Invictus here.

Interested parties were treated to a fascinating debate on the evening of November 14, as the Munk Debates assembled four estimable economic minds to debate the following resolution:

Be it resolved North America faces a Japan-style era of high unemployment and slow growth

Arguing the pro side of the resolution were David Rosenberg and Paul Krugman. Arguing the con side were Lawrence Summers and Ian Bremmer. Should the video be made available for replay, I’d suggest it’s well worth ~90 minutes of your time to watch. Felix Salmon posted on the debate here, and Paul Krugman made mention of it on his blog here.

The results tell us that Summers/Bremmer swayed the undecideds to their side:

Personally, I went in on the “pro” side and came out unpersuaded by Summers/Bremmer.

My take on the essence of each debater’s arguments:

• Krugman – There are solutions to our current issues, but our political system is — and will remain — too dysfunctional to enact them.

• Rosenberg – We are undergoing a massive, wrenching deleveraging that must run its course, notwithstanding monetary/fiscal policy.

• Bremmer – Essentially argued that the US will always be the least dirty shirt in the hamper.

• Summers – His most persuasive argument, I thought, was his closing comment that pessimism can be a self-fulfilling prophecy. The audience seemed swayed by this rhetorical flourish, though we certainly all know by now that hope is neither a plan nor a solution.

Rosie was clearly the most fact-based debater. The arsenal of facts he has at his disposal is simply mind-boggling. He could likely tell you the unemployment rate in April 1955 as easily as he could tell you his youngest son’s name.

The sad truth of the matter, though, is that we’re already mired in an “era of Japan-style era of high unemployment and slow growth.” The only real question for debate is how much longer it will last. Consider:

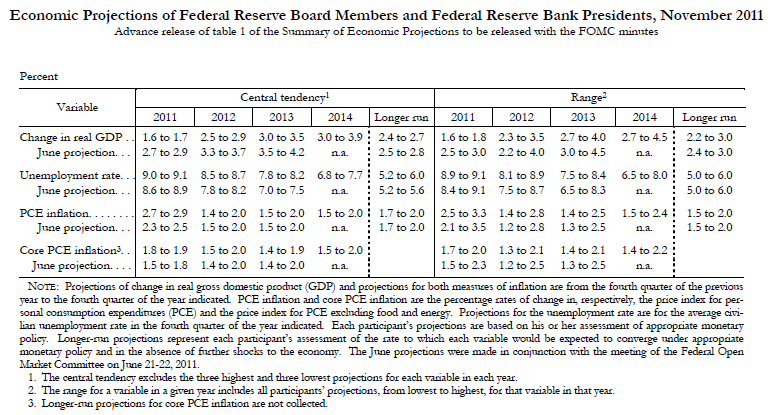

The unemployment rate has been above 7 percent since the end of 2008. The Fed, which has done nothing but downgrade its economic assessments for quarter after painful quarter, did so again earlier this month:

(Click through for larger)

(Source: FOMC release November 2, 2011)

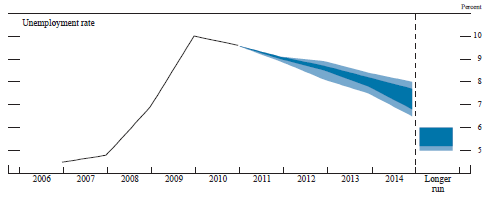

Note the drastic uptick in their assessment of the unemployment rate over the next few years, and the introduction of a forecast for 2014. Here’s a graphic representation that metric:

(Source: FOMC release November 2, 2011)

If they’re right — and they’ve been too optimistic all along — and we see a 6.8% unemployment rate in 2014 (best case), that will take it down to a level last seen in November 2008, a six year round-trip up to 10.1% and back. And, by the way, let’s not even kid ourselves that 6.8% is anywhere near acceptable.

In metrics that matter most to Americans, we are simply not moving the needle. Or, more accurately, we’re moving it in the wrong direction.

(Click through all for larger)

(Source: Census.gov, Household Tables, H-6)

Takeaway: Well over a decade of stagnant incomes.

