Source: Federal Reserve Bank of Cleveland

More info after the jump . . .

The Why of Weak Wages

by Michelle Park Lazette

Technological advances. Lower productivity. Fewer full-time workers. Depending on whom one asks, the reasons vary for why we’ve experienced more than a decade of low wage growth. Observers agree, though: Stubbornly low wages impact society and the US economy.

Both of the economists, independent of each other, call the trend puzzling.

Why, if the unemployment rate has fallen from 9.5 percent at the recession’s end a half decade ago to 5.5 percent as of May this year, does wage growth remain low and slow?

“It’s a bit puzzling how wage growth has been so depressed,” Federal Reserve Bank of Cleveland senior research economist Filippo Occhino says. “We are in the later stages of the recovery, and typically in past recoveries, wage growth had picked up much, much earlier.

“At the beginning of any recovery, wage growth is low,” Occhino adds. “With so many unemployed people, businesses don’t need to raise wages. Then, as a recovery progresses and the labor market tightens, you should expect more competition and a bit of higher wage growth. But, we don’t see that. We see low wage growth.”

Wage growth had been marginal even before this most recent recession, notes Cleveland Fed economist Joel Elvery.

“There was remarkably little wage growth between the 2001 recession and the beginning of the 2007 recession,” he says. “There was some income growth at the very high end of the income distribution, but there was actually very little at the middle or at the low end. So, overall wage growth was quite flat before the [2007] recession, as well.”

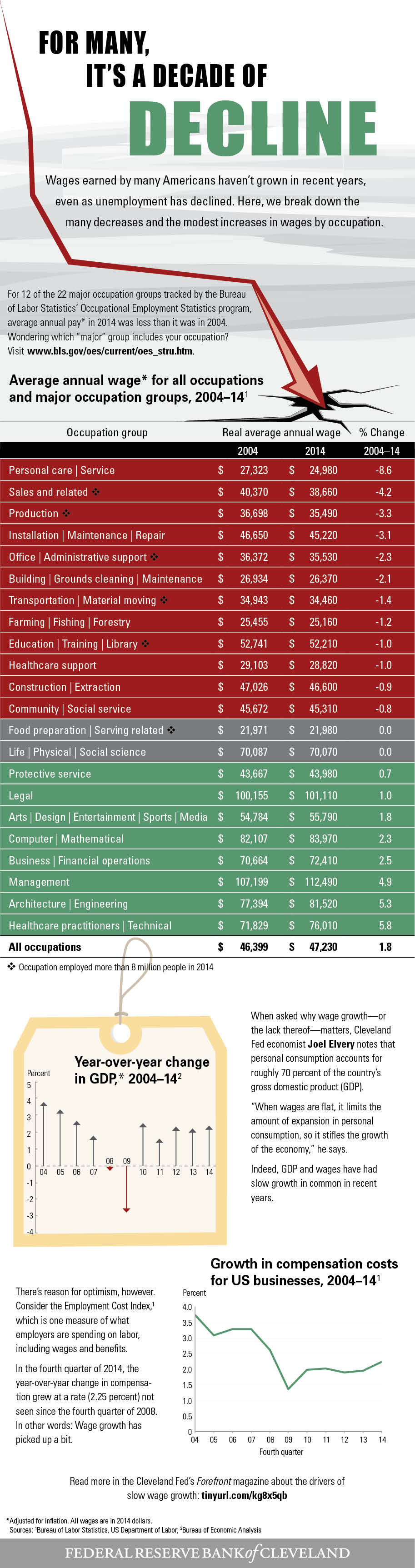

Data from the Bureau of Labor Statistics tell the long, slow-wage-growth story, too: For 12 of the 22 major occupation groups tracked by the BLS, average annual wages adjusted for inflation shrank from 2004 to 2014. Two more of them registered no wage change during the decade, and only 2 experienced an increase of more than 5 percent in average annual wages.

Tempered by technology

Both Occhino and Elvery recently published research about the lack of American wage growth.

In a piece titled “Behind the Slow Pace of Wage Growth,” Occhino and Cleveland Fed research analyst Timothy Stehulak identify 2 factors keeping wage growth low: low productivity growth and labor’s declining share of income.

Average productivity growth—that is, growth of the output of employees, or the goods and services produced relative to the labor hours spent—was 3.5 percent between 1997 and 2004. After 2004, however, it has averaged 1.5 percent.

“When the productivity of workers rises, through competition, employers pay more for their workers,” Occhino says. “So one reason why wage growth has been low is productivity growth is low.” Productivity is influenced by various factors, mainly a worker’s skillset and education. Also driving productivity is the capital, such as equipment, afforded to each worker.

“One possibility is that the high productivity growth at the end of the century was sort of temporary or that the current productivity growth is depressed by something,” Occhino says. “It could be that it is suppressed by the consequences of the Great Recession.”

Occhino’s recent research also shows this: Labor income has declined as a share of total income earned in the United States. In other words, labor income, which includes wages, salaries, and other work-related compensation, has declined relative to capital income, which includes rent, interest, dividends, and capital gains.

Though both labor income and capital income have increased over time, capital income has increased at a faster rate.

Occhino cites a few reasons why labor’s share of total income has declined.

“One could be simply technological change that has favored [investment in] capital to labor,” he says.

Technological shifts have put strong headwinds on wage growth, Elvery notes. Another reason could be globalization, which allows firms to import goods from other countries rather than producing them (and paying labor to produce them) in the United States, and there’s also the loss of bargaining power by labor. Unionization, Occhino notes, has declined.

Harry J. Holzer also cites the substitution of technology for workers and the use of imports and offshoring as reasons why employers seemingly haven’t had to work as hard to attract and retain workers since 2000. Wages, he points out, haven’t kept up with inflation even with inflation’s being quite moderate. Holzer, a professor of public policy at Georgetown University and a visiting fellow at The Brookings Institution, has focused his research during most of his career on the low-wage labor market.

“Our standards of living require higher wage growth, so it’s very discouraging to workers,” he says of the trend. “Especially if you think of college graduates, who were told, ‘Go to school. There is a strong reward for schooling.’

“The general finding is that the only place you see wage growth since 2000 is for people with graduate degrees,” Holzer adds. “Even college graduates with bachelor’s degrees have had flat or even slightly declining earnings, adjusted for inflation.”

‘Noticeable declines…everywhere’

Typically, average wages go up during a recession and fall during a recovery. This is largely because occupation mix changes during recessions, explains Elvery of the Cleveland Fed.

Because it is easier to find low-skilled workers, firms are more likely to fire low-skilled workers during a recession than high-skilled workers. This changes the occupation mix and pushes the average wage up. In addition, some industries—for example, manufacturing and construction—are more susceptible to cyclical conditions, so occupations prevalent in those industries also decline during recessions.

These cyclical changes in occupation mix usually reverse themselves during the recovery. However, recessions can change the mix of occupations in more permanent ways, too. Firms that cut staff during a downturn may alter what they do, and who they employ doing what, when the recovery occurs. Elvery wanted to know: How much of the recent change in average wages (or lack thereof) is due to changes in the occupation mix rather than wage change within occupations?

Using the Bureau of Labor Statistics’ Occupational Employment Statistics, Elvery and Cleveland Fed research analyst Christopher Vecchio sought to determine whether wages are flat or falling by examining a fixed sample of occupations over time.

Elvery identifies 2 major takeaways. One, when he examined wages adjusted for inflation during much of the recovery from 2010 through 2013, “there were noticeable declines pretty much everywhere we looked.”

“To me, it’s a sign of how weak the labor market was in 2010 to 2013,” Elvery says.

Controlling for occupation mix in Ohio, a state within the Cleveland Fed’s region, average inflation-adjusted wages fell 3.5 percent between 2007 and 2013, Elvery found.

“That means that people who didn’t change occupations experienced substantive real wage loss since the recession started,” he says.

Ohio’s numbers were worse than those of the nation, Pennsylvania, West Virginia, and Kentucky. US average wages—keeping occupation mix constant—fell 0.6 percent in the same timeframe, as did Kentucky’s, while Pennsylvania’s wages climbed 1.2 percent and West Virginia’s increased 0.8 percent. (Like the state of Ohio, parts of Pennsylvania, West Virginia, and Kentucky are served by the Cleveland Fed.)

The second major takeaway? The 2 Cleveland Fed researchers observed little change in real average hourly wages in Cleveland and Cincinnati between 2007 and 2010 and also between 2010 and 2013, the time periods referenced in the study.

“Where you see very little change in average wage either during the recession or during the recovery, that’s surprising,” Elvery says. “You would think that we would have had a large shift in average wage. It’s puzzling that we had such little change.”

But, the way Elvery and Vecchio decomposed the change allowed them to see that declines in wages within occupations were essentially completely offset by shifts to higher wage occupations.

A problem for the economy

From Teresa Carroll’s vantage point, the reason for slow wage growth in certain occupations is simple supply and demand.

Where there is high supply and low demand (think light-industrial and logistics-related occupations), slow wage growth persists, says Carroll, senior vice president and general manager of KellyOCG, a group of the workforce solutions company, Kelly Services, which does business in all of the Cleveland Fed’s region and globally.

There’s another reason for slow wage growth, according to Carroll: 35 to 50 percent of companies’ talent is not full time.

“Years ago, it was, ‘Here’s the job, here’s the role, you work full time, you get these wages, and supply and demand is going to drive what happens with those wages,’” Carroll says. “There was the promise of loyalty both by the man and the company, and a lot of wage inflation happened as a result of that loyalty.

“Nowadays, up to 50 percent of the talent of a company is non-full-time,” she continues. “It’s giving companies an option to get the work done without increasing wages to their full-time workforces. If you have a project that you need completed in an IT department, rather than increasing wages of talent to do so, you could utilize independent contractors, you could work with an outsource provider, you could bring in a contractor.”

Sources say it matters well beyond individual households when wages don’t grow.

For one, wage growth affects inflation. The greater the wage growth, the greater the inflation.

Plus, wage growth may be related to inequality, the Cleveland Fed’s Occhino says. People who receive a greater share of their income through labor, rather than through earnings such as interest and capital gains, tend to be poorer, Occhino says.

“Given that, obviously if the labor share of income declines, you’re going to have a little bit more inequality,” he says.

Young workers have been hit especially hard by the lack of wage growth, Holzer says, and a lot of workers have pulled out of the labor market. That move carries consequences.

“That’s a problem for the United States economy,” Holzer says. “If fewer people are willing to work, you’re losing productive capacity.”

And of course, slow wage growth affects how much people will spend. “People’s personal consumption accounts for about 70 percent of the economy,” Elvery says. “When wages are flat, it limits the amount of expansion in personal consumption, so it stifles the growth of the economy.”

There’s also a familial shock, Holzer asserts. For one, parents who owe child support but are earning less or are not working are less able to meet their commitments. He also notes that college graduates often delay marriage and child-bearing until their careers have taken off, and that takeoff is taking longer.

In search of skill

It’s hard to say when depressed wage growth will lift.

(And another Cleveland Fed researcher said as much in a May piece: Using three models for forecasting wage growth, Cleveland Fed vice president Edward S. Knotek II finds evidence suggesting that movements in compensation growth have been essentially unpredictable since the mid-1990s.)

But one trend Kelly Services started seeing in the fourth quarter of 2014 bodes well for wage growth and, in fact, was driving wage increases in the first quarter of this year, Carroll says. The average work week is growing for the temporary employee, and if that growth continues, the first tool employers will tap is paying overtime, which drives wage growth.

“Then people get worn out, and then employers will need to hire,” Carroll says.

Plus, Kelly Services is seeing an increase in its client employers hiring their temps for full time, a situation which tends to be another driver of wage growth.

For his part, the Cleveland Fed’s Occhino expects wage growth to pick up as the unemployment rate, which was 5.5 percent in May 2015, continues to decline and the labor market tightens.

“Recent data on wage growth have been more encouraging,” he says, citing the Employment Cost Index, which tracks what employers are spending on labor. Total compensation costs for all civilian workers increased 2.6 percent for the 12-month period ending March 2015 compared to the 1.8-percent increase for the 12-month period ending March 2014.

Modest and gradual wage growth, which Georgetown University’s Holzer also expects, doesn’t address the long-term and structural problems, though, he notes.

“There’s a higher demand for skill, and a lot of workers don’t have those skills,” he explains. “It’s not just more education. In America we love to do that: We send a lot of kids to college and they get there and a lot of them drop out and don’t finish, or they don’t necessarily get a degree in a high-demand area. It’s not more education. It’s better education—education and skills that better match the growing sectors of the economy.”

The Cleveland Fed’s Elvery doesn’t see government changing the slow wage growth story, though theoretically it could respond by expanding the social safety net.

A major expansion in education could increase the supply of high-skilled workers and help reduce the number of people competing for low-skill jobs, but “right now what we’re seeing is very little change in educational attainment and high change in technology,” Elvery says.

“It just leads to this question: What education change would help in this situation?” he poses. “And that is an open question that we should all think about.”

KellyOCG’s Carroll agrees that the acquisition of new skills will be important to changing the wage trend.

“The supply has to acquire the skills to meet the demand,” she says. “We need to get talent out there developing their skills toward what companies need. From a demographic standpoint, many, many tradespeople are retiring. How do we get people to learn the trades to replace the workforce that’s leaving?”

“Why, if the unemployment rate has fallen from 9.5 percent at the recession’s end a half decade ago to 5.5 percent as of May this year, does wage growth remain low and slow?” I have penned dwn my own ideas in a different thread, but repeat here (I’m suspecting Mr. Ritholtz is seriously considering to ban me … and he couldn’t be that wrong). The core of the problem is the weight on man-hours cost on the unit of finished product. If the sellable product requires less man-hours, there are two possibilities, or higher compensation to less people or less compensation to the same people. The latter ways is simply impossible, so the cause must be the first. And, IMHO, it’s just an empirical observation. The whole process of production has been technologically pushed up by computers, software and robots. You need a quite smaller number of workers, but they have to master a far more complex process. This is an exponential phenomenon, will go faster and faster in time, and soon will become THE social problem, I deem. Down the road I can only forecast that more and more people will be paid for not working, or better to use their time outside the generation of wealth process. Paradise or hell ? I can’t figure this out

to get the management labor rates that low they must include those who manage stores. and there must a be a lot of them to offset those who make 100 millions per year

course that only happens in the US

could be just cynical and think its just Americans competing LCC (low cost counties, i.e. Vietnam, et all).and with the magic of offshoring jobs (or exporting them as some economist claimed was just another trade ‘good’) it doesnt take rocket science to see that wages will stay low. course that has been true longer than the current depression would seem to account for

My simple foot on the ground anecdote has that architects – at least the one’s my age (late 50’s) still practicing is that most are S corps – one man shops and income is down significantly and has been for the last decade. Automation has just gutted this once proud profession. Large outfits will skew the data big time as this is the other ‘silo’ of professionals working in the field. Most however are the one man shops doing 2 maybe 3 projects a year. I say BS to the data shown in the table for architects.

willid3, let’s imagine you need a new washing machine. Do you prefer to buy it at 300 $ made in Wherever or at 500 $ made in USA, the quality being the same ? I guess you prefer to waste 200 $. Yes, it’s WASTE, nothing else because the washing machine is the SAME and the cost different. So if you buy American you pay somebody to do a useless work, that is WASTE money. Can an economy be managed on wasting ? not at all. So you ( and USA) would better off paying 300 $ for the washing machine and putting 200 $ in a Nationwide fund for, say, improving particle physics or removing plastics from Northern Alaska sea shores. Strange, isn’t it ? Rules are changing and neo-luddites are as useless as original ones

Since the recession of 1974-75, “wages” have been falling by government meters outside 95-00.

For the median non-college educated male I suspect real wages did peak in 1972.

I have debated for years whether then or 1979 was the true peak of the real US economy.

Back in the ’90s it became apparent that the real salary of most engineers peaked in 1973. College education doesn’t matter – unless your degree is in management or finance.

Employers ability to move the work abroad, bring the worker here or create technology to remove the skill from the position..why would wages ever go up?