Over the past few years, we have owned Berkshire Hathaway — not because I am a crazed Dodd & Graham fan (like many BRK owners) but because it is an excellent assortment of assets at a very reasonable price. (Its done well for us).

Over the past few years, we have owned Berkshire Hathaway — not because I am a crazed Dodd & Graham fan (like many BRK owners) but because it is an excellent assortment of assets at a very reasonable price. (Its done well for us).

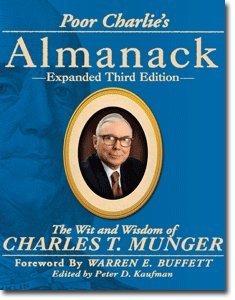

I bring this up because I wanted to reference this tome of a book: Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger, Expanded 3rd Edition

As you imagine, Warren Buffetts partner Charlie Munger is no slouch. He lays out his view of the world in very succinct (if I can describe a 500 word book that way) and direct fashion.

He has a terrific mind for business and investing, and essentially tells you what his secrets are in this book. He goes into the behavioral and cognitive issues investors face, but much more as well. The Munger approach to problem solving teaches you how to look at problems.

It is weird to say this, bu Charlie Munger may be an underrated investor. He is overshadowed by Buffett, and his blunt honesty may not be appreciated by some. But Munger is the reason Berkshire owns Coca-Cola, Gillette, and J&J.

He has been described as having numerous advantages over ordinary investors: An analytical edge, a behavioral advantage, the ability to see the world through multiple discipline, and a broad freedom from institutional norms.

Note the title of the book comes from Munger’s role-model, Benjamin Franklin. I have been reading speeches from Munger for years, and this morning I finally broke down and bought the book on Amazon.

The Psychology of Human Misjudgment speech after the jump

What's been said:

Discussions found on the web: