Albert Edwards is the uber-Bear who sits on the Global Strategy Team at Société Générale. Edwards notes: “It’s that surreal time of the quarter, just ahead of the reporting season, when US companies cajole compliant analysts into reducing their profit forecasts so that on the day the company can record a positive earnings surprise.”

Here’s Edwards:

“Yet, as the cycle once again starts to slow and with sky-high margins, this time around the downgrades may be for real.

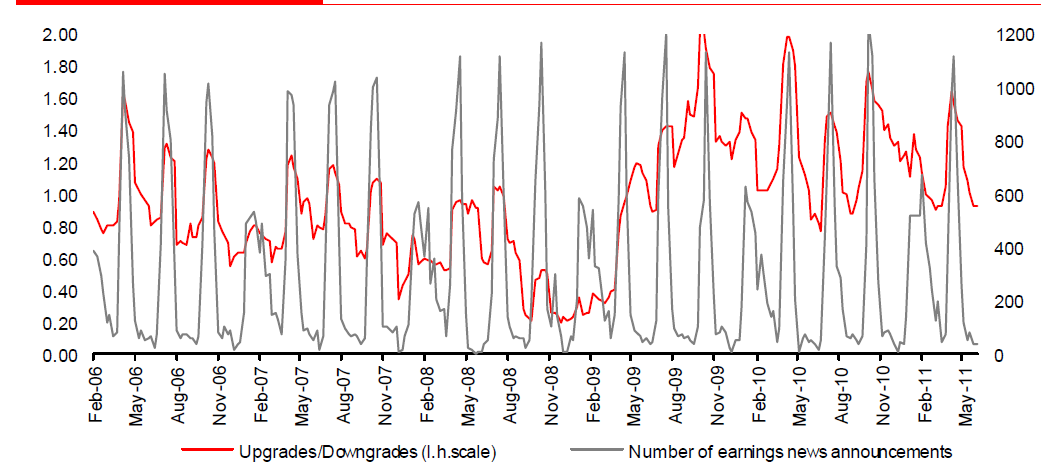

My Quant colleague Andrew Lapthorne has long railed against the nonsense that masquerades as the US reporting season. Companies place so much store on beating analysts’ estimates that they play this ridiculous game of guiding down analysts numbers in the weeks or even days ahead of the announcement, only to beat depressed forecasts by a penny on the day (see chart below). The angle in the press and in analysts’ reports is then that this constitutes ‘good news’ despite, more often than not the outturn undershooting the market estimates of only a few weeks previous. Nuts!

But ultimately you can’t fool all of the people all of the time and the market eventually punishes these earnings manipulators. Indeed Andrew a while back put together a trading strategy shorting those companies who beat estimates on the day but not from a month earlier (see Earnings manipulation – why Investors should avoid the MUC (Manipulated Underperforms Conservative).

All these shenanigans make any assessment of what is actually going on with the profit cycle on an underlying basis extremely difficult, especially during the reporting season. One has to stand slightly aside from the seasonal white noise.

>

What's been said:

Discussions found on the web: