If the crisis is resolved and the rally is real, then why is it that:

1) Treasury yields in the U.S. are still at panic levels and NOT confirming the collapse in the VIX?

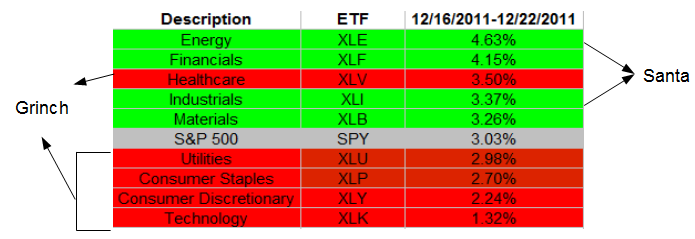

2) Bear sectors (Utilities, Consumer Staples, and Healthcare) are have not significantly underperformed?

3) Bullish Sectors (Technology, Consumer Discretionary) have underperformed?

4) European long bonds yields have NOT budged, with Italy’s 10 year-yield reaching 7% again?

5) Emerging Markets have FAILED to rally in a convincing way

6) Gold and Silver are NOT rallying on a reflation trade

While the whole world is excited about the coming of Santa, be careful that underneath his beard is Mr. Grinch. Market internals are not fully convinced.

>

>

Michael A. Gayed, CFA is Chief Investment Strategist at Pension Partners, where he structures portfolios. Prior to this role, Michael served as a Portfolio Manager for a large international investment group, trading long/short investment ideas in an effort to capture excess returns. In 2007, he launched his own long/short hedge fund, using various trading strategies focused on taking advantage of stock market anomalies. Michael earned his B.S. from New York University, and is a CFA Charterholder.

What's been said:

Discussions found on the web: