inflationary, and once commodities settle down ― they are volatile and self-correcting as we have seen in the past ― all this talk of inflation is going to subside pretty quickly.

Finally, on a semi-related matter, the NY Times ran an interesting piece that follows up nicely on my recent post highlighting the growth in student loans.

What's been said:

Discussions found on the web: