Earlier this week, I received a copy of a paper co-authored by Carmen Reinhart of the University of Maryland and Kenneth Rogoff of Harvard University, titled Is the 2007 U.S. Sub-Prime Financial Crisis So Different?. (alt source)

Each of these authors have rather distinguished affiliations. Reinhart is with the NBER, the group whose Business Cycle Dating Committee officially marks the beginning and end of Recessions. And Rogoff is an adviser to the John McCain, who has (almost proudly) professed his economic ignorance.

Yesterday, in the NYT, Paul Krugman linked this paper to an interesting and perhaps unique factor regarding the 2008 presidential contest. None of the remaining 3 contenders — McCain, Obama or Clinton — are economic ideologues. No supply-siders in this group, no one from the Democratic old school.

If it turns out that the candidates are pragmatic centrists, more focused on problem solving than ideological belief system, it would be a good thing.

This is especially true, if the authors of the paper are correct. Why? If the present situation plays out as they expect, we are going to need all of the problem solving skills available. You see, Reinhart and Rogoff draw parallels between the current U.S. financial woes and five previous financial crises. All five of these were “associated with major declines in economic performance over an extended period:”

– Japan (1992)

– Spain (1977)

– Norway (1987)

– Finland (1991)

– Sweden (1991)

Of course, none of these are identical to the present 2008 USA, economically, culturally, or politically. However, when one takes a closer look, some of the major parallels are a cause for concern.

The Chronicle of Higher Education did just that. In reviewing the Reinhart

and Rogoff paper, they focused on the parallels to the Japan crisis.

Like Japan et al., the United States has seen:

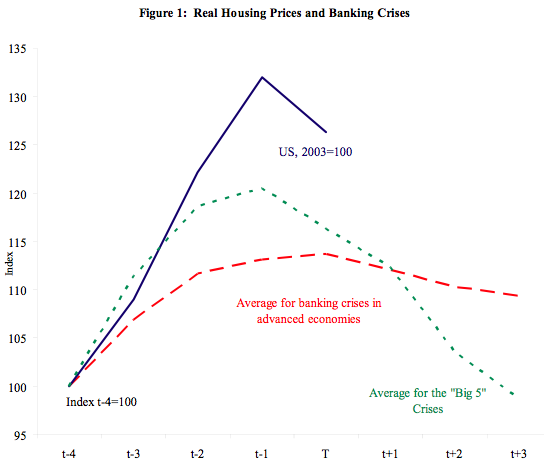

- A steep rise in housing prices during the four years preceding the crisis. (The U.S. rise was more than twice as large as the average of the other five.)

- A steep rise in equity prices. (Again, the U.S. rise was larger.)

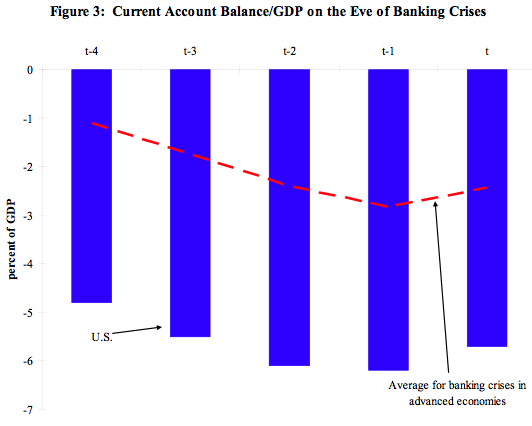

- A large increase in its current account deficit.

- A decline in per-capita growth in gross domestic product. (In this case, the U.S. situation doesn’t appear as bad as in the five predecessors.)

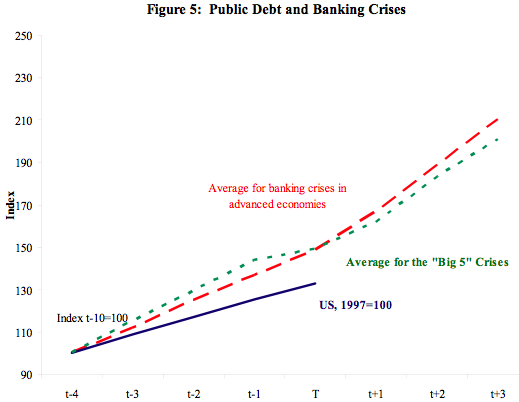

- An increase in public debt. (Here again, the U.S. situation isn’t as bad as in the historical examples – but Reinhart and Rogoff add that “if one were to incorporate the huge buildup in private U.S. debt into these measures, the comparisons would be notably less

favorable.”)

The authors’ conclusion:

“Given the severity of most crisis indicators in the run-up to its 2007 financial crisis, the United States should consider itself quite fortunate if its downturn ends up being a relatively short and mild one.”

UPDATE: October 1, 2009

The authors have assembled all of their data in a new book: This Time Is Different: Eight Centuries of Financial Folly. It is on my list to check out, as their paper was so insightful in advance of the full financial crisis.

Current Account Balance/GDP Ratio

Sources:

Is the 2007 U.S. Sub-Prime Financial Crisis So Different? An International

Historical Comparison* (PDF)

Carmen M. Reinhart, University of Maryland and the NBER

Kenneth S. Rogoff, Harvard University and the NBER, January 14, 2008

ttp://www.economics.harvard.edu/faculty/rogoff/files/Is_The_US_Subprime_Crisis_So_Different.pdf

A Long Story

Paul Krugman

NYT, February 8, 2008

http://www.nytimes.com/2008/02/08/opinion/08krugman.html

Portents of Financial Doom

David Glenn

The Chronicle of Higher Education, February 8, 2008

http://chronicle.com/blogs/footnoted/1629/portents-of-financial-doom

It’s inflate or die time…NOW

Bullion into the $000s…

If reports are correct that McCain’s vision is virtual war, I see no other scenario than increased debt. That can’t help.

Except that McCain won’t win a general election against either of the Democrats – Obama would wipe him out and Hillary would win by a relatively narrow margin, IMHO.

I apologize in advance for a lengthy post but the information seems timely and of importance.

First, it would seem logical to conclude that the degree of the financial problems would be mirrored somewhat by the solutions offered.

This looks more like a funhouse mirror.

From Juan Carlos Arroya Calderon writing at The Wall Street Examimer:

Quote: “The British government on Monday confirmed that it’s tentatively backing a plan presented by its advisor, Goldman Sachs, to convert Northern Rock mortgages into bonds to fund a private-sector takeover of the troubled mortgage lender.

Under the plan, Northern Rock would sell a pool of residential mortgages, unsecured consumer loans and some investment-grade securities to a financing vehicle, which would then issue notes. To make it palatable to investors, the vehicle’s notes would be guaranteed by the British government.” End Quote.

So here we have one solution – a nationalized M-Lec, passing the risk to the citizen’s of the U.K.

Now another proposed solution, here in the good ‘ol U.S.A. Again from the same source as above, quoting Howard Milstein of The New York Private Bank and Trust:

Quote: “The health of the American — and indeed the global — economy depends on having a financial system that is able to extend credit to businesses and consumers.

The losses that have been incurred as a result of the excesses in subprime mortgage lending will take years to work their way through the worldwide financial system, as dozens of banks act to replenish their lost capital by issuing more common stock in the public markets and trading other equity securities to sovereign wealth funds. Until the banks rebuild their capital, they will not have the wherewithal to lend money and support economic growth. If banks of all sizes could regain their capital immediately and easily, it would be a tremendous benefit to the American economy.

The federal government could make this happen by entering into an arrangement with American banks that hold subprime mortgages, in which homeowners typically pay a low interest rate for two or three years then face much higher payments. Here’s how it would work: The government would guarantee the principal of the mortgages for 15 years. And in exchange the banks would agree to leave their “teaser” interest rates on those loans in effect for the entire 15 years.

This would instantly give the lending banks new capital. As these mortgages would be guaranteed by the Treasury, they would suddenly be assessed, on bank balance sheets, at their original value — and a significant amount of the banks’ lost capital would be restored. Plus, the banks would receive, from most of the homeowners with subprime mortgages, up to 15 years of teaser-rate payments.

By solving the bank capital crisis immediately, this strategy would ensure that fewer families would lose their homes, that fewer neighborhoods would deteriorate because of abandoned housing and that, as a consequence, there would be less downward pressure on local real estate prices and property tax revenues.” End Quote.

So, by again nationalizing the risk of poor debt, the banks can be saved and the bubble reflated, causing “less downward pressure on local real estate prices and tax revenues.”

This isn’t a solution – it’s robbery. If a nationalization plan is truly needed, the implications of how great the problem are truly frightening.

And lastly this, from CNNMoney.com:

Quote: “FRANKFURT -(Dow Jones)- European Banks have pledged more private paper, such as asset-backed securities, to the European Central Bank to use as collateral in its liquidity-providing repurchase operations, but that does not mean that the ECB is bailing out private banks, ECB President Jean-Claude Trichet said Thursday.” End Quote.

Let me see if I can convert this from EuroSpeak to English for my own benefit.

My car payment is due and all I have to sell and raise money is this bag of crap. I can’t find anyone dumb enough to buy a bag of crap, but the European Central Bank is willing to let me use a worthless bag of crap as collateral for a short-term loan so that my car won’t be repossessed.

Wow. I get it now. The ECB is not a bank but a group of philanthropists.

And just think how much “good” they can do if they can pass off their “good deed risks” to taxpayers.

The American Flu spread to Europe; will the European vaccine spread back to the U.S.A.?

A flexible, non-rigid, problem solving, President will have the same solution… open the floodgate of money supply.. increase controls and taxes… demonize markets and property. Hardly innovative.

A return to sound money and responsible govt expenditures is not in the cards given the present political culture. It’s so old fashioned, so rigid, so ideological.

On the last point about the increase in the debt, what is missed is that a lot of the government debt increase is hidden by the non-marketable Treasury bonds held by the entitlement programs. Add that in, and consider the unfunded promises made at the Federal, State, and municipal levels, and the debt increase on an accrual basis is staggering.

Major differences among these countries and the US are that dollar is the reserve currency, US is the biggest consumer market (apart from the EU) and with one of the best business environments with good democratic institutions.

Can you explain what the effects would have been if US did not have the military power and the oil currency was not dollar but was distributed in various other currencies?

One other parallel between the US and Japan that may also exist: Both countries are experiencing a graying of their populations. What will happen to stock prices when baby boomers who put $ into their 401Ks for retirement start to withdraw that money to live on???

“None of the remaining 3 contenders — McCain, Obama or Clinton — are economic ideologues. No supply-siders in this group…”

Except after originally voting against the Bushie tax rate cuts for the Rich & Corporate because he stated they heavily favored the wealthy and were not paid for which would result in large deficits, McCain has now proclaimed he would adopt the Supply-Side fairy tale and extend those tax rate cuts.

.

There is a devastating chart in the Rogof paper;

It shows that the run up in the average bubble was much lower than in the “Big 5”;

then it shows our run up towering over all the others! and we are at the top of the roller coaster baby!

Wheeeeee!

Spam filtered once again. “Oh will the anguish never cease”.

mc – As I’ve read, 2009 begins the long slide when babyboomers not only start withdrawals, they stop making durable goods purchases as well.

jbh,

Sorry to burst your bubble here but as a recently retired Boomer, I find it amusing that we are now type cast.

Age 62 or 65 is just another number. Like Dow 14,000 a number has no significance in itself.

I still pay myself a salary so I can contribute to my IRA. I hate taxes.

As for ‘stop making durable good purchases’ well all I have to say is that I need to clean my carburator and file the points so my truck will start tomorrow.

Seriously, between Medtronic and the Scooter store, I promise to keep spending.

If a bailout occurs it had better be paired with substantial reform measures (reinstituion of the Glass Steagal Act and regulation of hedge funds would be suitable first steps) and some high level indictments. All IMHO

I’m with Donna.

I’m very resistant to the idea of a bailout of stupid financial institutions and stupid homeowners; my gut-level response to their problems is that they deserve what they get. The obvious problem with this attitude is that if things collapse in the manner that seems possible, it will come back to bite me in the rear end eventually. I don’t benefit from failed banks on Main St. and empty foreclosed homes on the next block.

However, if I’m going to contribute to solving this mess with my tax dollars (and those of my daughter), I will only do so with any willingess if substantial reforms are instituted to prevent these abuses from occurring next decade. Otherwise, it’s all a complete waste of my money, and everyone else’s.

Howard Milstein is unreal. He was probably spending the previous year crying that capitalism was hamstrung by regulation. Sorry, the banks effed up as much as anyone in this mess and if they are going to get a bailout it dammed well better not be greater than 50¢ on the dollar. Sheesh. Shorter Milstein: My banking friends are children who need their noses wiped for them, but you better not stop them from running into the street next time they are up and running!

——

That would make McCain is a ditto head, not an ideologue, and could have his rhetoric modified again once in office. Depends on his staff more than him. Just like Chimpy. The more names you recognize from the Nixon/Ford/Reagan eras, the more screwed we are.

What donna and bluestatedon said. Any serious bailout must be matched by regulatory reform (such as reinstating Glass-Steagall) of at least equal seriousness — and public backing of private debt is very serious indeed.

This is capitalism. If banks make mistakes, they (i.e. their shareholders) have to pay. If they fail, it’s a consequence of the risk they took; it is (or it should be) business as usual. Therefore, in principle, it’s not appropriate to bail out banks. To quote someone (don’t remember where I read it), a bailout is not capitalism, it’s socialism for the rich. And this is not healthy for the system because it distorts the risk-reward profile that every economic action takes (or should take) into account.

That said, there is a way to make it work. If there is a bailout, the government shouldn’t just guarantee the loans, but rather inject equity capital to the banks. Instead of being a good Samaritan, it should be a greedy investor, enforcing its own terms. Receive preferential treatment and get cheap equity, which is still beneficial to the current shareholders because the big capital infusion means they will be back in business and therefore their equity will actually be worth more (they get a smaller piece of a much bigger pie).

In fact this is much better long term solution than the monetary loosening (which was the root of the problem in the first place). With healthy balance sheets and robust capital base, banks will be willing to lend to each other and LIBOR spreads will decrease once again, leading to more lending, more investments and more growth; even with higher Fed funds rates. And the government will be able to cash out on its investment on banks’ equities, and the taxpayer won’t be the sucker but rather the winner.

The Japanese asset bubble was much larger than the US. It is said the the value of the royal grounds of the Imperial Palace was worth more then all the land in the ENTIRE state of California. This asset inflation was of a magnitude many times that of the US. I can’t speak to the other 4 problems. But the study, basically, sucks royally in quality for not mentioning the Japanese distinction.

The US will have to work hard to put it’s budget deficit and national debt in order. The foreign accounts will take care of themselves. Foreigners will buy US assets to settle the current account. This may not be a popular solution, but it will work just fine.

To learn more about Japan’s asset inflation problem, read this book. It is a quick read and is an excellent resource. Amazon has used copies for very little, too.

It will also help make Japan a little less inscrutable.

Balance Sheet Recession: Japan’s Struggle with Uncharted Economics and its Global Implications (Hardcover)

by Richard C. Koo (Author)

If Krugman linked to this paper and implied it was a respectable resource, he must be an idiot or a scare monger.

Last post.

I’m 48 and thus a boomer. I’m a health buff and anticipate working in my professional field at least into the late 60s. After that I intend to continue earning money in a field I can enjoy without the stress and in a location I like. My sisters are in their 50s. None of them said the “r” word yet. They will work until they drop. I am not speaking for all boomers, but plenty of them are stuck in overinflated houses they foolishly thought would finance retirement. They have to continue making mortgage payments, thus they have to work more years than they intend since R.E. prices are deflating the next several years. Personally I am a renter and have saved instead of gambled or piled on debt. I can live on my savings outside of retirement without a job if needed. But I like to keep active. I hope to maintain great health to be able to continue working like I’m doing now.

The US has a debt bubble many times larger than the one in Japan in the early 1990s. The authors’ ominous conclusions are accurate.

A country with a debt to GDP ratio of over 300% is in huge trouble.

The subprime fallout is just a symptom of a much larger problem which is a massive debt bubble which poses scary secular risks to the US economy worse than anything seen since the Great Depression.

I think this will be the milder recession — followed soon after by the deeper one, if we are not careful.

In my view, McCain’s lack of economic knowledge will lead him to be talked into disastrous moves. I’m glad at least one of his advisers seems to have some sense of what’s ahead, but — I think he will be far too swayed by the corrupt interests of the Republican party and his own warlike tendencies to continue the disastrous Iraq war and add an even more disastrous Iran war.

McCain, continuing Bush’s path, will lead us to incredible decline at a rapid pace.

Howard P. Milstein is the chairman and chief executive of New York Private Bank and Trust.

New York Private Bank is primarily seeking depositors with assets of more than $50 million.

Mr. Milstein said, “This plan is a way to use our nation’s strength, and not current tax dollars, to keep people in their homes…”

Oh, of course. I’m now starting to get the hang of this.

This isn’t b-a-n-k bailout – this is “enhanced mortgage adjustment technique”.

The Japan comparison has been a popular choice among Armageddon prophets for sometime now. There are two issues that are never addressed in the rantings. The first is the fact that Japan has been an export driven economy that would always be threatened by the next low cost producer, a la China. Secondly, the United States has a tremendous asset in a young workforce thanks to immigration. There are no flotillas of people seeking a better life in Japan.

Yes, but the US has a higher personal debt rate than Japan did. The US may rebound quicker, but the pain will be sharper.

So it’s an asset to have millions of unhdocumented aliens taking jobs from americans and wiring most of the money to Durango, etc every week? My feeling that America is really dumbing down is unchanged.

Speaking of dumbing down, how is freezing the teaser rates for fifteen years unlike death by a thousand cuts?

Just for the recored and OT – Barry thanks for posting the Reinhart & Rogoff paper. Ken by the way is also a distinguished/int’l economist, now at Harvard, and before in a very sr. position at the World Bank.

A Japanese deflation is the very thing that Ben and Uncle Alan were worried about back in ’01/’02 since it HAS been the natural outcome of every major market bust in history. And the Jap. made it worse by cornerning themselves in a liquidity trap. We avoided what could have been a disaster but at the expense of two other bubbles which are now coming home to roost. Let’s hope the Fed does as well dancing among the swords as they did last time. People have no clue how ugly this could get if they don’t.

“no one from the Democratic old school. ”

Riiiiight. Dream on. Obama is the most, explicitly, liberal candidate in history. Hillary is the most illicit, closet liberal, in history.

“If it turns out that the candidates are pragmatic centrists, more focused on problem solving than ideological belief system, it would be a good thing.”

Sure, historic, vigorous, liberals suddenly discover the virtue of “pragamatic” centrism. Exactly when, and where, in the world have liberals exercised newly found power in the direction of the center?

Dream on. They’ll be a disaster….and McCain won’t be very far behind.

>> Sure, historic, vigorous, liberals suddenly discover the virtue of “pragamatic” centrism. Exactly when, and where, in the world have liberals exercised newly found power in the direction of the center?

Bill Clinton signed welfare reform and NAFTA into law.

(Didn’t even have to think very far back.)

If someone wants to waste pixels on my last post, please yell at me via my yahoo email. No unnecessary, redundant flames on TBP, please.

Before you email me, here’s the mandatory disclaimer I forgot in my prior post: I do not now nor did I ever support the Clintons.

We have the greatest capitalism in the world. Profits are privatized and losses are socialized.

What a country.

I’m with Dona and Ross regarding bailout and reform.

Just one question when do we bailout the people who invested in the NASDAQ in 2000 when it was 5000. Eight years later, its barely half that. Just saying ;-)

Markos wrote, “That said, there is a way to make it work. If there is a bailout, the government shouldn’t just guarantee the loans, but rather inject equity capital to the banks. Instead of being a good Samaritan, it should be a greedy investor, enforcing its own terms.”

What you suggest is a nationalization of the banks. Are you certain this is such a good idea?

What about Figure 2? If you are to believe Figure 2, the equity markets correction is already over or almost over.

Tyaresun

Bank Bailout: I was under the impression the current stimulus plan is a bank bail out as a good chunk of the $150 billion in ‘stimulus’ will be used to make credit card payments.

Main issue is the USA is household debt which went from 50% of GDP to 100% of GDP over the past few years.

Talking about debt without taking about all debts (public, household, business) is just plain stupid.

You can own your house (you have the debt) or rent a government build house (government has the debt), you can ride a government built road (government has the debt) or pay a fee for a private road (business has the debt). Debts can substitute one another according to policy, talking about one in isolation is meaningless.

Economists always talk only about public debt, but it’s not like economists know anything about the economy :).

And MSM never ever talked about household debt doubling.

Re: the guaranttee and freeze proposal

wouldn’t it be more rational to try to rebuild bank capital to prohibt it payment of dividends on common stock at major banks that are in trouble. Every $ paid out in dividends is a $ less of bank capital. At least include it in the package if were are going to go that route, no dividends (or share repurchase) for the 15 years of gov’t guarantees. If not, it would simply be easier for the gov’t to cut checks to the banks to shore up their capital. The net effect would be the same.

Global Financial Crises, Part II

Yesterday, we looked at 5 Historical Economic Crises and the USA. That discussion led to a reader in Norway referring us to this 2005 commentary about the Norwegian Financial Crisis, which began circa 1987. It was the first systemic crisis in a major i…

The worst outcome is to “save” the Banks, akin to spending a lot of money to save low quality sick trees and doing so by chopping down a few good trees (taking capital from other people–taxpayers).

If a few banks failed or just got diluted to be owned by new owners, and houses got re-priced downward quickly, then we could have a good recovery in a year or two.

TBP community needs to become politically active. We should campaign for candidates in either party who oppose bailouts. We have to educate the public about the concepts of moral hazard and “private profits, socialized risks”. Everyone’s inboxes are already full of email spam. So, we should go door-to-door, if necessary.

That all sounds like a lot of work though.

Re: “no one from the Democratic old school.” Uhhh, call me crazy, but isn’t this just what Krugman is calling for? Expansion of unemployment benefits and food stamps and massive public investment in infrastructure?

Perhaps all rememberances of the New Deal and a robust Keynesianism has fallen into the memory hole, so now “Democratic old school” is DLC-style neoliberalism which can only support a tax cut aimed more at the middle class than the rich as a fiscal stimulus?

Past Economic Crises

Speaking Personally With , Barry Ritholtz, Paul Krugman, and David Glenn, referencing it I will need to be reading Is the 2007 U.S. Sub-Prime Financial Crisis So Different? An International Historical Comparison* (PDF) Carmen M. Reinhart, University of…

I live in Japan, and the funny thing about the Japanese “recession” is that while it certainly put a damper on Japanese growth and cut into the profits of the massive Japanese corporations (Zaibatsu-like entities that are vertically integrated in ways that are staggering to behold)…it really did not have THAT much of an effect on the overall cost of, or standard of living for most people.

There is more unemployment than there used to be (3-5% rather than 0-1%), and a bit more poverty and visible homelessness…

But…I live here, and not on a crazy salary, either. In fact, I lived here when my daughter was born, and was living in central Tokyo on 20 K per year and supporting a family.

Why was their recession so much less damaging (overall) to their general population?

my answer is informed only by my own experience, as I am not an economist, but it goes like this:

Massive government investment in infrastructure, insanely good public transport, and really really cheap healthcare made it possible for most of the working class, middle class and etc to survive the recession far better than would be the case for a similar recession in the US.

Socialism does have its advantages.

Why does it appear that this financial dismantlement of the U.S. was planned?

Did you see Stan Liebowitz’s piece in the New York Post, providing evidence that it wasn’t banks that had decided to engage loose lending practices but Fed regulators that had forced them to do so–for the purpose of avoiding charges of racial discrimination, brought by the federal government if banks’ lending officers didn’t comply: that is, this entire sub-prime mess is the result of an affirmative-action/racial-quota policy forced upon banks by federal regulators!

In April 2005, while ddressing the Federal Reserve System’s Fourth Annual Community Affairs Research Conference, Greenspan opined:

“Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for IMMIGRANTS [my emphasis]. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country. With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently EXTENDING CREDIT TO A BROADER SPECTRUM OF CONSUMERS [my emphasis]. The mortgage-backed security helped create a national and even an international market for mortgages, and market support for a wider variety of home mortgage loan products became commonplace. This led to securitization of a variety of other consumer loan products, such as auto and credit card loans [to include no-credit-record/no-down-payment/no-or-very-little-income consumers given ARMs].”

So, why isn’t there a class-action suit developing for all those ARM holders, in light of the fact that Allen Greenspan had CRIMINALLY violated his chairmanship duties at the Federal Reserve when he publicly advised prospective home-buyers TO TAKE OUT ARMs; that is, any information related to the housing market coming out of Greenspan has tremendous weight, regarding whatever INSIDE INFORMATION the chairman may possess, so that any of his comments which might influence how prospective home-buyers purchase their mortgages makes him – and the Federal Reserve – liable if home-buyers are damaged by his advice ((by the way, when Leslie Stahl interviewed Greenspan on 60 minutes recently, she had asked him about whether or not he had had a conflict of interest in routinely visiting the White House during Bill Clinton’s second presidency, to which question Greenspan had DECEPTIVELY answered: “We are one government,” and about which response Leslie Stahl failed to remark to him that the Federal Reserve is a private, share-holding concern—NOT A U.S. GOVERNMENT AGENCY))?

Planned Destruction of America: Open Letter

http://planneddestructionofamerica.blogspot.com/

Corporate America: What Went Wrong?

http://corporateamericawhatwentwrong.blogspot.com/

Why does it appear that this financial dismantlement of the U.S. was planned?

Did you see Stan Liebowitz’s piece in the New York Post, providing evidence that it wasn’t banks that had decided to engage loose lending practices but Fed regulators that had forced them to do so–for the purpose of avoiding charges of racial discrimination, brought by the federal government if banks’ lending officers didn’t comply: that is, this entire sub-prime mess is the result of an affirmative-action/racial-quota policy forced upon banks by federal regulators!

In April 2005, while ddressing the Federal Reserve System’s Fourth Annual Community Affairs Research Conference, Greenspan opined:

“Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for IMMIGRANTS [my emphasis]. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country. With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently EXTENDING CREDIT TO A BROADER SPECTRUM OF CONSUMERS [my emphasis]. The mortgage-backed security helped create a national and even an international market for mortgages, and market support for a wider variety of home mortgage loan products became commonplace. This led to securitization of a variety of other consumer loan products, such as auto and credit card loans [to include no-credit-record/no-down-payment/no-or-very-little-income consumers given ARMs].”

So, why isn’t there a class-action suit developing for all those ARM holders, in light of the fact that Allen Greenspan had CRIMINALLY violated his chairmanship duties at the Federal Reserve when he publicly advised prospective home-buyers TO TAKE OUT ARMs; that is, any information related to the housing market coming out of Greenspan has tremendous weight, regarding whatever INSIDE INFORMATION the chairman may possess, so that any of his comments which might influence how prospective home-buyers purchase their mortgages makes him – and the Federal Reserve – liable if home-buyers are damaged by his advice ((by the way, when Leslie Stahl interviewed Greenspan on 60 minutes recently, she had asked him about whether or not he had had a conflict of interest in routinely visiting the White House during Bill Clinton’s second presidency, to which question Greenspan had DECEPTIVELY answered: “We are one government,” and about which response Leslie Stahl failed to remark to him that the Federal Reserve is a private, share-holding concern—NOT A U.S. GOVERNMENT AGENCY))?

Planned Destruction of America: Open Letter

http://planneddestructionofamerica.blogspot.com/

Corporate America: What Went Wrong?

http://corporateamericawhatwentwrong.blogspot.com/

Catch-22 Imitates Life Dept:

I can see the government as Milo Minderbinder Enterprises, gleefully sucking up CLO’s and distressed bank stocks at auction, all the while shouting the no-worries “everybody has a share!” slogan.

It is indeed a great country.

http://depression2.tv/d2/node/7#comments

please watch video – its excellent