Fascinating discussion from Bloomberg Briefings:

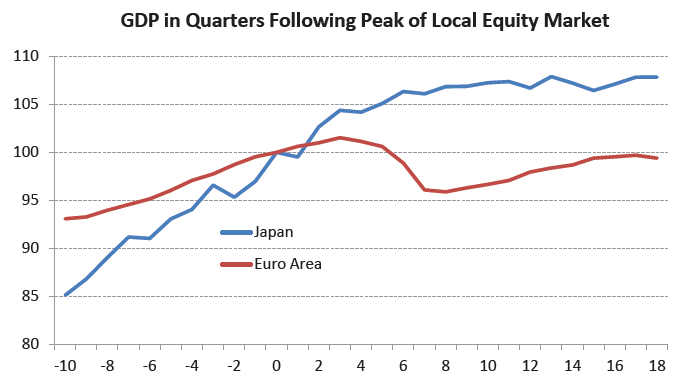

The ECB appears to be understating the similarities between the weak growth outlook in Japan after its domestic asset bubbles popped in the early 1990s and that for the euro area in the present crisis. The performance of the Japanese economy 20 years ago was better than that of the euro area more recently. The Nikkei 225 peaked at the start of 1990. GDP was 7 percent higher 4.5 years later, according to the IMF’s measure in constant prices.

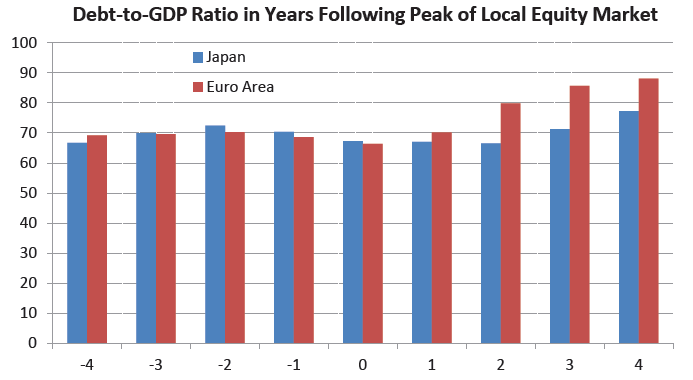

The Euro Stoxx 50 peaked in the second quarter of 2007. Economic output was about 1 percent lower 4.5 years later and about 2 percent below its peak of 2008. The superior performance of the Japanese economy relative to that of the euro area occurred during a period of less fiscal deterioration. The gross government debt-to-GDP ratio of the Asian country increased by 10 percentage points – during the four years after its stock market collapsed – to 77.3 percent in 1993 from 67.3 in 1989. The experience of the euro area has been much worse. Its aggregate debt-to-GDP ratio rose by 21.7 percentage points to 88.1 percent at the end of 2011 from 66.4 percent at the end of 2007.

As Mark Twain reportedly quipped: “History doesn’t repeat itself but it does rhyme.” ECB economists, in their analysis of the Japanese experience in the central bank’s monthly bulletin for May, published yesterday, wrote: “As banks struggled with bad debt for years, they curtailed lending to new firms, which led to distortions in the allocation of credit and ultimately exacerbated the financial crisis and postponed a sustainable recovery.” That description would fit the euro-area situation if the words “bad debt” were replaced with “raising capital”.

European policy makers have failed to implement some of the reforms that also proved elusive in Japan. The staff economists stated: “The strong emphasis traditionally placed on job security in Japan may have reduced flexibility by hampering sectoral adjustments in the economy.” This time, only one word needs to be changed to describe the euro area. That is “Japan”. The fiscal problems are also comparable. The analysts in Frankfurt said “deteriorating revenues and rising social security spending also contributed to the increase in the fiscal deficit in the early 1990s. To consolidate public finances, the government raised value-added taxes in 1997 with the onset of the Asian crisis, which some observers regard as having postponed the recovery.” Demographic similarities are striking as well. The authors of the analysis wrote: “The Japanese economy faced unfavourable demographic developments from the 1990s onwards, as the working-age population reversed its previous growth trend and started to decline.” The staff economists should report their findings to the Governing Council. They concluded: “Despite initial room for maneuver before reaching the lower zero bound of interest rates, monetary policy responded slowly to the crisis, partly because – even two years after the stock market crash – the central bank (had not) anticipated a protracted slowdown of the economy. As inflation expectations also remained low…credit contracted. During this period, the effectiveness of the monetary transmission mechanism may have been impeded by the underlying problems in the private sector, which were not tackled by regulatory authorities.”

Click to enlarge:

Source:

Bloomberg BRIEF

Economics – News, Analysis & commentary

What's been said:

Discussions found on the web: