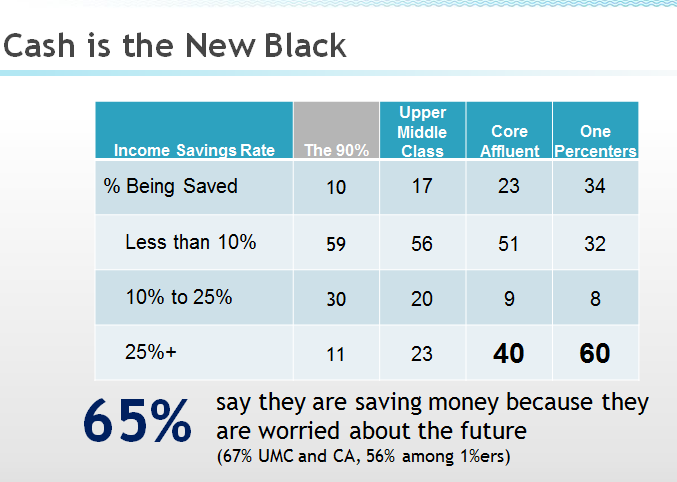

Every year, American Express publishes an in depth “Survey of Affluence and Wealth in America.” The 2012 version is notable for the attitudinal differences between the top 1%, 10% and everyone else (aka the 90 or 99%).

A few quick bullet points:

• Incomes up 6% for top 1% in 2011. Slightly lower among everyone else;

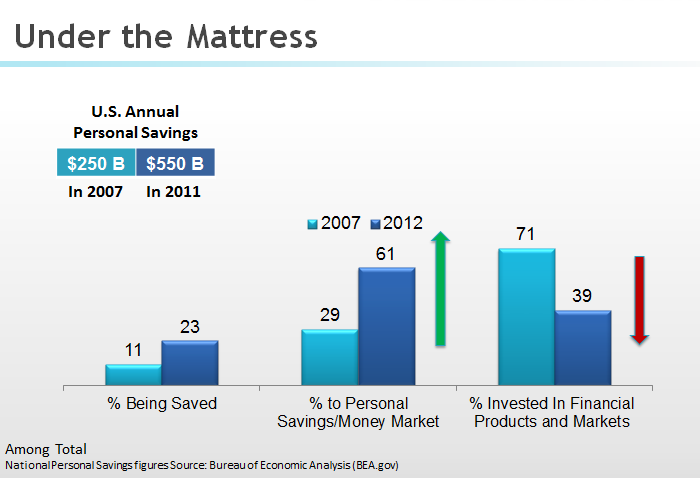

• Investing dollars down from 71% to 39% of portfolio;

• In ‘2007 savings was only 12% among the top 1%, now at 34%;

• Even after recession ended, savings has stayed high, unlike 1981 recession when consumers spent aggressively. (back then, passive income tax rates dropped from 70% to 20%);

• Almost $6 trillion in personal savings account by year’s end. Another $3-4 trillion in cash among business. Getting 0.3% interest and not complaining

Here is how this looks graphically:

No judgement here — I simply find the differences between the top 1% and the rest of the country intriguing.

Previously:

Invest in stocks? FORGET ABOUT IT (May 8, 2012)

Source:

American Express Publishing and Harrison Group

The 2012 Survey of Affluence and Wealth in America

Press Webinar, May 9, 2012

What's been said:

Discussions found on the web: