>

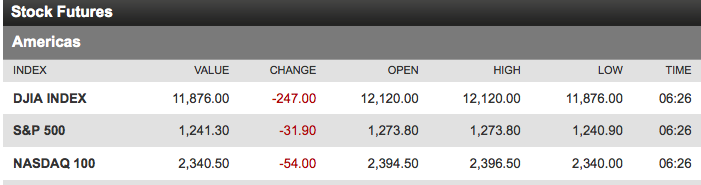

Futures are under pressure in the US, off about 2%.

Italian 10-year bonds hit 7%; The spread between Italian and German bond yields widened to the most since the introduction of the euro. Italy’s credit-default swaps jumped to a record.

RaJa’s Jeff Saut blames the yield spike on the Europeans ending credit default swaps. No insurance option makes the cost of owning bonds without insurance much higher. (I suspect that is but a small part of the problem).

~~~

Watch how US markets trade today: Do we gap down, and see more distribution and selling pressure? Or do buyers come out of the woodwork to accumulate at 2% better prices?

The reaction to the news, and not the news itself, is what matters most.

What's been said:

Discussions found on the web: