“Government securities are the default safe haven in times of heightened risk aversion. But what happens when Government finances are the cause of the tension? Where are the safe havens then?”

Dylan Grice makes the case that “over time, whats good for the currency and for government finances (bonds) should be good for the rest of the economy (equities) and vice versa.”

The problem is that the last ten years were an outlier, and that goverment bonds have benefited from their “safe haven” status:

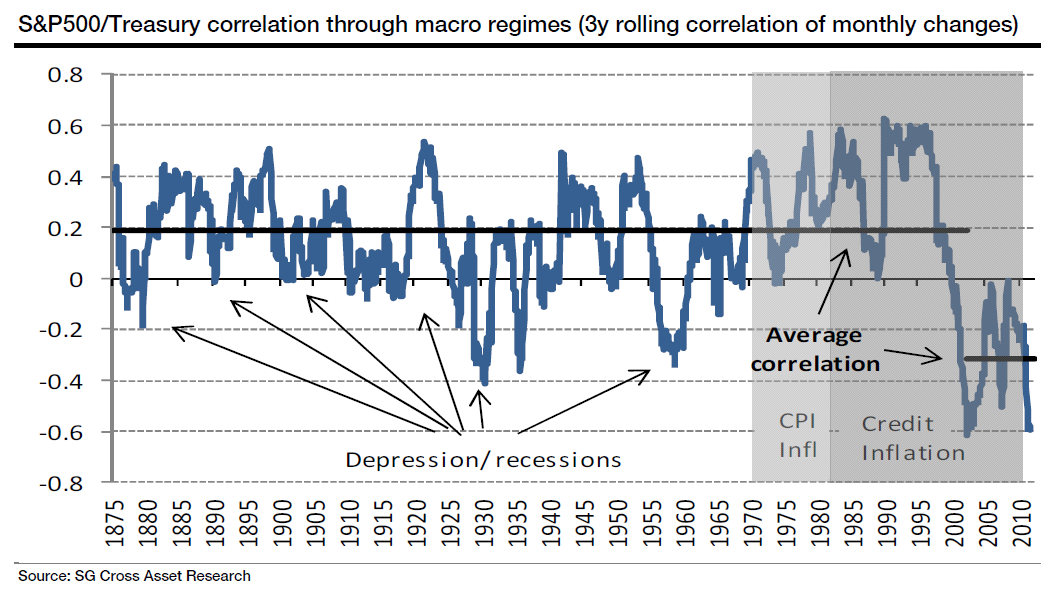

The correlation should be positive. Indeed, the following chart shows that the correlation generally has been positive, averaging +0.2 between 1875 and 2002, but -0.3 since 2002 (for the whole period, the average was +0.15). see chart below

Given this outlier status, Investors need to be on the lookout for when government securities lose their safe haven status.

Source:

The bull case for safe havens

Dylan Grice

Popular Delusions

Société Générale, October 23, 2012

What's been said:

Discussions found on the web: