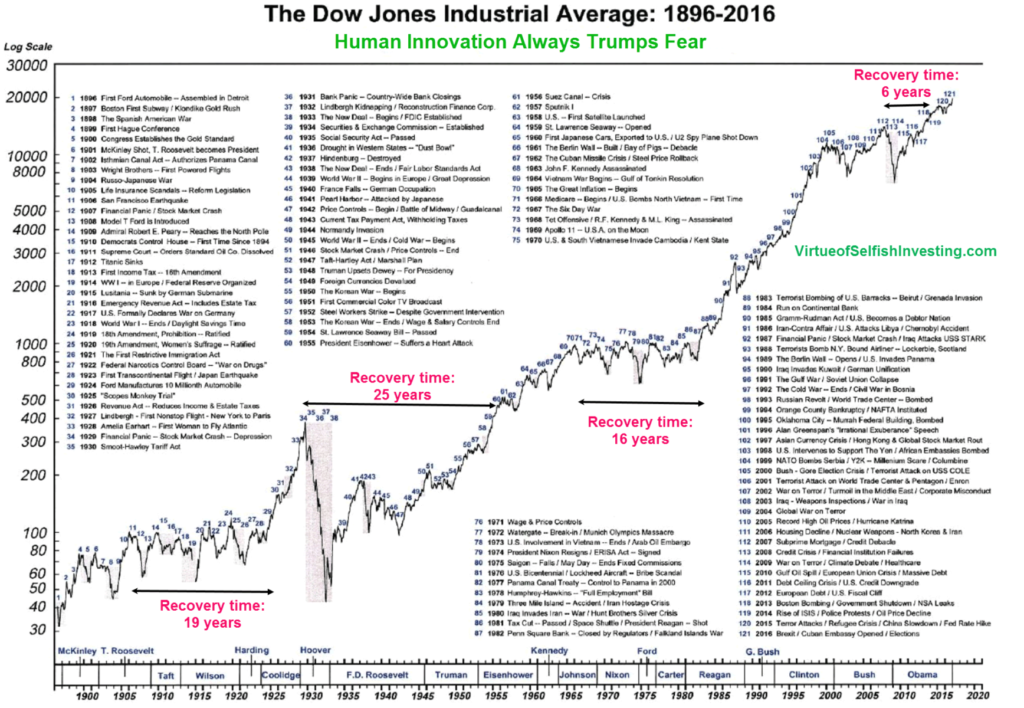

This graph of the Dow’s performance since 1896 that charts the index’s peaks and troughs, reflecting a variety of economic triumphs and tribulations. It intriguing to consider the short term reaction to various news events within the broader context: fear, market wobbles and occasional over-reaction.

“There is no get-rich-quick scheme. There is no such thing as a black box where you press a button and let it run indefinitely. Investing is more challenging than brain surgery.” -Chris Kacher, MoKa Investors

I find the graph + the annotations quite fascinating:

Human Innovation (eventually) Surpasses Short-term Fear

Click for ginormous grpahic

Source: Marketwatch

See also: Gradual Improvements Go Unnoticed

Update: James Macintosh points out that the chart neither includes Dividends nor is inflation adjusted (I like showing that as a second “compare and contrast” chart.

And, we should also note “New boom 1919, bust ’29” via the roaring twenties; that 19 year recovery section is therefore incorrect . . .