Relative to this morning’s column, consider this discussion about inflation and valuation:

From Savita Subramanian:

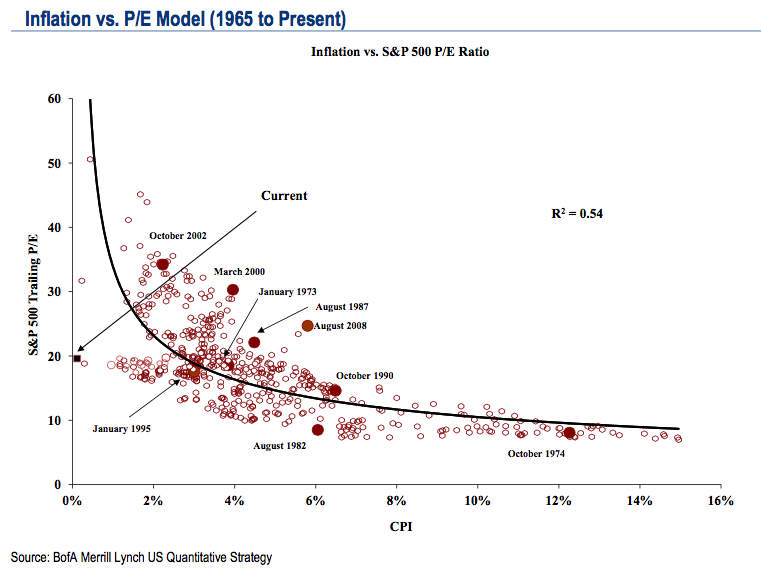

Inflation: The level of inflation also matters, and historically has had a strong relationship with PE multiples. Chart 2 below indicates that the relationship may not be linear, but many have simplified this relationship to the “Rule of 21” which suggests that the sum of the PE multiple and CPI inflation should equal 21. Given that the latest inflation data are slightly negative (-0.2%) and the trailing PE ratio of 17.6x, the Rule suggests valuations should jump 3-4 points, or that inflation should be 3-4% (or some meeting in the middle). And the chart below indicates that P/E multiples could be far higher than they are today without breaching the historical relationship between multiples and inflation.

Source:

Episode I: High valuations

Savita Subramanian, Equity & Quant Strategist

MLPF&S

Equity and Quant Strategy | United States 26 May 2015

So… the trailing P/E should now be infinite?

Beyond infinity – Buzz Lightyear, CFP

Isn’t the R2 correlation marginal at best at .54

My background includes laboratory statistics, but no data analysis like this. But I’d say that because the market moves for all sorts of reasons that are rational and irrational, an r2 correlation of 0.54 is reasonable and useful. But it is probably not directly tradeable.

http://www.multpl.com/us-gdp-inflation-adjusted/table A little GDP overlay for the debate.