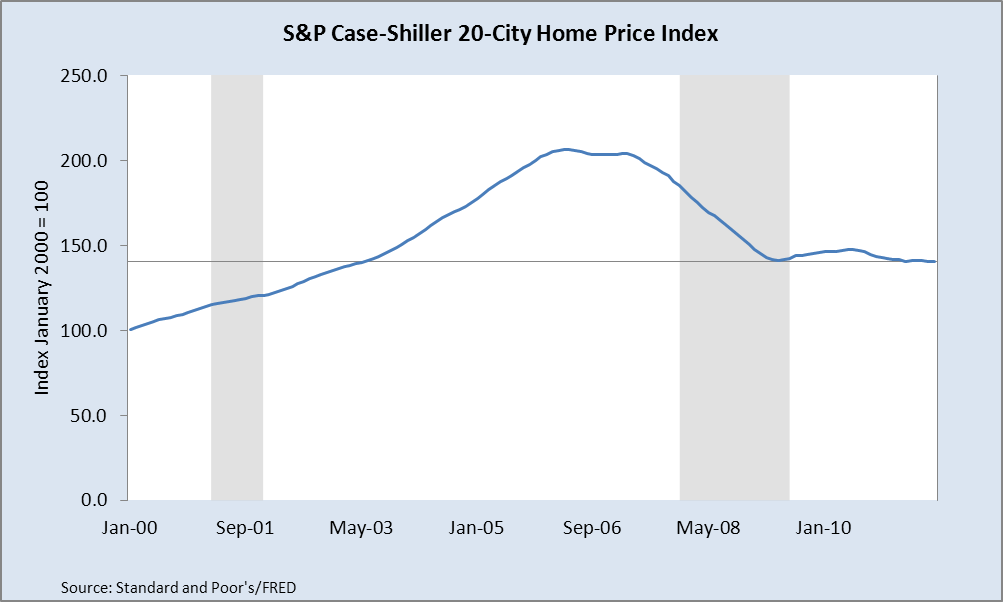

(Source: St. Louis FRED, Series SPCS20RSA)

Takeaway: Home prices are at mid-2003 levels, so we’re where we were 8+ years ago.

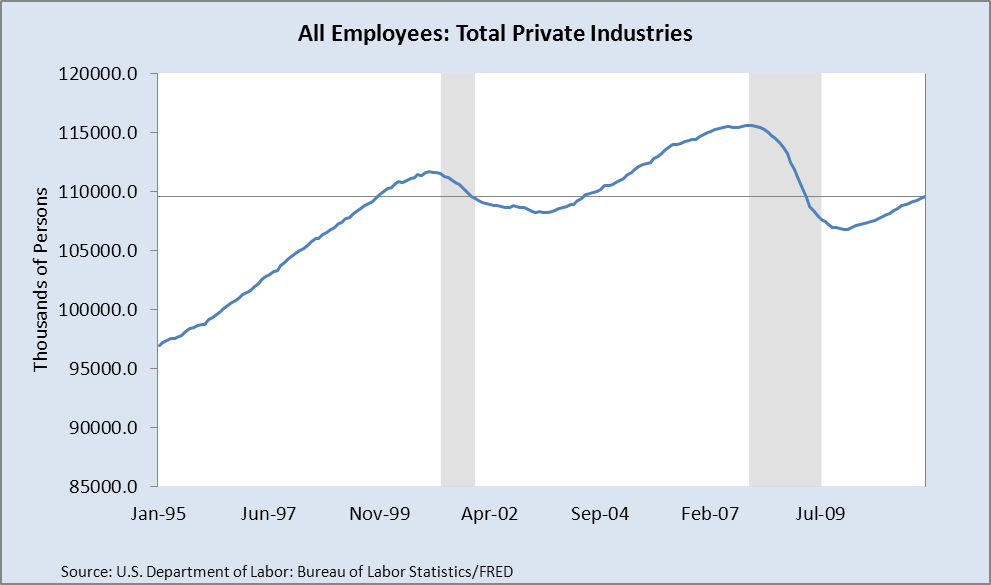

(Source: St. Louis FRED, Series USPRIV)

Takeaway: Private Payrolls are at about the same level they were at in late 1999 — well over a decade of stagnation here while the population has done nothing but go up.

I’ve already gone over poverty and food stamp statistics — the trends there are downright depressing, as were last week’s Census releases on children in poverty. Of the myriad statistics I look at, analyze, and digest on a regular basis, nothing saddens me more than stats on children living in poverty, be it in the United States or elsewhere. Many studies have shown that it is virtually impossible to overcome such an early disadvantage, and we should be doing all we can to eradicate this problem and ensure that our children begin their lives on a solid footing.

Bottom line: Had I been drawing up the debate resolution, I would have written it as follows: “Be it resolved North America faces an ongoing Japan-style era of high unemployment and slow growth.”

Next month will mark the fourth anniversary of the beginning of our Great Recession — December 2007. The progress we have made since then has been painfully slow and many metrics, some of which I display above, are still at levels first seen years ago. Given the glacial pace at which things have been improving, it’s hard to argue that the answer to the original debate resolution — or my modification of it — is anything but “yes.”

What's been said:

Discussions found on the web: