My afternoon train reads:

• Do Risk-Adjusted Returns Matter? (A Wealth of Common Sense) see also How to keep your portfolio on track for the long term (WSJ)

• Higher Housing Costs Aren’t Likely to Fade Soon, Cleveland Fed Study Says (Real Time Economics)

• Bankruptcy Filings Will Be the Lowest Since 1995 — Here Is A Reason Why (Credit Slips)

• Trouble in Paradise (Above the Market)

• China Loosens Monetary Conditions in Test of Credit Power (Bloomberg) see also Top One Percent Has One-Third of China’s Wealth (China File)

• Computational Linguistics of Twitter Reveals the Existence Superdialects (MIT Technology Review)

• Power Network Draws Rich Families to Chicago Banker Byron Trott (Bloomberg)

• Piketty and the Randomness of Wealth (FT Alphaville)

• Here’s Why Stealing Cars Went Out of Fashion (NY Times)

• Mac v. PC in 3 Charts (Fortune) see also Inside Apple’s Internal Training Program (NY Times)

What are you reading?

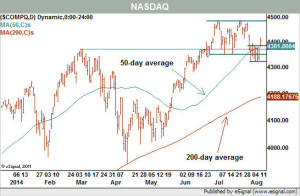

Is the market in rally mode?

Source: Barron’s

What's been said:

Discussions found on the web: