Click to enlarge

Source: NY Magazine

Kevin Roose:

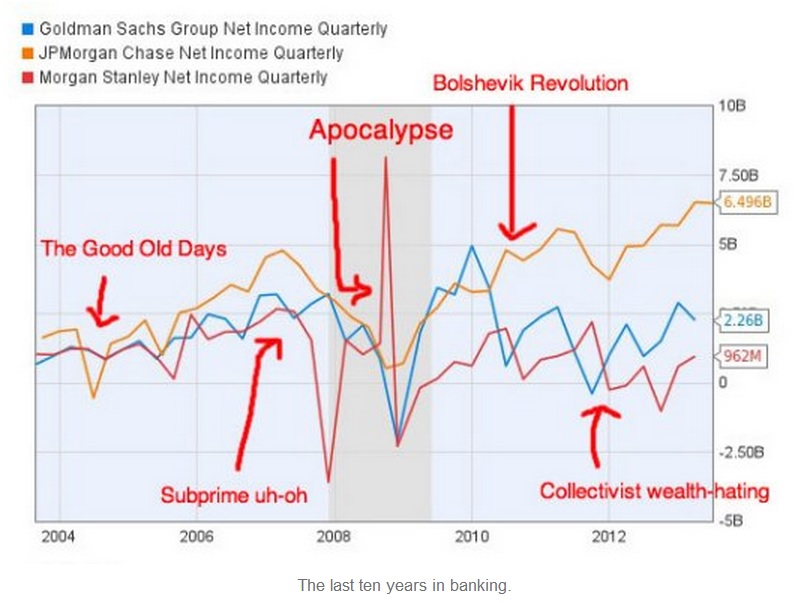

Inspired by Matt Yglesias, I made the above chart to show how wrong all of these doomsayers have been. As you can see, after the Dodd-Frank Act was signed in July of 2010, the biggest investment banks on Wall Street experienced no real setbacks when it came to their profits. They didn’t lose money in 2011 after shutting down their proprietary trading units to comply with Dodd-Frank’s Volcker Rule. (The dips on the graph in 2011 came mostly from the European debt crisis and political uncertainty over the debt ceiling.) And they didn’t suffer after the Fed announced in 2011 that it would implement Basel III, a set of international standards that raise capital requirements on banks.

What's been said:

Discussions found on the web: