Good morning, welcome to the 6:00 am direct to Penn Station morning train reads:

• Millennials overtook baby boomers as the largest voting-age group in the U.S. this year, and they’re poised to become a political force: The Millennial Takeover (Bloomberg View)

• What Are You Afraid Of? (NeuroLogica) see also Your Brain Is Killing Your Returns (StreetTalk Live)

• Should You Fear the ETF? (WSJ)

• The Future’s So Bright… (Calculated Risk) see also The Jobs and Workers of Tomorrow (jedkolko)

• A Strong Dollar Hurts China More Than the U.S. (Bloomberg)

• Private Equity Fees Are Sky-High, Yes, but Look at Those Returns (Dealbook) but see also Hedge funds lick wounds after tough year (FT)

• Tweets Reveal a Twitter User’s Income Bracket (Scientific American)

• The 2-Degree Warming Limit Is Arbitrary And Beside The Point (FiveThirtyEight)

• Why the west’s view of the Saudis is shifting (FT)

• Most violence in the world is motivated by personal morality (Quartz)

What are you reading?

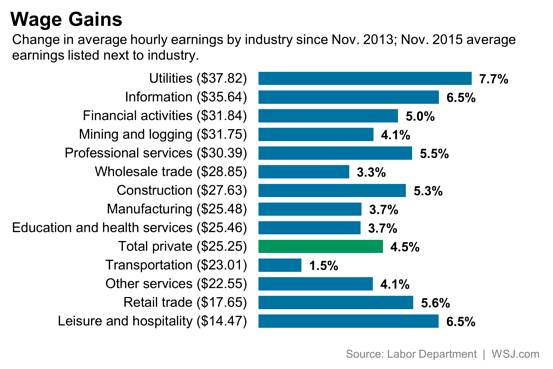

Change in Average Hourly Earnings by Industry

Source: Real Time Economics

Strange Cases for Fed Rate Hikes: The Poor Savers Story

Over the last seven years there has been a steady drumbeat of complaints from people who are upset by the Fed’s zero interest rate policy. We first heard that it was going to lead to hyperinflation. Then we were told that low interest rates would fuel asset bubbles. More recently a rate hike has become a matter of the Fed’s credibility.

One of the most persistent complaints is that the zero interest rate policy is unfair to small savers. The argument is that we have all these elderly people who depend on the income from their savings who are being destroyed by getting near zero interest on their CDs and money market accounts.

There are two problems with this story. …

all of the complaints about low rates being ‘unnatural’, course rates arent exactly ‘natural’ so i dont really see this as being much. course the weak economy (also seems odd that those that complain also complain about that too) seems to be a bigger impact than what the Fed is doing or could do . course there are lots of examples of how the Fed isnt doing it. like credit cards. those rates are petty high (20+%). dont seem to match up with the ‘low rates lead to disaster’ theme .

You do have to admit that this, at the least, calls for a change in the traditional 60-40 ratio. When the 60 portion returns zero or negative after real inflation, the formula has to change. Of course, elders could put everything in FDIC insured accounts and just hope they don’t outlive their money. Myself, I have shifted to 20-80 ratio and the 20 is BBB or emerging market. I don’t like it but it’s too late and I’m too frail to work another twenty years.

Best of luck to ya!

our future with conservative leadership?

http://qz.com/569464/heres-what-china-looks-like-under-red-alert-smog/

But just think of the profits that would be generated that could be stored in offshore tax havens! That is far more beneficial and important than clean air to breath.

i suppose the other ‘upside’ is population control?

I am baffled by the fuss about ETFs. They trade like a stock, with all of the vicissitudes that go along with that. That is a feature, not a bug. They are really just a modern variant of closed end funds that have been around for a very long time and have historically often sold at large discounts and premiums, especially during uncertain times. Stocks, bonds, and CEFs periodically disconnect from fundamentals either on the way up (1999) or on the way down (2008-9). The intraday pricing during a week often shows much more volatility than at the close. So why would we expect ETFs to behave differently?

I own a handful of ETFs in my rollover IRA as an experiment. So far, I haven’t seen any reason to own them instead of a low cost mutual fund. I understand how to do orders to buy and sell them, but many people don’t. I have found it to be a pain to try to track the NAV at the same time as the price to make sure it is being priced fairly, since I don’t have professional tools.

The average person puts in and takes out dollars, not number of shares, so buying and selling a mutual fund at NAV at the end of the day is nice and simple. Who wants to be hovering over a keyboard all day find the data and then make the transactions needed to meet your RMDs? You just want your cash to be available within a day or two. I don’t think I want to be dealing with the hassle of buying and selling ETFs when I am 80 and I am quite certain that my wife is even less likely to.

I think they have huge benefits for pros since they are traded on the stock exchange during business hours which allows them to complete all of their day’s transaction and do the book-keeping before they leave the office. That includes both traders for their own accounts and portfolio managers for clients’ accounts.

For Trump Tower residents, association with Trump is ’embarrassing

http://www.chicagotribune.com/business/ct-trump-tower-1209-biz-20151208-story.html

Netanyahu to meet Donald Trump in Israel this month

https://www.washingtonpost.com/world/middle_east/netanyahu-to-meet-donald-trump-in-israel-this-month/2015/12/09/59601348-9e74-11e5-a3c5-c77f2cc5a43c_story.html

GOP hero (after Putin) Bibi’s digging on Trump after the Donald’s nuanced discussion of Muslim Tourism. I wonder if Netanyahu’s going to share some of Israel’s gun control regs with him? Of just stare at him for forty five seconds?

I bet the tourist industry is up in arms! Sheldon Abelson and Steve Wynn must be furious and excluding a billion folks after the way they ranted and raved at Obama for asking Bankers not to spending bailout money in Vegas in 2009, right?

That’s the GOP one set of arguments for one situation, another for another.

UK petition to ban Donald Trump passes 250K

http://www.cnn.com/2015/12/09/politics/uk-donald-trump-ban-petition/

The Loud Liberal Mini-minority once again dominate the headlines while REAL AMERICANS KNOW the rest of the world worships us!

Two Thirds of GOP Primary voters Back Trump’s Muslim Ban Proposal

http://www.bloomberg.com/politics/articles/2015-12-09/bloomberg-politics-poll-trump-muslim-ban-proposal

The GOP Media Machine works to make The Base stupid.

You are reaping what you have sewn Establishment. You’re so sophisticated. So intelligent.

This is great to watch.

We incarcerate millions of people each year because they are simply found with something illegal in their possession. Intent to possess generally doesn’t need to be proven. Their property can be taken away from them in civil forfeiture as well where the rules are reversed so that they have to prove they didn’t get the property illegally. So why would intent to break a law for white collar executives need to be proven if there is a significant incident? For example, the mortgage and foreclosure mills were clearly structured so that proper paperwork could not be accomplished by the staff on hand. So an executive doesn’t necessarily have to instruct their staff to break laws but if they give them an impossible task and tells them they will be terminated and replaced if they can’t accomplish it, then they have deliberately structured an environment where fraud is a highly likely outcome.

http://www.marketwatch.com/story/why-its-hard-to-hold-corporate-executives-accountable-for-crime-2015-12-09

Capitalism needs its edge’s smoothed here and there every now and again.

humans tend to focus on negative news and almost ignore good news? like say the economy?

http://www.pragcap.com/the-relative-thinking-trap/

wally world has destroyed lots of US jobs

http://www.businessinsider.com/wal-marts-china-imports-cost-400000-us-jobs-2015-12

and the jobs they created were much lower wage jobs

It makes goods cheaper so they can buy more while on welfare.

for the 6 months they are on it

Gundlach

http://www.bloomberg.com/news/articles/2015-12-08/gundlach-says-coast-might-be-clear-for-fed-to-increase-rates

He guaranteed they wouldn’t on a show with Bianco and Rick Santelli back in the Fall on CNBC right there on the floor.

Don’t listen to these clowns ever. EVER

course he is also doing his imitation of chicken little too

compare Trump to fictional villains?

http://www.theverge.com/2015/12/9/9878050/donald-trump-darth-vader-mashup

social security is ‘saved”? seems US life expectancy has been stalled for 3 years now

http://angrybearblog.com/2015/12/us-life-expectancy-flat-for-third-year.html

Radical whack job seeks to de-masculinize America!

3. I want any young men who buy a gun to be treated like young women who seek an abortion. Think about it: a mandatory 48-hours waiting period, written permission from a parent or a judge, a note from a doctor proving that he understands what he is about to do, time spent watching a video on individual and mass murders, traveling hundreds of miles at his own expense to the nearest gun shop, and walking through protestors holding photos of loved ones killed by guns, protestors who call him a murderer.

http://www.huffingtonpost.com/gloria-steinem/the-top-10-things-i-want-for-christmas_b_8751268.htm

A number of folks including our host have explored the proposition that economic collapse rooted in the finance sector tends to last longer than usual. That duration and related factors is a problem in more ways than one:

The political aftermath of financial crises: Going to extremes

In a new paper (Funke et al 2015), we conduct the most comprehensive historical analysis on the political fall-out of financial crises to date. We trace the political history of 20 advanced democracies back to the 1870s and construct a dataset of more than 800 elections from 1870 to 2014. We then complement this dataset with existing data on more than 100 financial crises and with historical data on street protests …

In the light of modern history, political radicalisation, declining government majorities and increasing street protests appear to be the hallmark of financial crises. As a consequence, regulators and central bankers carry a big responsibility for political stability when overseeing financial markets. Preventing financial crises also means reducing the probability of a political disaster.

NB: Government austerity in the teeth of a financial recession was morally questionable given the hardships it fostered and also unwarranted in macroeconomic terms — no one could provide an empirically defensible model for it — and that should have been reason enough to avoid it. But it was also political folly, an invitation to political rejection and revolt, and it turns out these effects last considerably longer than the downturn itself.

I think somebody is stretching the data on the private equity returns at CalPers:

I got this from following the link at the dealbook article:

” Data from PEARS shows CalPERS’ private equity earnings from active funds were based on $29.3 billion in original investments, with total realized proceeds – return of original investment plus realized net gain – totaling $53.5 billion.”

But I just calculated that if you put in $1 in the S&P 500 from 1994 to 2014 you would get $6.64 back, while they are showing $29.3 in and only $53.5 out after 25 years. What goes? That is certainly NOT 12.3% CAGR

for twenty years.

First MERS and now fraudulent deeds and sales based on on-line county records. The title insurance industry is going to have a blast over the next couple of decades.

http://www.wsj.com/articles/latest-cyberthreat-stealing-your-house-1449622684

Ok, Trump craziness or not, how did these guys slip through the cracks when the govt has been collecting all of this data for years and years in order to keep us safe and intercept the bad guys before they did us harm?:

http://www.latimes.com/nation/la-na-san-bernardino-shooters-preplanning-20151209-story.html

http://www.bloomberg.com/politics/articles/2015-12-09/california-couple-radicalized-at-least-two-years-before-attack

Those guys were talking jihad two years ago and no one knew?

And all the data collection didn’t catch the bad guys?

Why isn’t anyone talking about that?

Since the global financial crisis in 2008, a total of 26 bankers have been sentenced to a combined 74 years in prison.”

http://www.thedailybeast.com/articles/2015/10/23/iceland-where-bankers-go-to-jail-for-74-years.html

In Iceland – not the United States (obviously). HT/ http://tywkiwdbi.blogspot.ca

Robert Reich “Just 158 families are responsible for *half* the money contributed to presidential candidates. ”

http://www.salon.com/2015/12/09/robert_reich_america_is_now_a_full_scale_oligarchy_partner/

Oh oh

http://www.theatlantic.com/politics/archive/2015/12/trump-may-have-more-support-than-we-think/419370/

Fox tells kids to charge gun men?????????

https://www.rt.com/usa/325162-fox-news-children-active-shooters/?utm_source=rss&utm_medium=rss&utm_campaign=RSS

unarmed kids at that?

Totally insane. The obvious solution is to arm all high school students to make everybody safer.

chicken little?

http://money.cnn.com/2015/12/08/investing/stocks-market-falling-apart-jeff-gundlach/index.html?iid=hp-stack-dom

Douglas Tompkins, clothing businessman and conservationist, dies at 72

https://www.washingtonpost.com/national/douglas-tompkins-clothing-businessman-and-conservationist-dies-at-72/2015/12/09/c788065c-9e8b-11e5-a3c5-c77f2cc5a43c_story.html

Put his big, fat fucking logo right on his tombstone. Big! ‘uge!!

From the Middle East to the Middle Class…

”…The hollowing of the middle has proceeded steadily for the past four decades,” Pew concluded…”

http://www.npr.org/sections/thetwo-way/2015/12/09/459087477/the-tipping-point-most-americans-no-longer-are-middle-class

Keep on buying a bunch of shit and don’t invest. That’ll fix it. You can consume your way to prosperity. That thing over there loves you. Mark Cuban, Donald Trump and the American Enterprise Institute care about you. Why they were just over at your place the other day.

DONALD TRUMP: Anus extraordinaire !

Up in Toronto, the city council is pondering whether they should ask The Donald to remove his last name from his newest building.

I suggested that a more expedient (and appropriate) idea is to simply ask the sign company to remove only the letter ‘T’.