I am not a Housing Bull, thinking that the net impact of massive government and Federal Reserve bought nothing more than some soft stabilization here.

My skepticism pales to that of Real Estate guru Mark Hanson, from whence the chart below comes. Mark writes:

Your comments of “The present RRE situation can be best described as massive Fed stimulus + government induced foreclosure abatements = some stabilization. Anything beyond that statement falls between wishful thinking and a guess.” are dead on . . .

Plus, don’t forget that a 150bps drop in YoY rates increases purchasing power by 17.5% for the 72% of those who use a mortgage to buy. Given prices are up nowhere near that normalized house prices are still down YoY.

Anyway, June is as good as it gets for existing [home sales] . . .

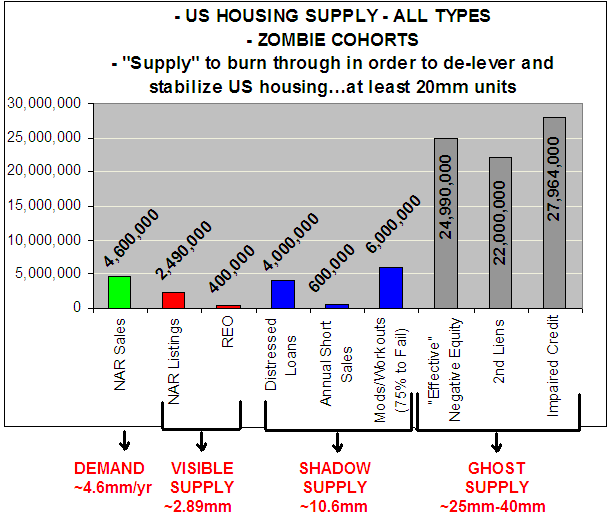

Several folks have been offsides with the inventory issue. The confirmation bias is rampant, with folks obsessing on inventory but ignoring everything else. The inventory I see that has to be de-levered before the housing market has a shot at a “durable” recovery stands at about 30 MILLION units.

Bottom line: In order to really de-lever the housing market something needs to be done about the 20 to 30 million homeowners in a negative or “effective” (lacking the equity to pay a Realtor 6% and put 20% down on a new house) negative equity position; with 2nd liens; and without the credit needed to qualify for a new vintage loan. That’s because repeat buyers are the “durable” demand cohort, not first-timer buyers and “investors” who come and go with the stimulus wind like we saw in 2010 and will again in the second half of this year.

Mark shows in the chart below that the annual demand for homes int he US is about 4.6m. That is offset by supply of 2.89 million homes in inventory for sale, plus 10.6 million in shadow inventory — REOs, distressed loans, and short sales.

>

Source: Mark Hanson

I don’t even consider his “Ghost Supply” — all of the homes that are underwater, have 2nd (or multiple) liens and/or impaired credit

~~~~

UPDATE: July 23, 2012 8:22pm

Quite a few comments about Mark’s 25-40m ghost inventory. My back of the envelope calculations (data from Census):

131 million housing units, with an owner occupancy rate about 66.66%. About ~88 million homes, of which 30% or so — about 27 million — have no mortgages. Of the remaining ~60 million houses, if the general estimate of 20-25% are underwater is accurate, than its about 12-15 million homes.

What's been said:

Discussions found on the web: