Renaissance Macro Research, May 14, 2013

Jeff deGraaf, technician extraordinaire (formerly of Lehman now at Renaissance Macro Research) makes an interesting observation about the heavily overbought markets.

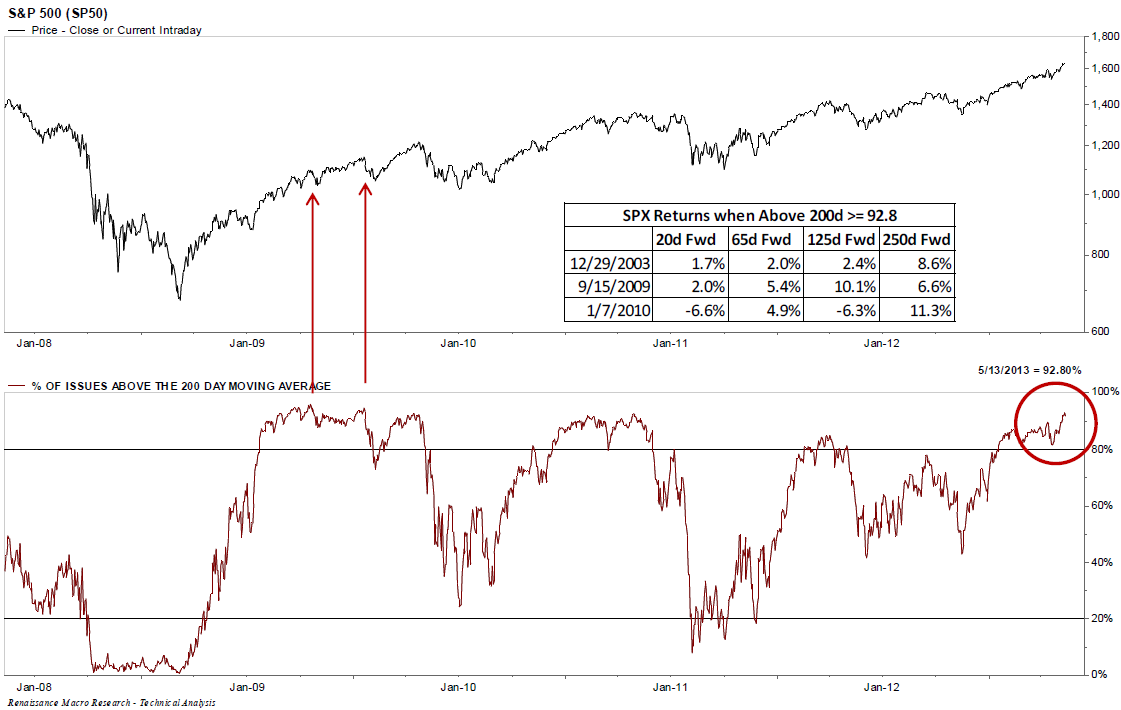

Last week, the S&P500 had ~93% of all stocks trading over their 200 day moving average. Normally, this degree of overbought should lead to a correction. As you can see in the inset box, it sometimes does.

However, if you are looking out a year, we see that over the past 3 instances, markets have been higher.

The takeaway is that you should determine if you are a trader or an investor before thinking about whether to lighten up or add on dips.

Different timelines and holding periods should consider different responses to the volatility.

Note you can get see the updated version of this measure at various places online (Index Indicators, StockCharts, Decision Point. You can read more about this measure here.

What's been said:

Discussions found on the web: