Another lovely day in NYC — crisp sunny and cold. It might be warmer after you absorb our extra-strength morning train reads:

• Why Active Management Fell Off a Cliff – Perhaps Permanently (TRB) but see If you want to make money on the markets you’ve got to tune out the noise (National Post)

• Apple Pay gets a big vote of confidence from the U.S. government (The Switch)

• At UPS, the Algorithm Is the Driver (WSJ)

• “In the one-thousand four-hundred and ninety-seven days since the market bottomed, we have admittedly been early in our call that the next shoe will drop. . .” (Irrelevant Investor)

• Jesse Livermore: The Greatest Trader Who Ever Lived (Crossing Wall Street)

• The size of the recent macro policy failure (Mainly Macro) see also Why do non-experts think they know about macroeconomics? (Noahpinion)

• Get Ready for $10 Oil (Bloomberg View)

• ‘From Atoms to Bits’: A Brilliant Visual History of American Ideas (The Atlantic)

• Arctic glacier’s galloping melt baffles scientists (Climate News Network) see also Why climate scientists are right about how hot the planet is going to get (Washington Post)

• How to Cause a Measles Epidemic in Five Easy Steps (Albert Einstein College of Medicine)

What are you reading?

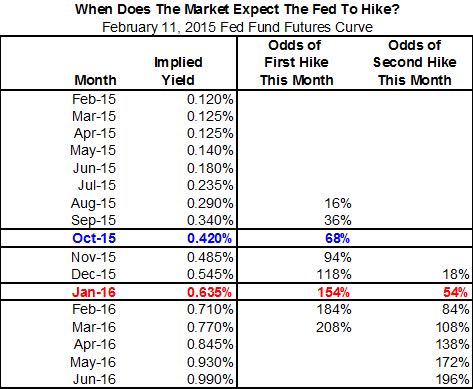

When does the market expect the Fed to hike rates?

Source: Bianco Research

The Munich screed is wrong wrt Ukraine

http://nationalinterest.org/feature/ukraine-not-munich-12271

Putin would be the Chamberlain if NATO moved into Donetsk.

I am still baffled by the Wall Street adulation of Jesse Livermore. He went bankrupt twice, eventually committing suicide after the second one. Some of his biggest positive trades were based on “premonitions”.

Isn’t he the prime example of everything we are NOT supposed to do? He appears to be the Dave Kingman, always swinging for the fences with a low batting average and 14th most strikeouts. Dave Kingman is the first 400 home run hitter who is not in the Hall of Fame (I believe all of the others are not in because of PED suspicions which do not apply to Dave Kingman).

http://en.wikipedia.org/wiki/Dave_Kingman

If you look at interest rates, currencies, the trend in US job creation, imports, exports and the plunge in oil prices, for investors, it’s an adviser pickers market.

Choose well.

Think I’d be more inclined to title this paper “When does financial sector growth …” rather than “Why does financial sector growth …” but the paper is rather persuasive regardless.

Why does financial sector growth crowd out real economic growth?

Abstract: In this paper we examine the negative relationship between the rate of growth of the financial sector and the rate of growth of total factor productivity. We begin by showing that by disproportionately benefiting high collateral/low productivity projects, an exogenous increase in finance reduces total factor productivity growth. Then, in a model with skilled workers and endogenous financial sector growth, we establish the possibility of multiple equilibria. In the equilibrium where skilled labour works in finance, the financial sector grows more quickly at the expense of the real economy. We go on to show that consistent with this theory, financial growth disproportionately harms financially dependent and R&D-intensive industries.

Twenty Five people to avoid on Wall Street

http://www.businessinsider.com/25-people-to-avoid-on-wall-street-2015-2