Following yesterday’s column on W2 tax data as a read of employment, several emailers/tweeps/friends asked about the Fed’s Labor Market Conditions Index.

This gets a bit wonky, but stay with it:

My thinking in looking at tax withholding data was two-fold: First, it is hard data actually measured (not modeled), drawn from actual dollars. Second, as we have noted, the BLS models have specific inherent limitations; its a noisy, oft-revised series measuring a small change in a huge number. I tried to get that across with my “NFP change was 0.02533 percent” comment but apparently the nuance was lost on some readers.

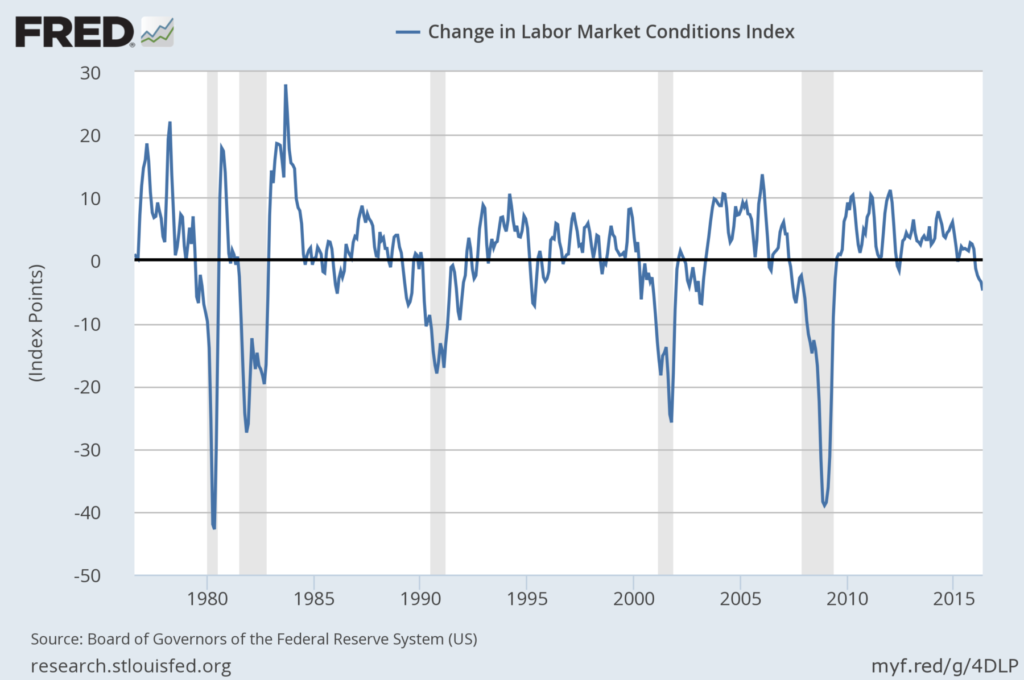

Some people are enamored of the Labor Market Conditions Index — a dynamic 19 factor survey devised by the Fed — so let’s address it.

Below you will find a table of the 19 components that go into LMCI. Note that most of them are sourced to BLS’s two main surveys, Establishment (CES) and Household (CPS). (I am not a big fan of those diffusion index surveys from NFIB, but I do find the JOLTS measure of interest).

Components, Labor Market Conditions Index

Source: Advisor Perspectives

Given that most of the LMCI is BLS derived, we should not expect it to be appreciably different than what we usually see from BLS; it is essentially a variant of BLS models, with all the strengths and weaknesses thereto.

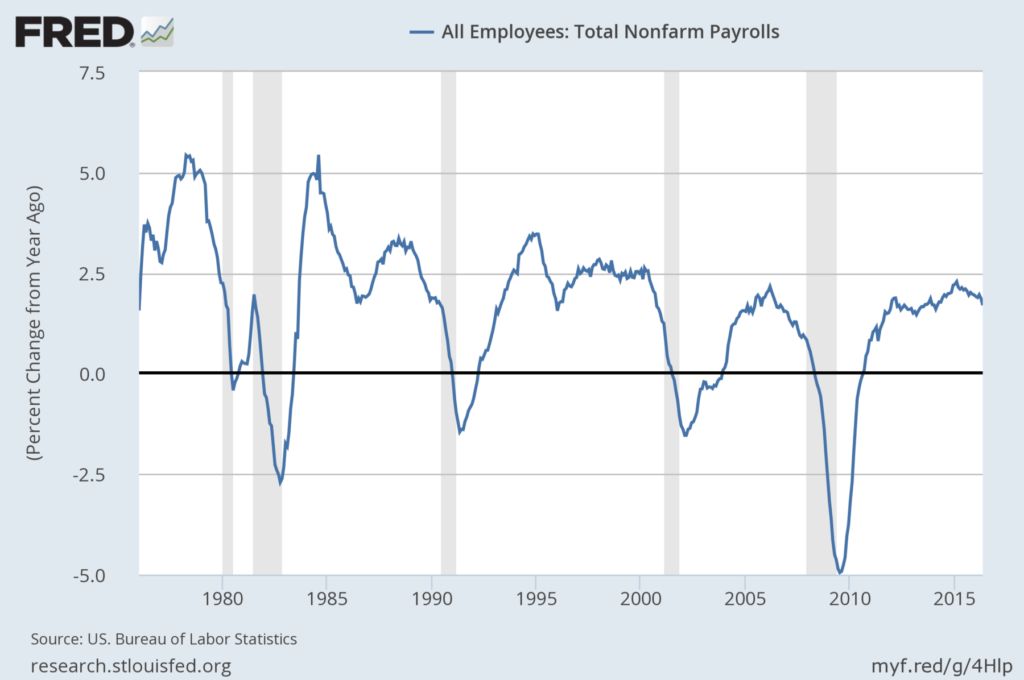

How similar is LMCI to ordinary employment NFP data? If we look at them both similarly — Monthly data, Seasonally Adjusted, percent change from a year ago=, from 1976 to present — you end up with two charts that look kinda similar:

All Employees: Total Nonfarm Payrolls

These two look rather similar; LMCI is a noisier series, with numerous false positives into the negative in 1986, 1995, 2002, 2012. We don’t know if the most recent negative readings in 2016 is yet another false positive or not.

Hence, I looked at W2 as it is a totally different data series; its a measurement, not a model, and its from Treasury, not BLS.

I try to avoid confirmation bias – that is why I check out different ways to evaluate the state of the labor economy whenever I can. To understand the models that are primarily used, and what their warts are, is easy. Being open minded about different ways to contextualize employment is more challenging. That’s why we do that.

What's been said:

Discussions found on the web: