>

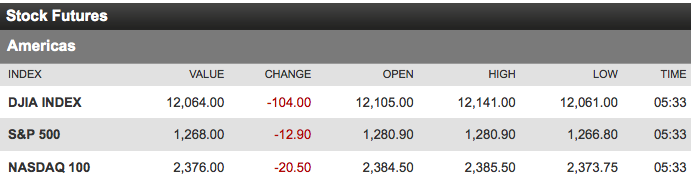

As seen above, U.S. index-futures are off ~1%. The October rally is a blistering 13.7%, fueling traders’ hopes for a continuation into the end of Q4.

But Halloween looks to have begun early across the pond, as markets there have been frightened, , now that the euphoria over the Euro-Zone deal has worn off. Stocks dropped 2-3% in advance of a European meeting this week to explain just how the European Financial Stability Facility (EFSF) will fund an expanded bailout facility. It is noteworthy that Italian yields have spiked higher, as Credit Markets have not found the same reasons to celebrate that equity markets did last week. The Greeks remain angry at the Germans, whose High Court expressed doubts of a quick green-light for the euro bailout program. The countries of Europe are locked in a bad marriage. Bottom line: The Greek orderly default is now behind us, and now the hard part, finding the money to recapitalize banks across the EU, has ahead of us.

Beyond the EU zone, there are a few factors worth noting:

• Fund manager catch-up: The S&P500 is up a mere 2% YTD, and plenty of funds managers are still down for the year. Merrill Lynch notes that “Only 31% of active large cap mutual funds have beat the Russell 1000 so far this year, and equity long-short funds are down 17% year to date. There is some evidence that during years in which performance is subpar heading into the fourth quarter, an end of year “catch-up” beta rally is more likely.” (“Hail Marys” are more likely when trading OPM rather than your own).

• Valuation Attractive?: The key to valuation depends upon the probability of a recession driven earnings collapse. Thursday’s GDP report gave comfort to the bulls that a recession is less likely, and therefore stocks are cheap. (I suspect this calculus was what drove US stocks Thursday, and not Europe).

• Seasonality: October 2011 is the 10th best month for market performance since 1929. Following the prior top 10 rallies, momentum continued, with median 3-month returns about 6.3% (that is double the average 3-month return).

• VIX Collapse: CBOE Volatility Index futures for Q2 2012 plunged 8.7% since last Wednesday. That is the biggest drop on record, according to Bloomberg. During Thursday’s rally, VIX futures of all maturities fell below 30 yesterday, the first time that’s happened since Aug. 17, the data show. This suggests some complacency when it comes to tail risk of major outlier events, such as an EU bank crisis or sovereign collapse.

• Sentiment still depressed: The other side of the VIX story is Merrill’s Sell Side Indicator, a gauge of Wall Street sentiment. It is still underweight equities and is therefor constructive for stocks.

Some consolidation is in order following last week’s huge move. The above bullet points suggest that following some consolidation, the year end rally can continue. How high is anyone’s guess; mine is that we are about halfway though the move upwards.

What's been said:

Discussions found on the web: